Analysis of Tuesday's deals:

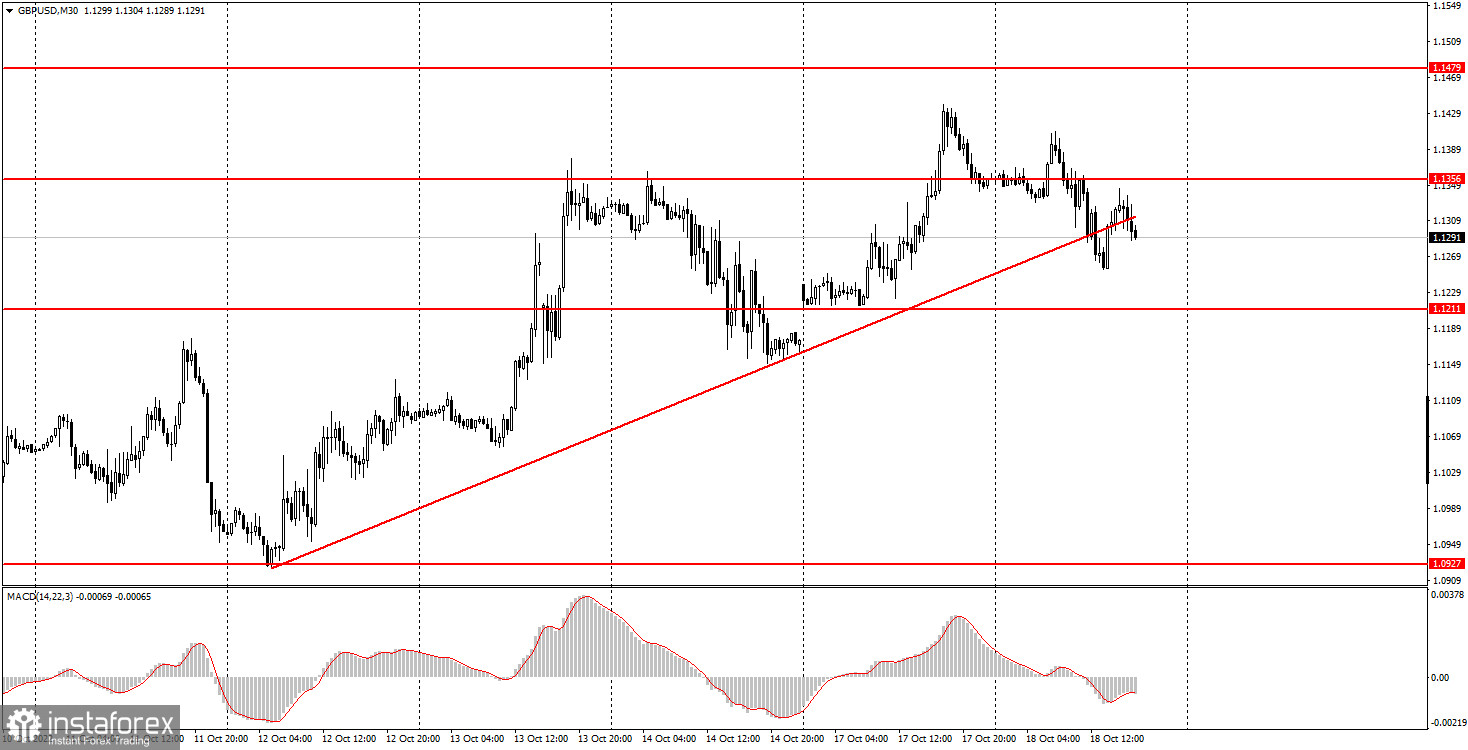

30M chart of the GBP/USD pair

The GBP/USD pair was trading very volatile again on Tuesday and did not stand in one place. At least 150 points were passed from the low to the high of the day, which is a lot for an "empty" day. And traders only had a report on industrial production in the US, which they gladly ignored. However, we did not expect a strong market reaction to this report. On the other hand, the pair managed to consolidate below the new ascending trend line, which once again proves the fact that even an increase of 1100 points cannot be considered the unambiguous beginning of a new upward trend in the long term. In our fundamental articles, we paid attention to the random fall of the pound by 1000 points, and then a similar increase. These movements were provoked by out of the ordinary events, which were quickly offset. Recall that the government of British Prime Minister Liz Truss first announced a large-scale tax cut, and then, having fallen under a flurry of criticism, decided to cancel a good half of the tax cuts, and generally take time to finalize their initiatives. Therefore, the pound "plowed" first 1000 points down (due to the collapse of the UK financial markets), and then 1100 points up (when it became known that taxes were not being reduced yet).

5M chart of the GBP/USD pair

The pound traded quite actively on the 5-minute timeframe, but still the movements were not the best. There were frequent reversals and pullbacks throughout the day. However, the good thing is that only two trading signals were formed. Both are near the level of 1.1356. First, the price overcame this level from top to bottom, and then rebounded from it from below. In both cases, novice traders could open a short position. In the first case, it closed at breakeven by Stop Loss. In the second case, the position should have been closed manually in the late afternoon, since the price did not reach any more levels. Therefore, there were no more signals. The profit on this position was about 30 points, which is not the worst result, given that the pair's movements were not the best during the day.

How to trade on Wednesday:

On the 30-minute TF, the pound/dollar pair "targeted" a new round of downward movement, but both "aimed" and "took aim". The price has already fixed below the trend line. So far, this does not mean anything, since the fall is observed only for one day. Nevertheless, we fully assume a new round of the fall of the pound. However, at the same time, let's say that in general, the British currency has much more chances for growth than the euro. On the 5-minute TF tomorrow it is recommended to trade at the levels of 1.1024, 1.1200-1.1211-1.1236, 1.1356, 1.1443, 1.1479, 1.1550, 1.1608, 1.1648. When the price passes after opening a deal in the right direction for 20 points, Stop Loss should be set to breakeven. The release of the inflation report is scheduled for Wednesday in the UK, and it could be very interesting. Forecasts suggest that the consumer price index will either accelerate to 10% or remain unchanged at 9.9%. In any case, no one expects a new, second slowdown in this indicator. A strong deviation of the predicted value from the actual value can provoke a noticeable reaction.Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română