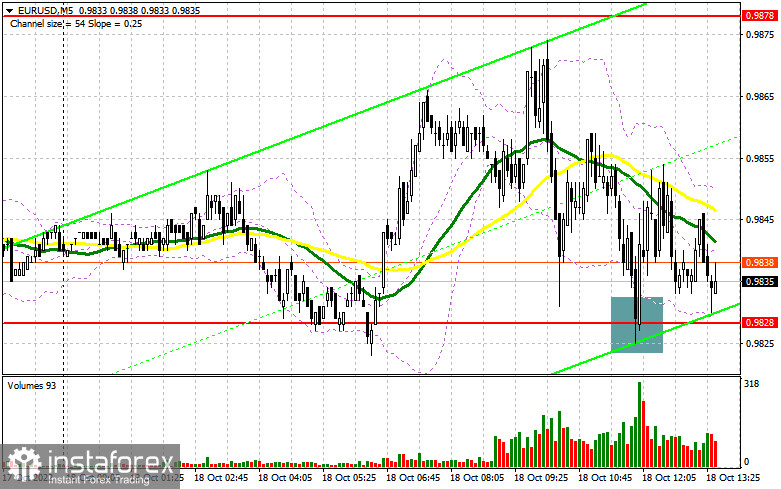

In the morning review, I focused on 0.9828 and considered entering the market at this level. Let's take a look at the M5 chart to get a picture of what happened. A fall and a false breakout after the release of disappointing macro data in Germany and the eurozone produced a buy signal. However, following a 20-pip increase, bulls felt less enthusiastic to extend the movement. The pair is now trading at around 0.9828, which indicates the possibility of a breakout through the mark in the second half of the day. Despite that, the technical picture on the chart, as well as the strategy, stays the same.

When to go long on EURUSD:

The situation on the chart is unlikely to change in the course of the North American session. Industrial production in the United States due today is projected to come in line with the market forecast. Therefore, with the euro feeling pressure, the price could retest the 0.9828 mark. In fact, the price has tested this level many times. A breakout through this range would create a buy entry point with the target at 0.9871. Bulls would attempt to maintain control over the market should the quote break through the 0.9871 mark, formed by the close of European trade. Bearish stop orders would trigger and an additional buy signal would be made after a top-bottom test of this range with the target at 0.9917. A reversal would occur should the pair consolidate above this level. Breaking above 0.9917, the price would head towards 0.9948, where it would be wiser to lock in profits. Should EUR/USD go down during the North American session when there is no bullish activity at 0.9828, with the bullish moving averages passing slightly below the mark, pressure on the euro would increase. However, even a breakout through the range would not be enough for the bears to regain control over the market. So, long positions could be considered after a false breakout at 0.9828. EUR/USD could also be bought at 0.9786 or 0.9734 on a rebound, allowing a bullish correction of 30-35 pips intraday.

When to go short on EURUSD:

The bears should not just protect the 0.9871 mark but also think about how to push the euro below 0.9828, as they failed to do this in the first half of the day. It would be wiser to go short after a false breakout through 0.9871, similar to the one that took place during the Asian session. In case of a sell signal, the price would return to 0.9828. This would become its third daily test of this mark. A breakout and a bottom-top test at 0.9828 would make another sell signal with the target at 0.9787. However, this would not be enough to harm the euro bulls. The pair would return in the sideways channel should it test the most distant target standing at 0.9734. This is where it would be wiser to lock in profits. Should EUR/USD show growth during the North American session when there is no bearish activity at 0.9871, demand for the pair would increase, which could trigger a stronger bullish correction. In such a case, the instrument could be sold after a false breakout through 0.9917 only. Short positions on EUR/USD could be opened at the 0.9948 high or at 0.9990, allowing a bearish correction of 30-35 pips.

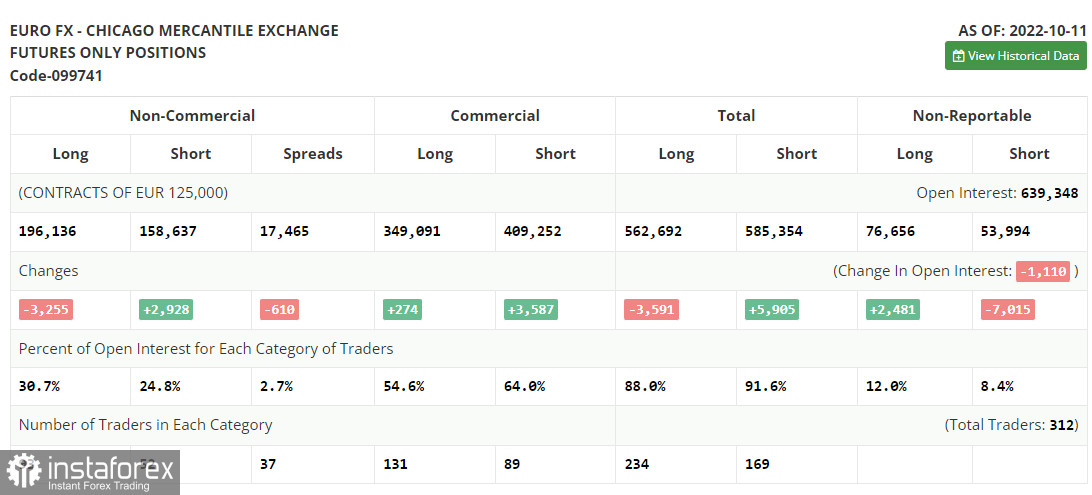

Commitments of Traders:

The COT report for October 11 logged a steep fall in long positions and a rise in short ones. It seems that traders were bracing themselves for the release of data on inflation and retail sales in the United States. Clearly, taming inflation has been a challenge for the Federal Reserve. As the September report shows, US inflation slowed just by 0.1% from the previous reading. In this light, the US regulator is likely to remain hawkish or become even more aggressive. Notably, it has been a while since the last mass sell-off of the euro below the parity level. In fact, such factors as geopolitical developments and the tightening cycle of the Federal Reserve are not enough to push the pair lower. Therefore, consider buying the euro in the medium term. According to the COT report, long non-commercial positions dropped by 3,255 to 196,136, while short non-commercial positions grew by 2,928 to 158,637. In a week, the total non-commercial net position remained positive and amounted to 37,499 versus 43,682. Investors use this as an opportunity to buy the cheaper euro below parity and accumulate long positions, hoping for the end of the crisis and the pair's recovery in the long run. The weekly closing price decreased to 0.9757 from 1.0053.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, signaling the continuation of the uptrend.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at around 0.9870, in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română