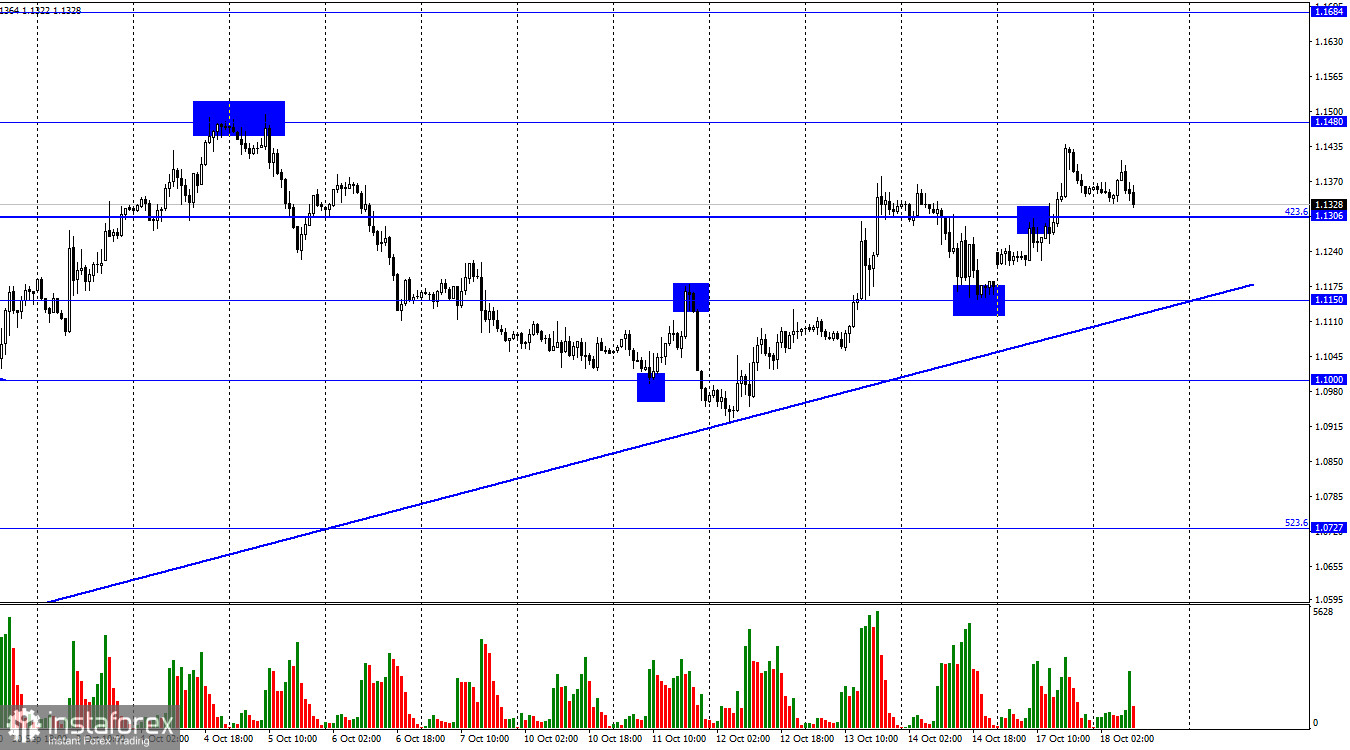

On Monday, GBP/USD reversed in favor of the pound on the 1-hour chart and advanced to the level of 1.1480. At the time of writing, the quote has returned to the Fibonacci retracement level of 423.6% at 1.1306. A rebound from this level may send the pound upwards to 1.1480. A firm hold below 1.1306 will make the decline towards 1.1150 more likely. The new ascending trendline indicates the bullish sentiment of traders.

The pound sterling has been actively rising in the past four days. There has been some contrasting news in the UK lately. At the moment, financial markets have somewhat calmed down as the Bank of England wrapped up the emergency bond buying program of £65 billion. Now traders have switched their attention to politics. UK Prime Minister Liz Truss may face a non-confidence vote from her party members. Besides, the calls are growing for Liz Truss to stand down as a prime minister due to her failure to implement the plan on tax cuts that caused financial markets to collapse even before its approval. It is not clear yet who can replace her as a new prime minister. However, Liz Truss is not going to give up that easily and uses the rhetoric that Boris Johnson had once used. We all know how it ended. Boris Johnson was forced to quit due to a series of scandals surrounding him. Meanwhile, Liz Truss may have to resign due to her economic mistakes.

In the meantime, Goldman Sachs has downgraded Britain's economic outlook. The bank noted that tighter monetary policy and higher corporate taxes would lead to a deeper recession than predicted earlier. Against this backdrop, the pound may resume its fall.

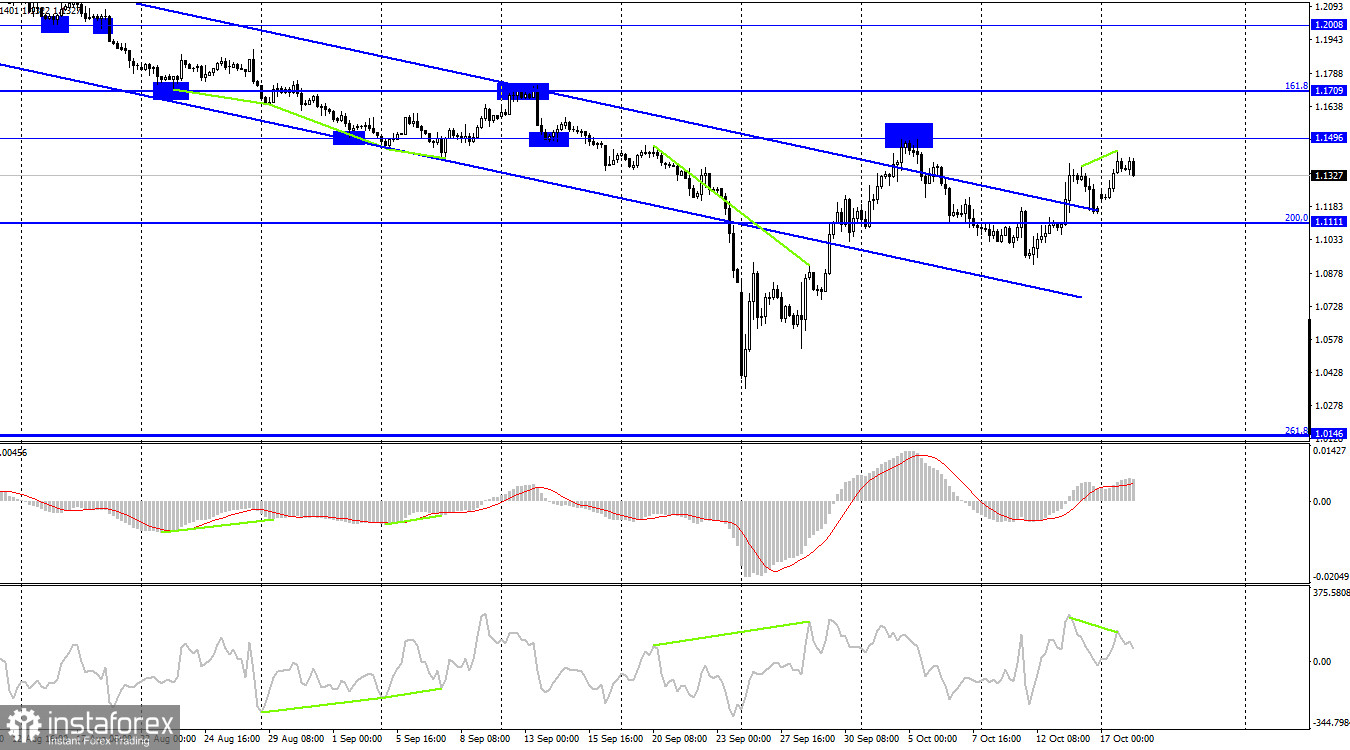

On the 4-hour chart, the pair closed above the descending trend channel. As this is the second time the pair settles there, the chances of a further uptrend towards at least 1.1496 are getting higher. At the same time, the information background may put pressure on GBP/USD. The bearish divergence of the CCI warns that the pound may start to decline as soon as today. In general, the technical setup on the H4 chart does give a clear idea about the further trajectory of the pound.

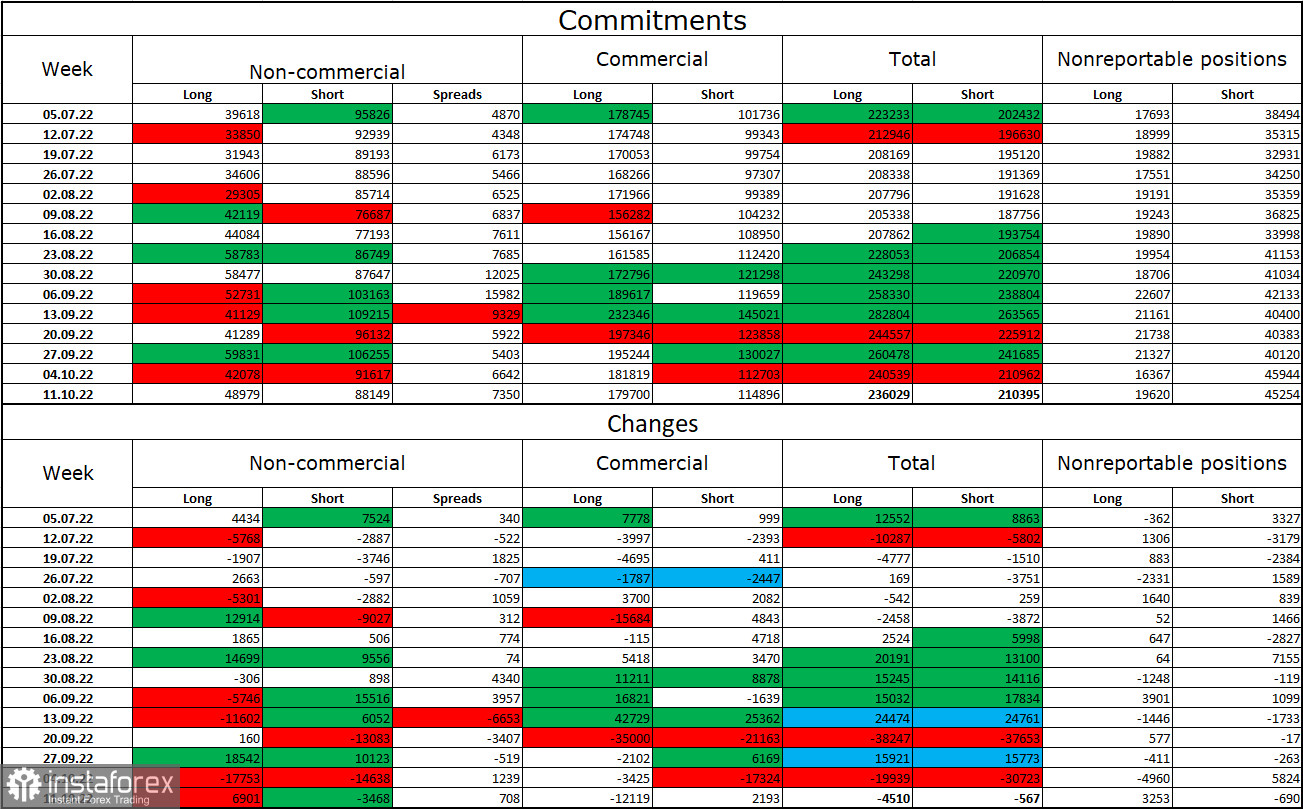

Commitments of Traders (COT) report:

Over the past week, the non-commercial group of traders became less bearish on the pair than the week earlier. Traders added 6,901 new long contracts and closed 3,468 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still depreciating against the US dollar. As for the pound, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

US - Industrial Production (13-15 UTC).

There is only one important event in the US calendar today. The impact of the fundamental background on the market sentiment will be very weak in the second half of the day.

GBP/USD forecast and trading tips:

I would recommend selling the pair with the target at 1.1150 after the price closes below 1.1306. This target has already been tested. New short positions can be opened when the price closes below the trendline on H1 with the targets at 1.1000 and 1.0727. Buying the pair will be possible when the quote rebounds from 1.1306 on the 1-hour chart. In this case, the target is found at 1.1480.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română