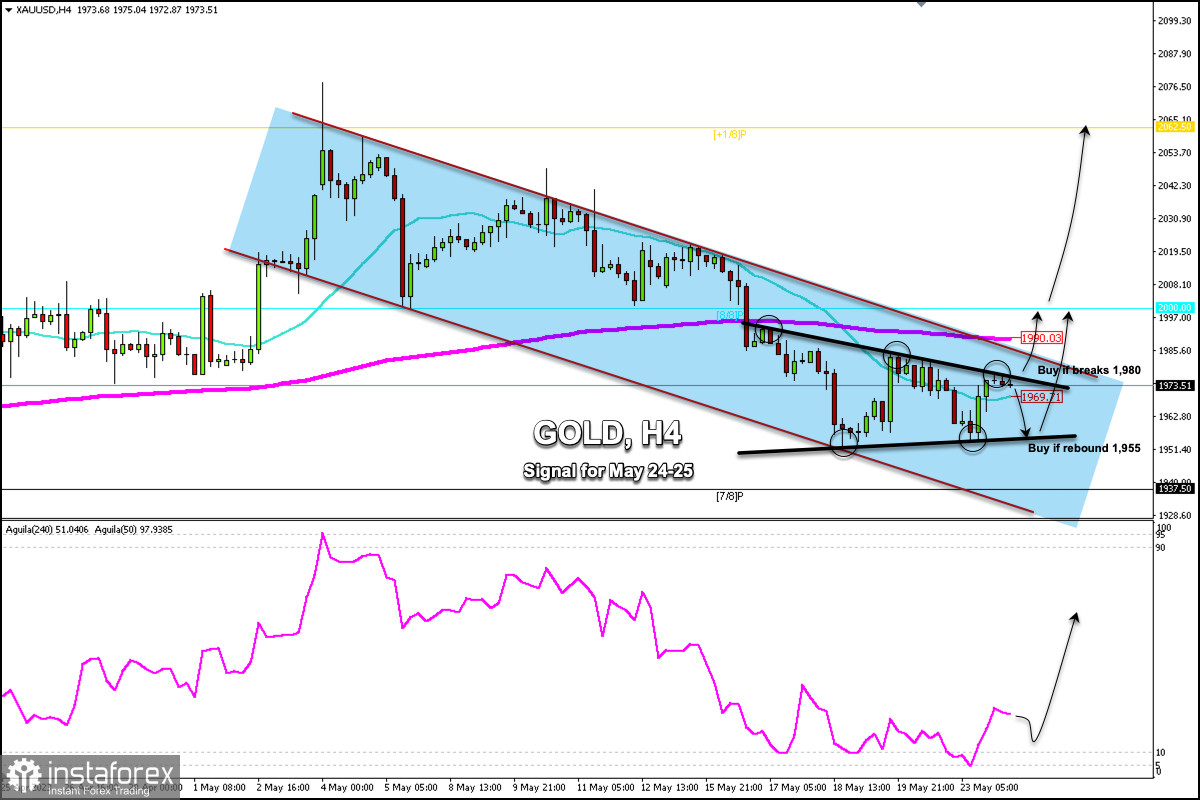

Early in the European session, Gold (XAU/USD) is trading around 1,973.51, above the 21 SMA, and within a downtrend channel formed since early May.

On the 4-hour chart, we can see that since May 15, gold has been forming a symmetrical triangle pattern. Gold has been testing the top of this pattern in recent hours. If it fails to break above and consolidate, we could expect a correction to the bottom of this pattern around 1,955.

On the other hand, a sharp break above the technical pattern could confirm a bullish acceleration and gold could reach the 200 EMA located at 1,990 and the psychological level of $2,000.

On the contrary, in the event that gold falls below 1,969 (21 SMA), we could expect it to reach the rebound zone of the technical pattern around 1,955, which could also be seen as an opportunity to buy.

In case a break below the symmetrical triangle pattern is confirmed, we could expect a bearish acceleration and the instrument could reach 7/8 Murray located at 1,937. Finally, it could reach the bottom of the downtrend channel around 1,925 and even the psychological level of 1,900.

There is strong resistance around 1,980. If gold fails to break this level, then a technical correction could occur. The Eagle indicator entered the extremely oversold zone (5 points) on May 23. Since then, a strong technical rebound occurred above the key area of 1,951. It is likely that if a break above 1,977 occurs in the next few hours, we could expect the bullish sequence to continue and the metal could reach 8/8 Murray.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română