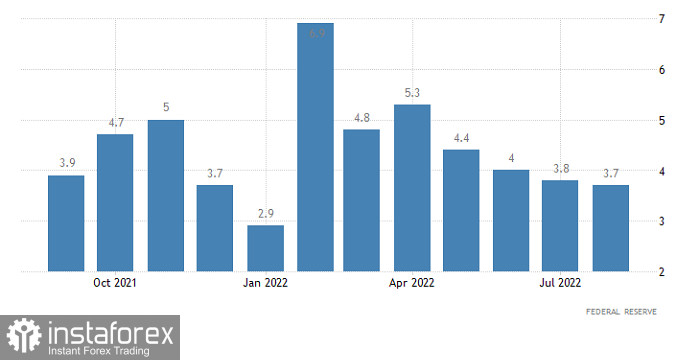

The pound sterling needed just one short announcement provided by Andrew Bailey to skyrocket and drag the euro. The BoE's governor said that he approved of the appointment of Jeremy Hunt as Britain's finance minister. The fact is that Jeremy Hunt has the same view on the economic situation as the BoE and intends to achieve economic stability. Andrew Bailey also pinpointed that the regulator would continue hiking the key interest rate. That was enough to cause a noticeable drop in the US dollar. What is more, today, the greenback is likely to go on falling amid the US industrial production report that may unveil a slowdown to 3.4% from 3.7%. While on the yearly basis, the indicator will only slacken, on a monthly basis it is likely to decline by 0.1%. In the previous month, industrial production dropped by 0.2%. In other words, the indicator has been falling for the second month in a row. If the predictions come true, the greenback will have no reason to rise.

US Industrial Production

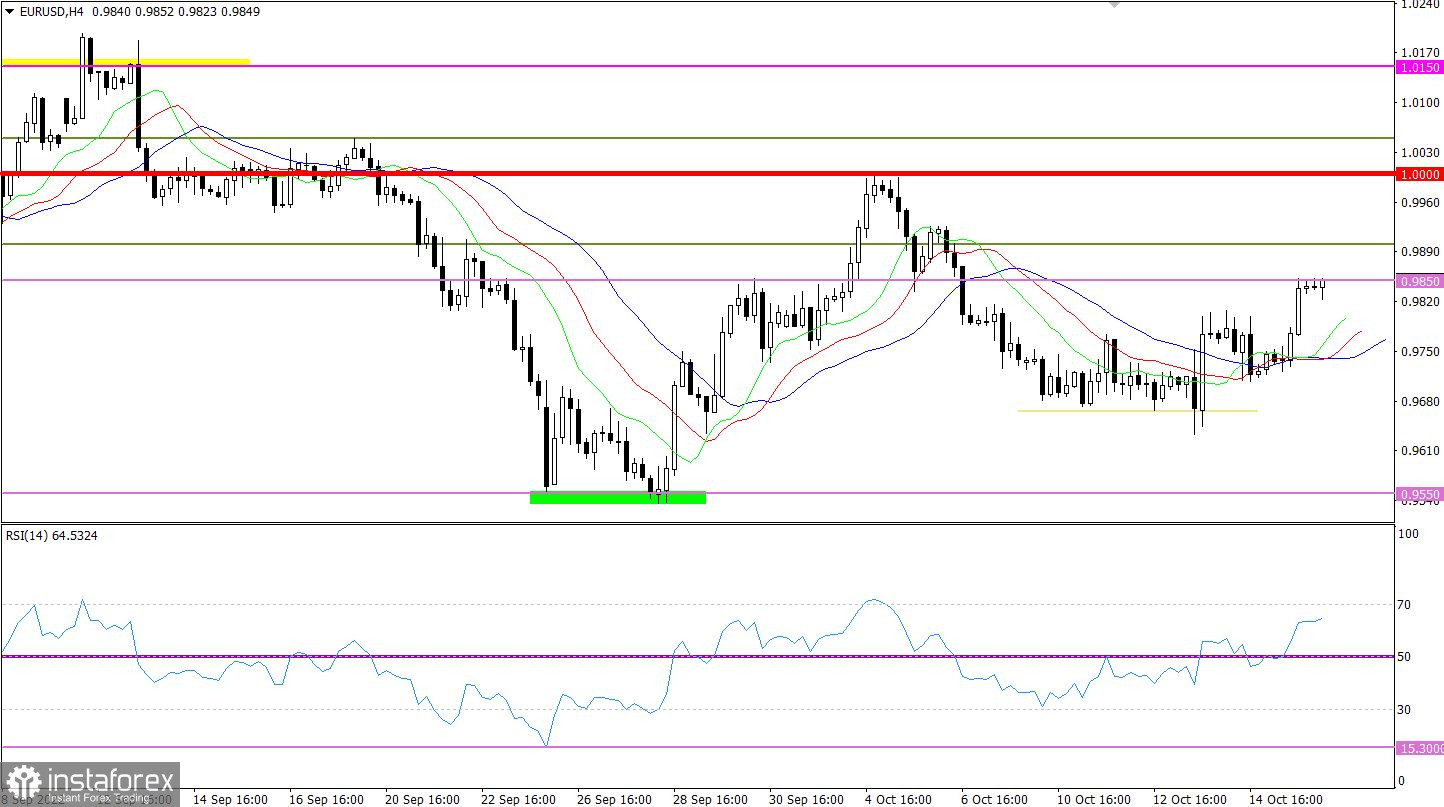

The euro/dollar pair reached a new high thanks to a considerable upward movement. As a result, traders received a technical signal of a change in the market sentiment. This fact boosted the volume of long positions.

On the four-hour chart, the RSI indicator is moving in the upper area of 50/70, which points to the bullish interest among traders. If the moving average upwardly intersects line 50, the signal will be confirmed on the daily chart.

On the four-hour chart, the Alligator's MAs are intersecting each other, which does not give a clear signal of a further direction.

Outlook

If the price consolidates above 0.9850 it may climb to the parity level. Otherwise, stagnation within the current levels may spur a bounce to the intermediate level of 0.9700.

Regarding the complex indicator analysis, we see that in the short-term and intraday periods, the indicator is signaling buy opportunities amid the upward impulse.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română