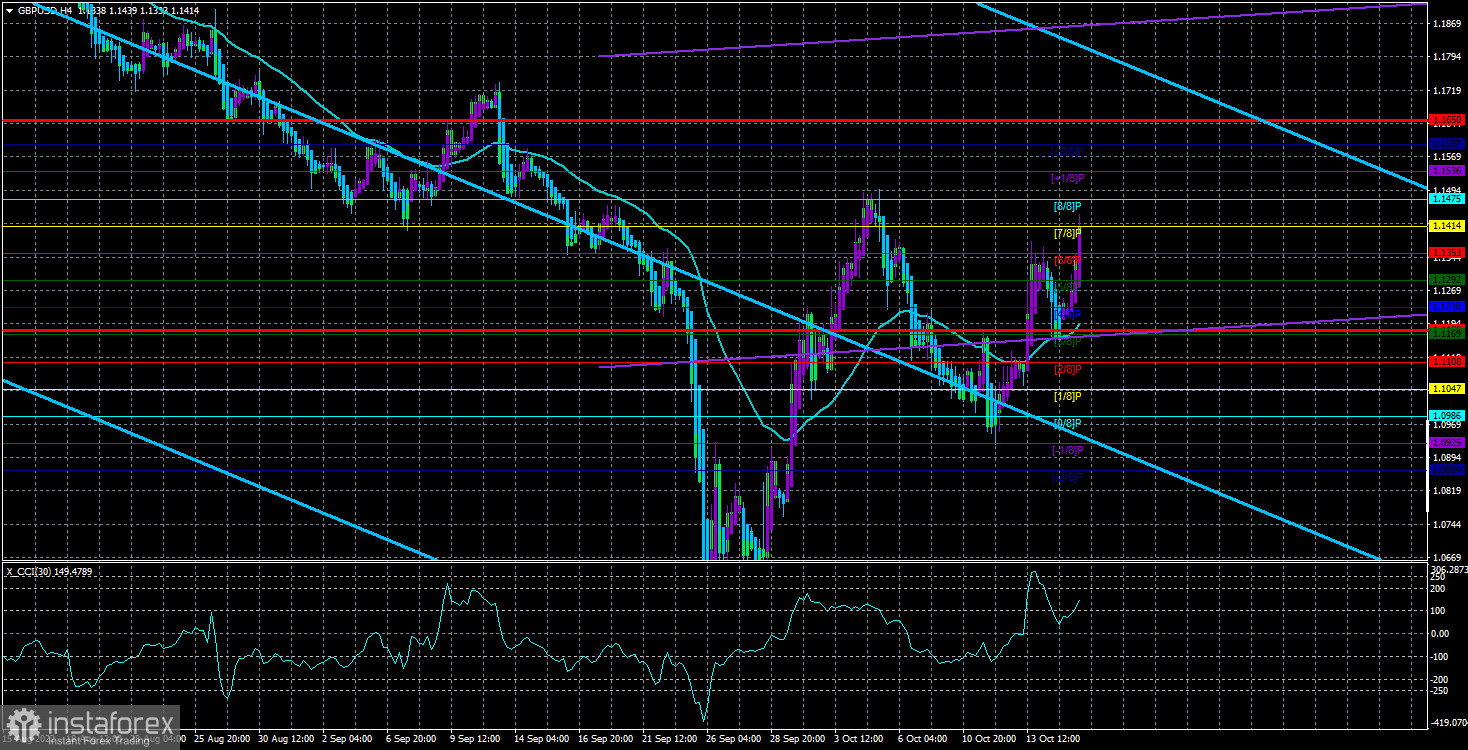

Since the European trading session, the GBP/USD currency pair began to grow on Monday, although no important events were planned for this day. However, the strong movements of the pound no longer surprise anyone since the pound has been showing extra volatility for more than three weeks. If we consider that high volatility is almost always a trend movement, then there are only two options in which direction to move. Consequently, the pound can rise or fall, but this does not mean it will only fall daily on a negative fundamental background. Therefore, we do not consider it a tragedy because of the growth of the British currency on Monday and do not believe that it means anything specific. For technical reasons, it could have been a normal round of upward movement. On the 4-hour TF, it is clear that the price bounced off the moving average line on Friday, which means that there were already reasons for the pound to grow. We also recall that there are grounds for the pair's growth on the 24-hour TF since the price managed to stay above the critical line.

Although the fundamental and geopolitical backgrounds remain as unattractive as possible for the British currency, this does not mean that the pound cannot grow in principle. Look at the illustration above: each subsequent price peak is still lower than the previous one, which means the downward trend continues. Thus, even an increase of 1100 points does not mean 100% that the downward trend is over. The pair may be in a "tipping period," but the price must go beyond at least its last local maximum to identify the possible end of the downward trend. And this requires growth to the 15th level, not lower. Of course, with the current volatility, the pair may reach this level as early as Tuesday or Wednesday. If this happens, the pound will be even closer to breaking the long-term collapse against the dollar.

Politics is interesting, but not for the pound.

The most recent news concerning the UK and the pound has been political. Many Conservatives have already regretted it after Boris Johnson left the post of Prime Minister. After just one month, it became clear that Liz Truss would not become the "new Margaret Thatcher" and, in general, could leave her post as quickly as possible. In principle, in the UK, it is normal practice to pass votes of no confidence in leaders, dismiss ministers for any wrongdoing, or resign voluntarily. Remember how many times key ministers have changed in recent years. However, Truss can set a world record, receive a vote of no confidence, and leave the position within a month of taking office.

The problem is that Truss was chosen because of her high loyalty to Boris Johnson, her relatively high popularity among Conservatives and Britons, and her high competence in international politics (Truss is an ex-foreign Minister). However, economic issues are now the first place for the UK, and the first initiative of the Truss faced such a portion of criticism that she may leave her post.

The tax reduction plan, which practically did not "hurt" anyone during the election, came under a barrage of criticism as soon as it was published. Truss had to look for a "scapegoat" urgently, and that could only be the newly minted finance minister and personal friend of Truss, Kwasi Kwarteng. Thus, Truss has already had to take radical steps to cool the ardor of the opposition and their party members. However, this may not save her from a vote since, according to the latest information, a whole group of Tories will call on Truss to resign publicly. Of course, Truss will not leave his post voluntarily, and even a vote of no confidence (if passed) does not mean that all parliamentarians will support the resignation of the Prime Minister. Truss urgently needs to abandon her tax reduction plan if she wants to retain the position of head of state. This will show her incompetence in economic matters, but at the same time, it will show her strength as a leader who could admit her mistake and do everything that would be good for the state and the nation.

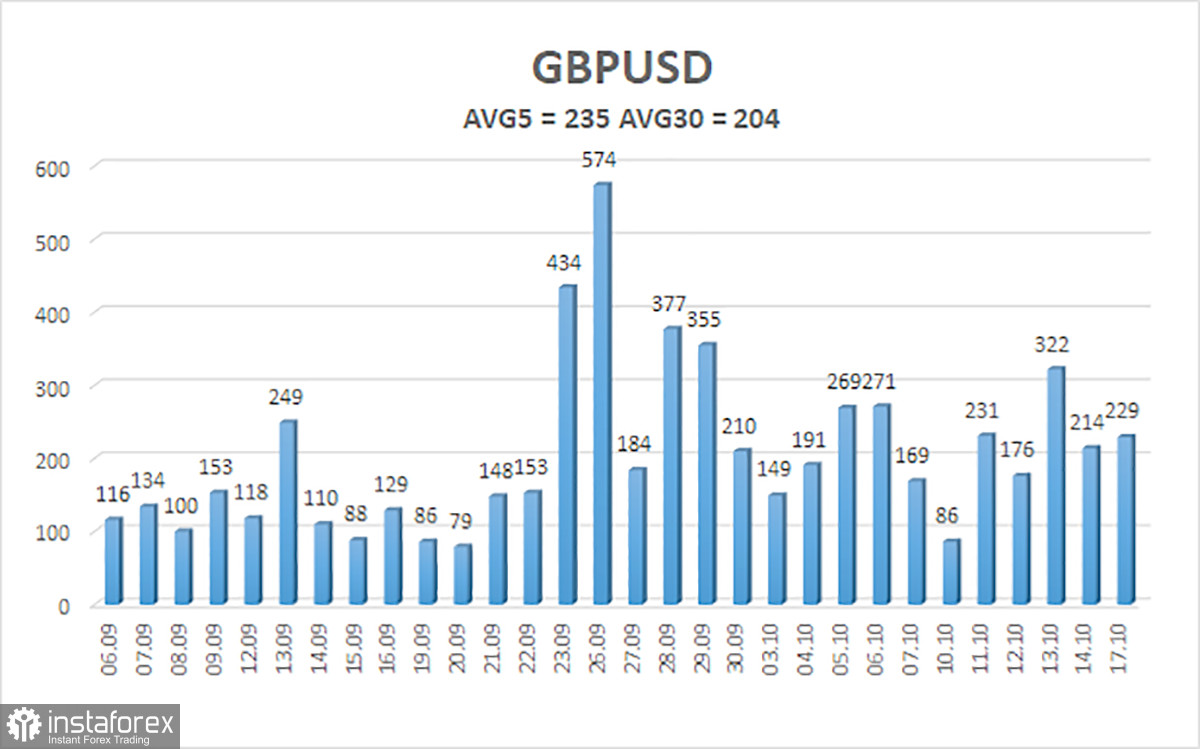

The average volatility of the GBP/USD pair over the last five trading days is 235 points. For the pound/dollar pair, this value is "very high." On Tuesday, October 18, thus, we expect movement inside the channel, limited by the levels of 1.1180 and 1.1650. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction.

The nearest support levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

The nearest resistance levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading Recommendations:

The GBP/USD pair resumed its upward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in buy orders with targets of 1.1536 and 1.1650 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.1047 and 1.0986.

Explanations of the illustrations:

Linear regression channels help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below-250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română