EUR/USD 5M

The euro/dollar pair rose significantly on Monday, as for the scale of the hourly timeframe. On higher time frames, the upward movement does not look overly strong, but on the hourly it is impressive. However, by the end of the day, the pair was only near the Senkou Span B line, and at the same time near the level of 0.9844. Thus, there was no clear breakthrough of these levels, which means that we can deal with another correction, after which the downward movement will resume. However, it should be noted that the euro had no special grounds for growth on Monday. Thus, "growth out of the blue" can be considered a positive moment for the euro. But we still believe that this is not the beginning of a new long-term upward trend. Unfortunately, the fundamental and geopolitical backgrounds still look very difficult for risky currencies, which means that the dollar can go on the offensive at any moment.

Everything was complicated in regards to Monday's trading signals. The pair traded exclusively sideways during the European trading session, in the area of the Kijun-sen line and the level of 0.9747. There was exactly one pin above this area, which turned out to be false. At the same time, there should not have been a loss on the long position, since there was no sell signal, which means that it should not have been closed. The price nevertheless started an upward movement on the second attempt and subsequently went up by at least 100 points. The long position had to be closed manually at a profit of about 75 points.

COT report:

The Commitment of Traders (COT) reports in 2022 can be entered into a textbook as an example. For half of the year, they showed a blatant bullish mood of commercial players, but at the same time, the euro fell steadily. Then for several months they showed a bearish mood, and the euro also fell steadily. Now the net position of non-commercial traders is bullish again, and the euro continues to fall. This happens, as we have already said, due to the fact that the demand for the US dollar remains very high amid a difficult geopolitical situation in the world. Therefore, even if the demand for the euro is rising, the high demand for the dollar does not allow the euro itself to grow. During the reporting week, the number of long positions for the non-commercial group decreased by 3,200, while the number of shorts increased by 2,900. Accordingly, the net position decreased by about 6,100 contracts. This fact is not of particular importance, since the euro still remains "at the bottom". At this time, commercial traders still prefer the euro to the dollar. The number of longs is higher than the number of shorts for non-commercial traders by 38,000, but the euro cannot derive any dividends from this. Thus, the net position of the non-commercial group can continue to grow further, this does not change anything. Even if you pay attention to the total number of longs and shorts, their values are approximately the same, but the euro is still falling. Thus, it is necessary to wait for changes in the geopolitical and/or fundamental background in order for something to change in the currency market.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. October 18. The ECB will not be able to fight inflation effectively.

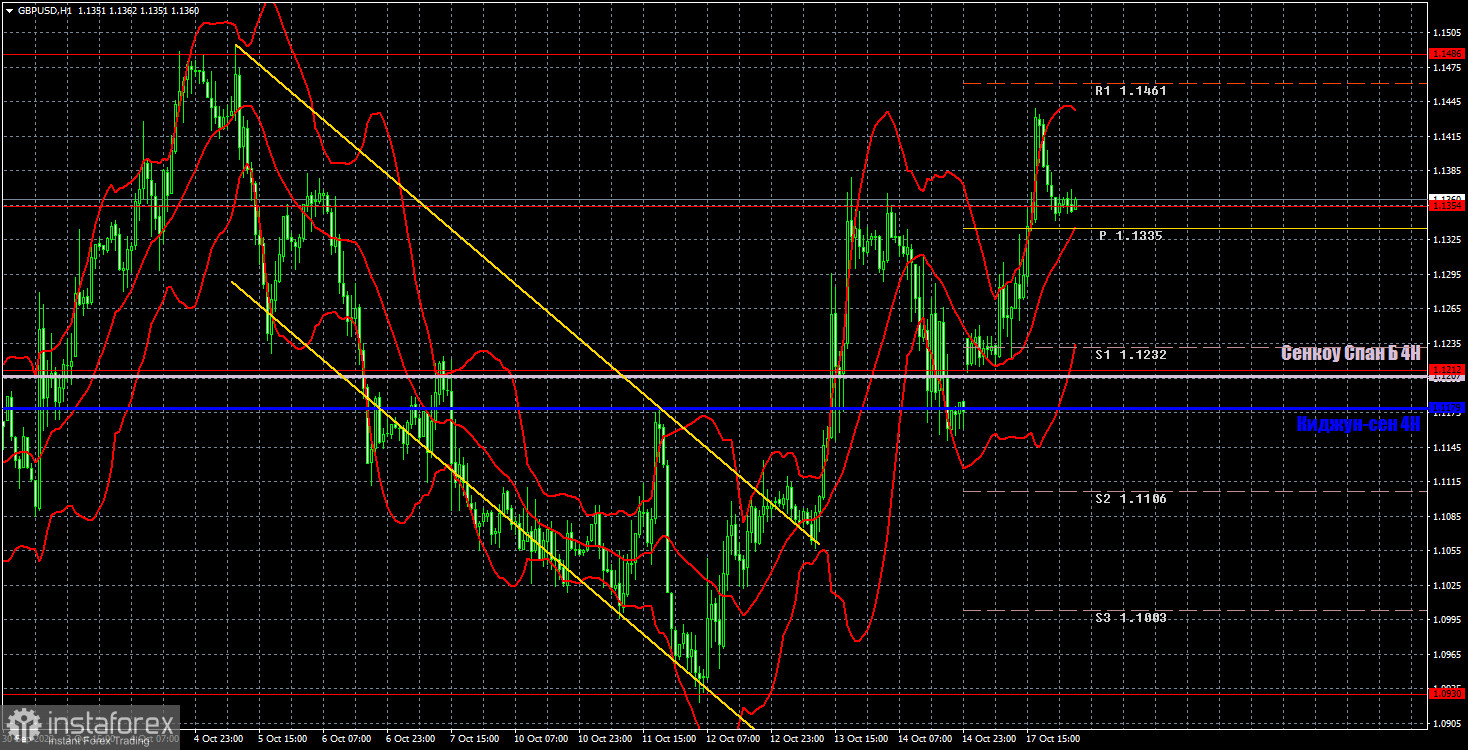

Overview of the GBP/USD pair. October 18. The political pun in the UK persists.

Forecast and trading signals for GBP/USD on October 18. Detailed analysis of the movement of the pair and trading transactions.

EUR/USD 1H

The downward trend still cannot be considered reversed on the hourly timeframe, despite a solid rise over the past few days. However, the euro is close to trying to start forming a new upward trend. If it manages to confidently overcome the Senkou Span B line, it will be possible to count on additional growth of the pair. On Tuesday, we highlight the following levels for trading - 0.9553, 0.9635, 0.9747, 0.9844, 0.9945, 1.0019, 1.0072, as well as Senkou Span B (0.9834) and Kijun-sen lines (0.9740). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. No important events or reports are scheduled in the European Union on October 18, and a report on industrial production will be released in the US, which is interesting only from the point of view of statistics. However, the pair showed a very high volatility out of the blue on Monday, so there is reason to expect its active movements on Tuesday as well.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română