The pound sterling advanced during the Asian session as investor's trust towards the UK currency was reinforced by expectations of further U-turns on Liz Truss's unfunded tax cut plans.

GBP gained 1.2% against the US dollar and reached $1,1305. Jeremy Hunt, who was recently appointed Chancellor of the Exchequer, told BBC on Sunday that "nothing were off the table" regarding the possible cancellation of the prime minister's economic plans. The Chancellor is set to speak on the government medium term financial plans later today. According to The Times's journalist Steven Swinford, Liz Truss has signed off Jeremy Hunt's plans to defer a 1p cut in income tax until 2024.

"The U-turn around tax cuts is the minimum that UK markets needed to see to avoid another tantrum and so these headlines may be useful in nixing any short sentiment amongst pound speculators," Viraj Patel, global macro strategist at Vanda Research in London said. "If pension funds or other gilt holders aren't done meeting collateral needs or raising liquidity buffers, and we continue to see firesales of UK bonds, then sentiment for the pound can quickly turn on its head."

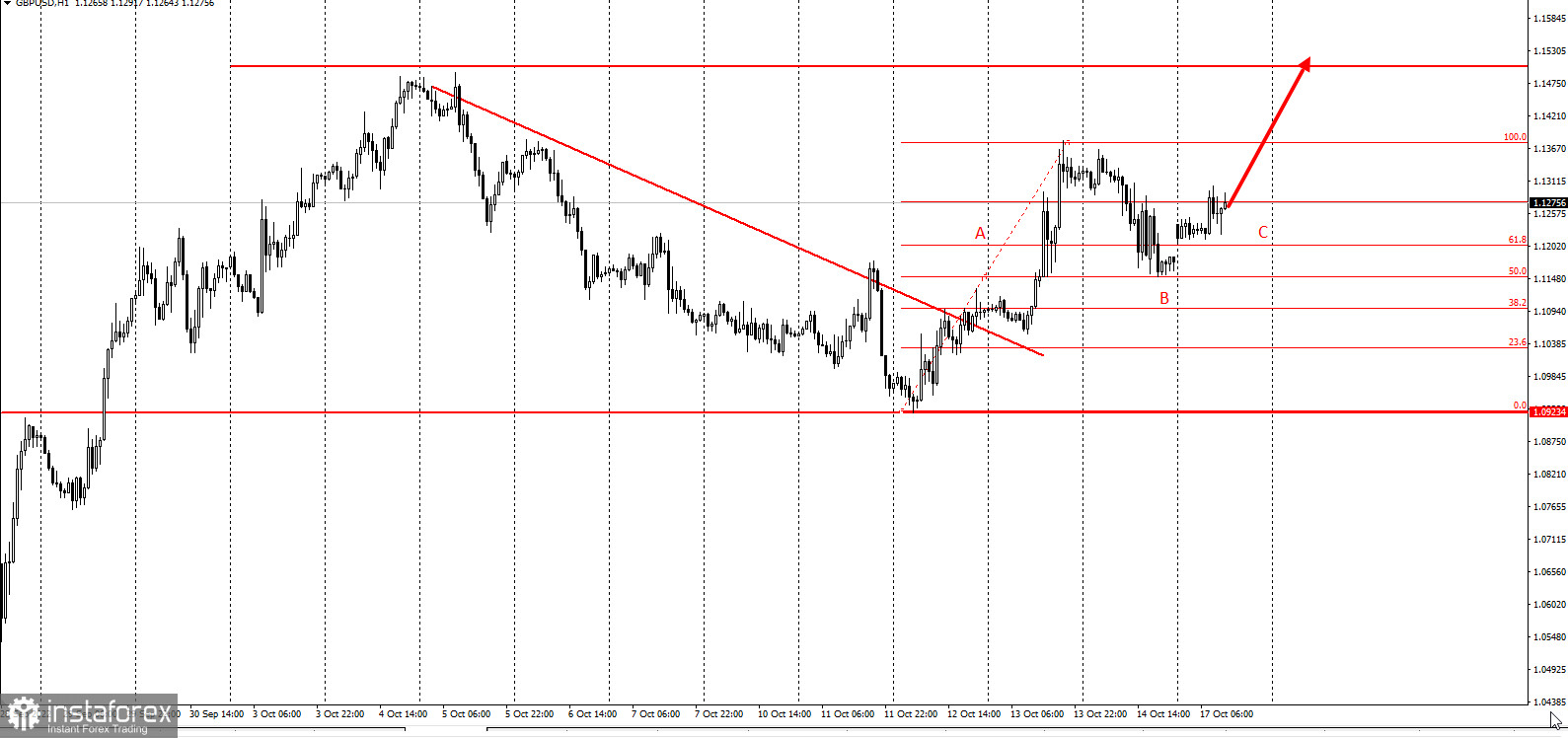

The pound dropped sharply earlier amid rumors about a possible wave of U-turns from the Treasury. On Thursday, GBP advanced by 2.5% against USD, as reports of widespread changes trickled in. However, the UK currency fell by 1.4% the following day after Liz Truss's lackluster press conference that contained little new information.

Nevertheless, the pound sterling remains vulnerable. The Bank of England has finished its emergency bond purchase program on Friday, which could lead to further volatility in the gold market. Uncertainty is persisting over the extent to which liability-driven investment funds have recovered from the impact of the spike in bond yields.

However, despite the volatility, the pound sterling has recovered near the levels it held before the government's announced its fiscal plans on September 23. Analysts have attributed this recovery in part to the BOE's interventions in the bond market that staved off the risk of broader financial instability.

"When the dust settles, we expect that the BOE will hike less than the market is pricing, and sterling will need to act as the main adjustment mechanism," Goldman Sachs Group Inc. strategists including Kamakshya Trivedi wrote in a note. The company sees the pound falling to $1.05 in three months.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română