As British government officials lined up on the road of shame, the pound managed to bounce back after the weekend sell-off by October 14th. They were caused by the termination of the Bank of England's £65bn quantitative easing program. Markets are so accustomed to something temporary from the central bank becoming semi-permanent that they were sorely disappointed that this time everything went wrong.

As the BoE tries to replace QE with a bond buying and selling repo program, knowing full well that it is impossible to tighten and loosen monetary policy at the same time for a long time, members of the cabinet ministers stubbornly repeat the same mantra. Taxes will not fall as quickly as many would like, and there is no fiscal stimulus without more borrowing and debt. Tax cuts should be done in such a way that people see that the government can afford it.

The last drops in the sea of financial market turmoil were the change of the Chancellor of the Exchequer and Liz Truss' announcement that corporate tax in 2023 will increase from 19% to 25%. Investors realized that the new government, after an erroneous mini-budget, decided to synchronize monetary and fiscal policy. This had a positive effect on the debt market and GBPUSD. However, the stabilization of the pair is likely to be a temporary phenomenon. Goldman Sachs notes that as soon as the dust settles, that is to say, the markets will calm down, there will be talk that the repo rate will not rise as fast as it is currently expected, which will drop the sterling to $1.05.

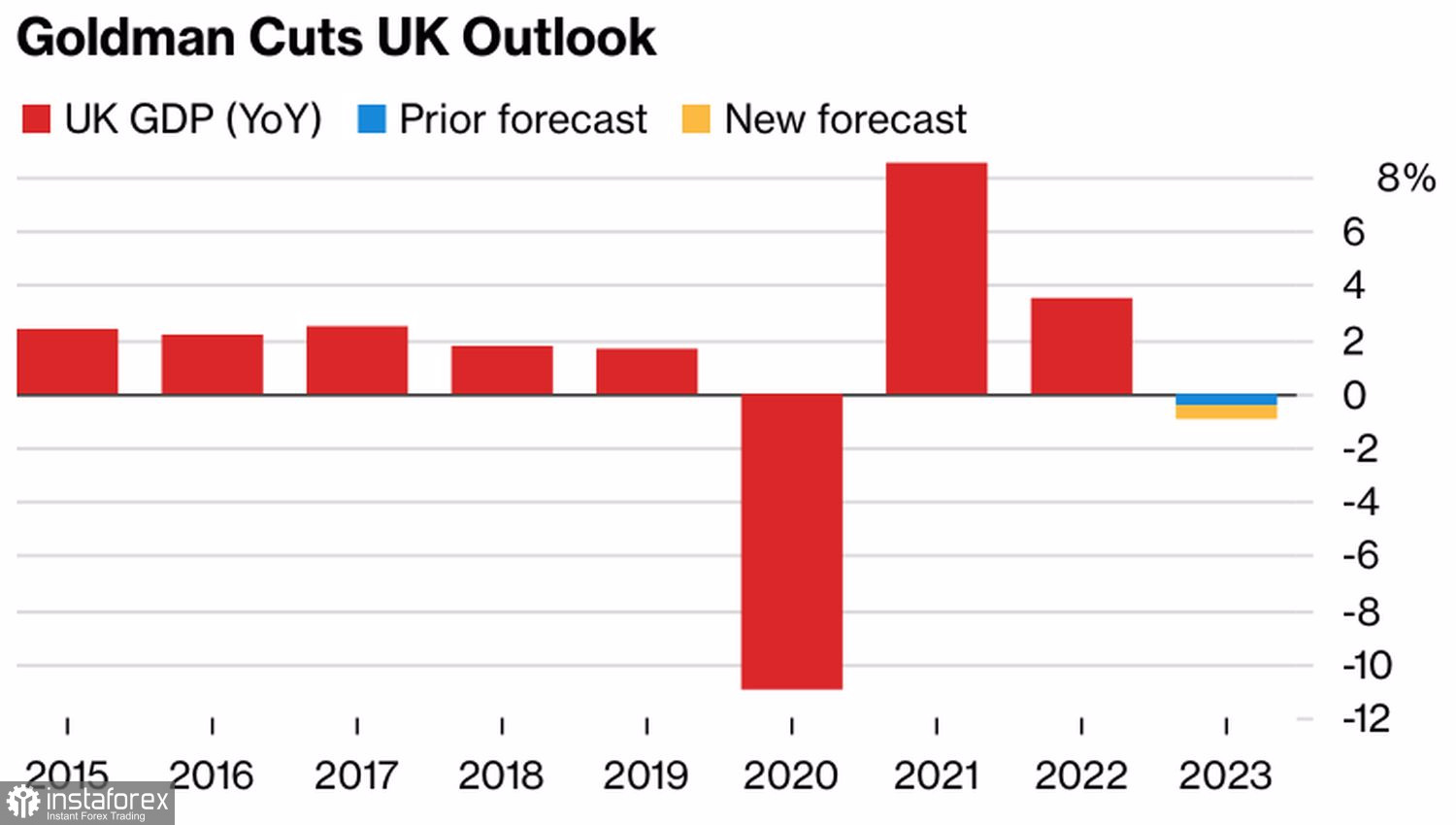

Moreover, Goldman Sachs, citing an increase in corporate tax, cut its UK GDP growth forecast for 2023 from -0.4% to -1%. Core inflation at the end of next year is expected at 3.1%, not 3.3%.

UK GDP dynamics

According to 47% of the 452 investors participating in the MLIV Pulse survey, it is the UK that has the greatest chance of facing a recession. The probability that the eurozone will be the first to fall into recession is 45%, and the US is 7%.

In terms of inflation, the release of consumer price data will be the highlight of the UK economic calendar in the week leading up to October 21st. Bloomberg experts expect CPI to accelerate from 9.9% to 10% in September. Core inflation will rise from 6.3% to 6.4%, the highest since 1992.

Such dynamics of indicators on paper should increase the aggression of the Bank of England, and with it, the chances of a 100 bps increase in the REPO rate in November, which could theoretically support the GBPUSD. However, given the confusion on the financial markets and rumors about the resignation of Liz Truss, the strengthening of the sterling on macro statistics looks unlikely.

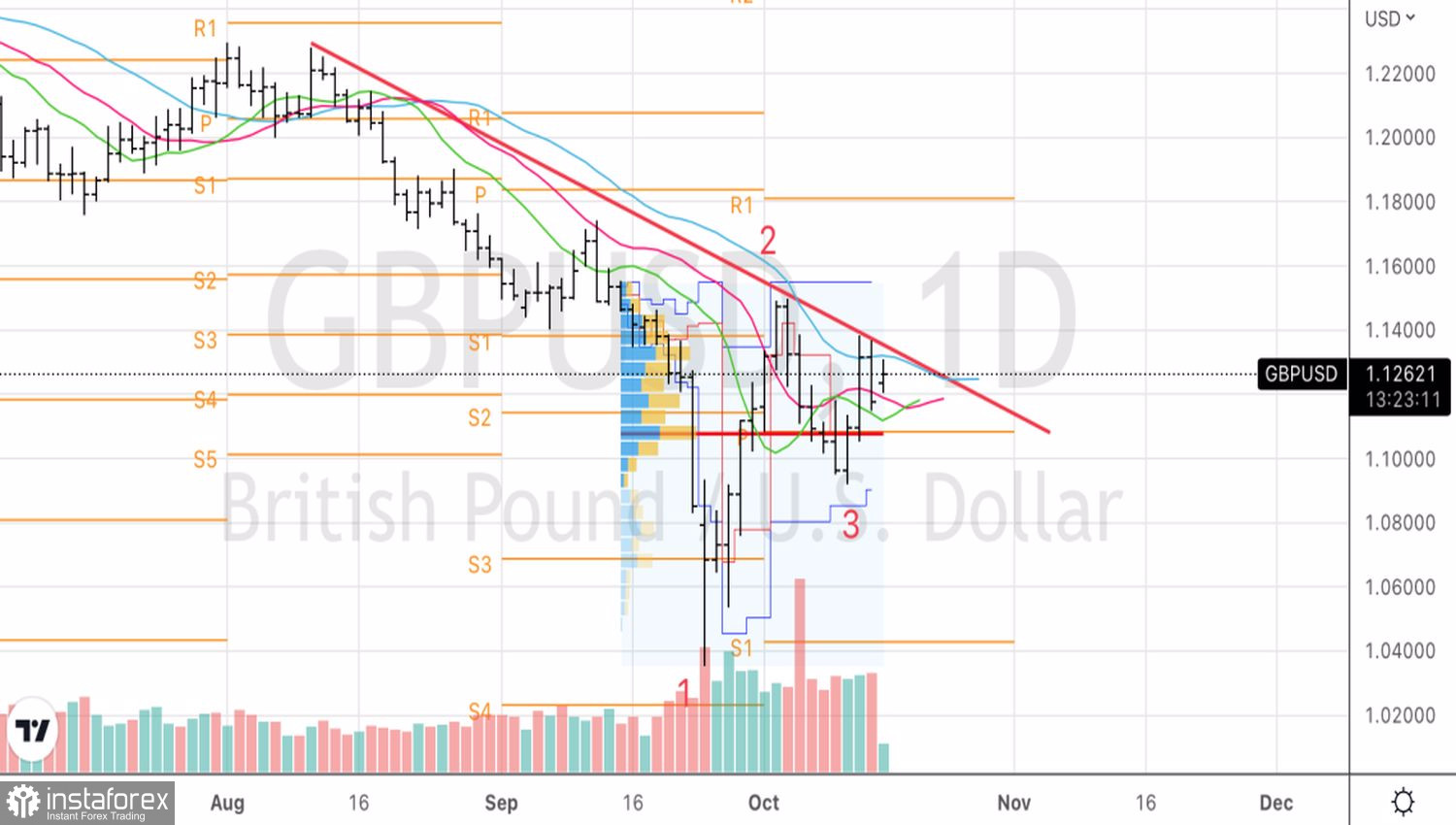

Technically, there is an inverted 1-2-3 pattern on the GBPUSD daily chart. A break of the diagonal resistance near 1.136 could be a buying opportunity. Until this happens, we keep the focus on sales. Including in case of a successful assault on support at 1.116.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română