trend analysis

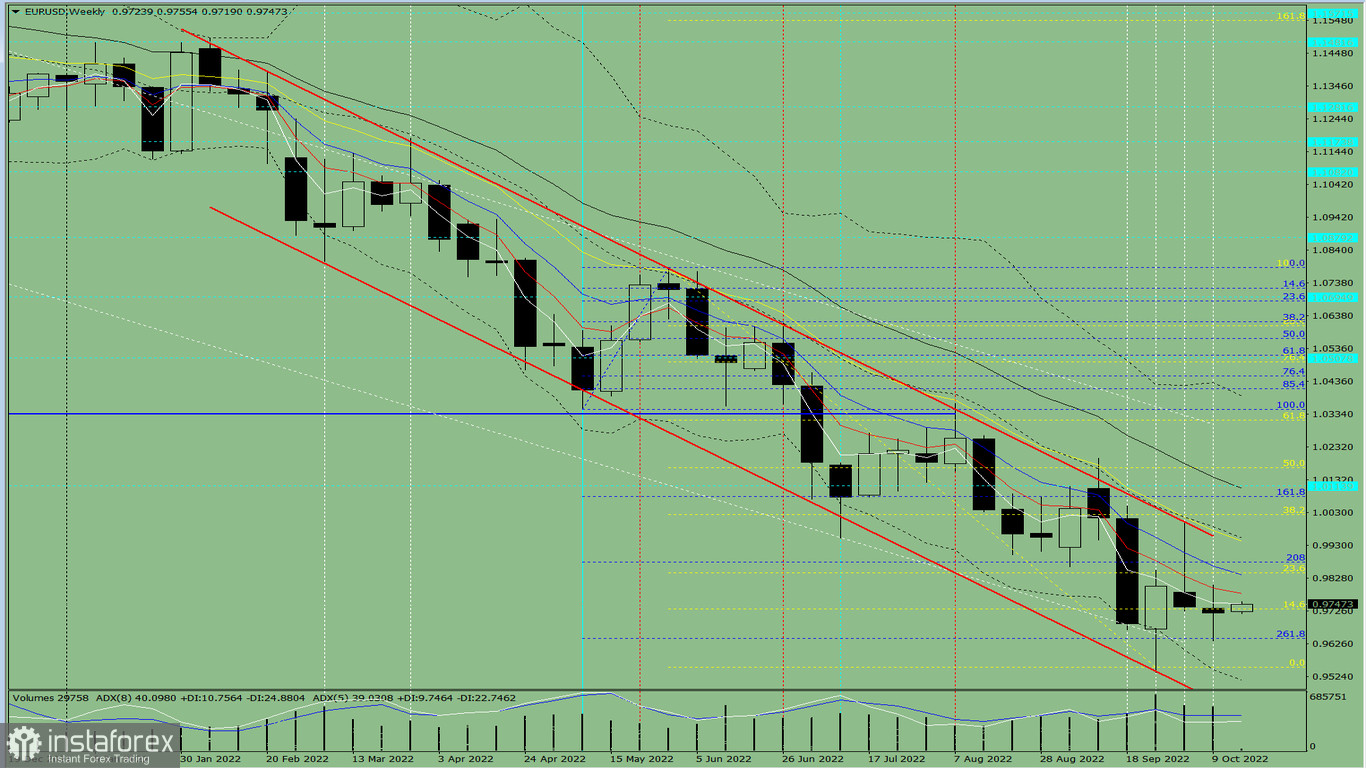

This week, EUR/USD quotes may move up from 0.9721 (closing of the last weekly candle) in order to test the 23.6% retracement level at 0.9843 (yellow dotted line). Then, it will go to the 38.2% retracement level at 1.0023 (yellow dotted line), before falling down to the 208% retracement level at 0.9874 (blue dotted line). The pair will attempt to resume the upward trend from this level.

Fig. 1 (weekly chart)

comprehensive analysis:

Indicator analysis - uptrend

Fibonacci levels - uptrend

Volumes - uptrend

Candlestick analysis - uptrend

Trend analysis - uptrend

Bollinger bands - uptrend

Monthly chart - uptrend

All this points to an upward movement in EUR/USD.

Conclusion: The pair will have a bullish trend, with no first lower shadow on the weekly white candle (Monday - up) and no second upper shadow (Friday - up).

So during the week, euro will rise from 0.9721 (closing of the last weekly candle) to the 23.6% retracement level at 0.9843 (yellow dotted line), go to the 38.2% retracement level at 1.0023 (yellow dotted line), then fall down to the 208% retracement level at 0.9874 (blue dotted line). The pair will attempt to resume the upward trend from this level.

Alternatively, quotes could climb from 0.9721 (closing of the last weekly candle) to the 23.6% retracement level at 0.9843 (yellow dotted line), then bounce down to the 261.8% retracement level at 0.9641 (dashed blue line). The pair will continue to rise after testing this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română