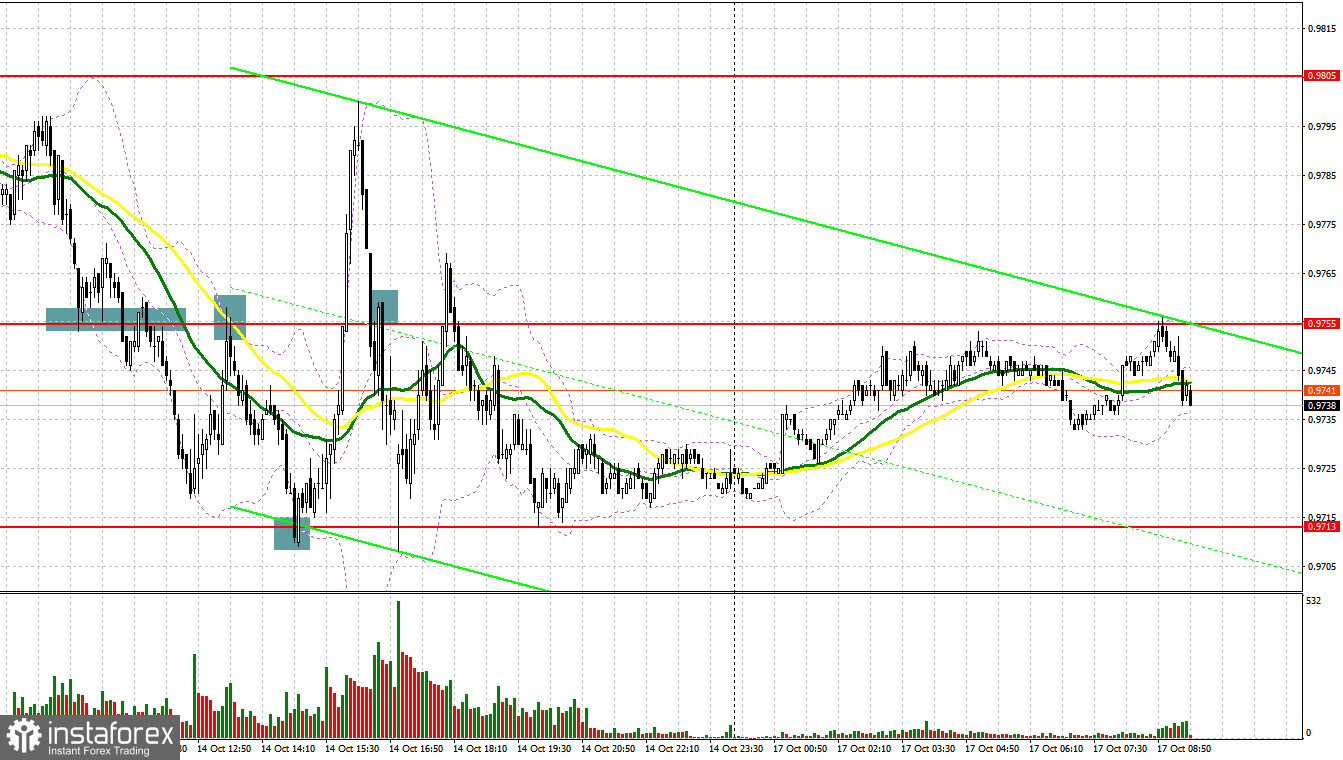

On Friday, we had several great entry signals. Let's analyze the 5-minute chart. In my morning review, I outlined the level of 0.9755 and recommended entering the market from there. This was obviously the key level as the bulls tried to develop an upward movement from there after a false breakout in the first half of the day but failed to do so. There was just a short spike of 15 pips that ended very quickly. Meanwhile, bears managed to break below 0.9755 on the second try. Its retest generated a sell signal which resulted in a drop of 35 pips. Even if you missed this opportunity, there was a retest and a false breakout of 0.9755 which created another entry point for going short. As a result, the pair declined by more than 40 pips. In the second half of the day, we could observe a false breakout at 0.9713 which developed into an upside movement of 80 pips. Yet, bears did not allow bulls to stay in control of the market and brought the pair back below 0.9755 closer to the North American session. An upward retest formed a sell signal and led to a decline of 40 pips.

For long positions on EUR/USD:

Retail sales in the US remained almost unchanged since August which is why the pressure on risk assets has slightly eased. At some point, lower retail sales should mean lower inflation which the US Federal Reserve has been fighting for so long. At the start of the week, the pair may trade within the sideways channel that has been there for quite some time even despite the release of important data from the US. Apparently, bears are no longer willing to sell the euro. However, the market is not ready to buy it either, given the ongoing geopolitical tensions. Today, ECB representatives De Guindos and Philip Lane will speak. Yet, their comments are unlikely to change the market sentiment. The monthly report by the Bundesbank also seems to be a mere formality. My trading recommendation will be to focus on the boundaries of the sideways channel. If the pair declines, a false breakout of the lower boundary of the current sideways channel at 0.9709 will be a great moment to add more long positions with the target at 0.9755. Bulls will reclaim their control over the market only when the price breaks above 0.9755 and retests this level from top to bottom. This will trigger stop-loss orders set by bears, thus creating an additional buy signal with a possible surge to the upper boundary of the channel at 0.9798. A firm hold above this level will cancel the bearish trend that has been developing since October 4. A rise above 0.9798 will pave the way towards 0.9841 where I recommend profit taking. In case of a decline and no buying activity at 0.9709, the euro will come under more pressure. This may widen the sideways channel and send the price down to 0.9675. However, this shouldn't be viewed as a victory for bears. The best scenario to buy the pair is to wait for a false breakout at 0.9675. Then you can buy EUR/USD right after a rebound from the level of 0.9638 or 0.9592, bearing in mind an upside correction of 30-35 pips within the day.

For short positions on EUR/USD:

Bears need to protect the middle of the sideways channel at 0.9755 which will allow them to head for its lower boundary at 0.9709. It is better to open short positions on a false breakout from 0.9755, just like the one we observed in the Asian session. The euro is unlikely to get any support from today's news background. So, a false breakout at this level will be perfect for opening short positions with the view to returning to the lower boundary at 0.9709. At this point, sellers may face an obstacle. If the price settles below this range and retests it from the bottom up, traders will continue to sell the pair to trigger stop-loss orders set by the bulls and bring the price to the area of 0.9675. The mark of 0.9638 will act as the lowest target. This is the level where large market players bought the euro last week amid disappointing inflation data from the US. I recommend taking profit here. If EUR/USD moves up in the European session and bears stay idle at 0.9755, demand for the pair will increase, leading to a stronger upside correction. If so, I would advise you to sell the pair only when a false breakout is formed at 0.9798, just like I described above. You can sell EUR/USD on a rebound from the high of 0.9841 or 0.9878, keeping in mind an upside correction of 30-35 pips within the day.

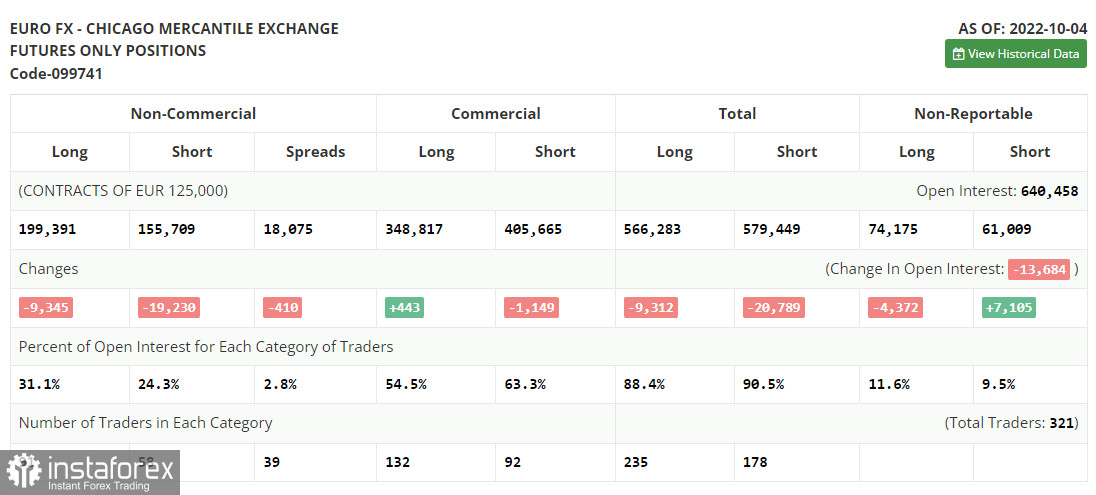

COT report

The Commitment of Traders report for October 4 showed a rapid decline in both short and long positions. It seems that investors and large market players prefer to stay in a wait-and-see mode amid extremely high geopolitical tensions. Against this backdrop, demand for the US dollar will definitely increase. Besides, the latest data on the US labor market and the inflation report for September may send the euro to new lows against its American rival. In the near term, we may witness a final massive sell-off in risk assets. According to the COT report, long positions of the non-commercial group of traders declined by 9,345 to 199,391, while short positions dropped by 19,230 to 155,709. As a result, the non-commercial net position remained positive at the end of the week and stood at 43,682 versus 33,797. This indicates that investors are benefiting from the cheap euro that is trading below the parity level. Traders also keep their long positions open as they hope that the pair will recover in the long term. The weekly closing price rose to 1.0053 from 0.9657.

Indicator signals:

Moving Averages

Trading near the 30- and 50-day moving averages indicates high market uncertainty.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of an upward movement, the upper band of the indicator at 0.9755 will serve as resistance. If the pair declines, the lower band at 0.9709 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română