The euro-dollar pair showed increased volatility on Thursday, reacting to the release of data on the growth of the US consumer price index. It is noteworthy that the volatility was multidirectional: at first, the price of EUR/USD fell sharply to the level of 0.9634, thereby updating the two-week low, but then reversed 180 degrees and jumped under the border of the 98th figure. Apparently, the dollar fell victim to the "buy on rumors, sell on facts" trading principle: the greenback was in demand ahead of the inflationary release, but after the fact, traders almost immediately took profits by opening long positions at the same time. In addition, the fact that the growth of headline inflation continues to slow down played its role – this indicator demonstrates a downward trend for the second consecutive month.

But if we abstract from Thursday's intraday fluctuations and consider the situation in the perspective of a wider time range, we can come to a rather unambiguous conclusion: the downward trend of EUR/USD is still in force. The headline indicator of the report, which reflected a slowdown in the overall consumer price index, should be viewed through the prism of the latest decision by OPEC +, whose members announced a reduction in oil production by 2 million barrels per day since November. This is the biggest decline in oil production since the coronavirus pandemic in 2020.

US President Joe Biden has already blamed the likely rise in gasoline prices in the United States on Riyadh. We will not go into the political background of this decision of the cartel (OPEC cut production on the eve of the November elections to the US Congress) - we are only interested in the economic side of the issue. So, according to some experts, prices at American gas stations will rise by approximately 10-30 cents per gallon. According to other analysts, the price will rise more significantly - by 40-50 cents per gallon. The cost of fuel can vary from state to state (for example, gas is always more expensive in California due to the nation's highest fuel taxes and very strict environmental restrictions), but in general, everyone will be affected by this situation.

And here it is necessary to return to the inflation report published on Thursday. Its structure suggests that gasoline prices, which have been declining for the third consecutive month, have contributed to slowing down the pace of growth in energy prices. This component rose in September to 19.8% y/y, while in August an increase of almost 24% y/y was recorded. But in light of the aforementioned OPEC decision and the process of rising gasoline prices in the US, we can assume that the general consumer price index in October-November-December is unlikely to continue the downward trend.

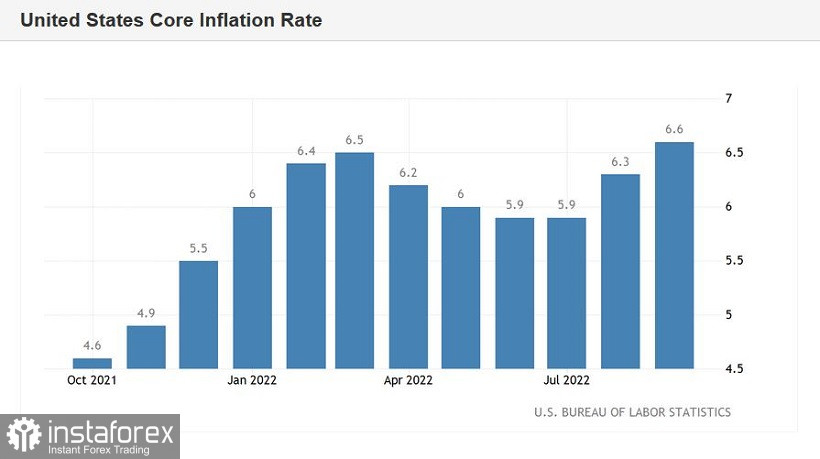

This is about the overall CPI. The core consumer price index does not even think of declining: it showed an upward trend both in September and August, eventually reaching a record high of 6.6% (the strongest growth rate of the indicator over the past 40 years). The lion's share here is occupied by the cost of using housing, the cost of medical services, transport, and air tickets. In general, core inflation has reached a level that was last recorded back in 1982.

The conclusions are obvious. The US Federal Reserve will be forced to respond to the current situation by further tightening monetary policy. According to the CME FedWatch Tool, the probability of a 75 bps rate hike at the November meeting is already 98%. Moreover, the market began to cautiously discuss the 100-point scenario. And although the probability of such a scenario is currently estimated at only 5%, the very fact of discussing this scenario will provide the greenback with background support. For comparison, it can be noted that just last Monday, when the disappointing ISM index in the manufacturing sector was published in the United States, the chances of a 75-point rate hike in November were estimated at 49%. Therefore, now we can safely say that the latest releases (Nonfarm, CPI, producer price index) have significantly increased the hawkish mood of traders and members of the Fed.

Actually, the latest comments of the Fed representatives (Brainard, Mester, Bowman) serve as a vivid confirmation of this. It is also worth recalling here the position of Fed Chairman Jerome Powell, which he voiced at the end of August at a symposium in Jackson Hole and has since repeated it several times in one interpretation or another. According to Powell, the US central bank will continue to raise interest rates and will keep them high, "even if it hurts households and businesses." Powell was actually saying that Americans would have to put up with a slowdown in economic growth, as "it's the sad price of lowering inflation." At the same time, he has repeatedly stated that the pace of tightening monetary policy this year "will depend on incoming data", primarily in the field of inflation.

Thus, despite the current counterattacking actions of EUR/USD bulls, in the medium term, short positions are prioritized. The targets remain the same - 0.9600 and 0.9560 (the lower line of the Bollinger Bands indicator on the daily chart).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română