Trading in the financial markets in the second half of the year is pure pleasure. The stock indices of the US and EURUSD step on the same rake with enviable frequency, counting on a dovish reversal where it does not even exist. Even the acceleration of US core inflation to 6.6% in September, the highest mark in 40 years, was seen as a command to euro fans. Where, where are you heading, fools?

When the probability of a 75 bps hike in the federal funds rate in December jumps from 35% to 65%, and its ceiling rises from 4.5% to 5%, selling the US dollar is absolutely the wrong strategy. The US currency is enjoying well-deserved popularity in 2022 due to the aggressive tightening of the Federal Reserve's monetary policy and high demand for safe-haven assets due to recurrent stresses. Why get rid of it if the rate of monetary restriction is increasing, and there is no end in sight to the problems? The same crisis in the British debt market that has swept through global bonds in waves is far from over.

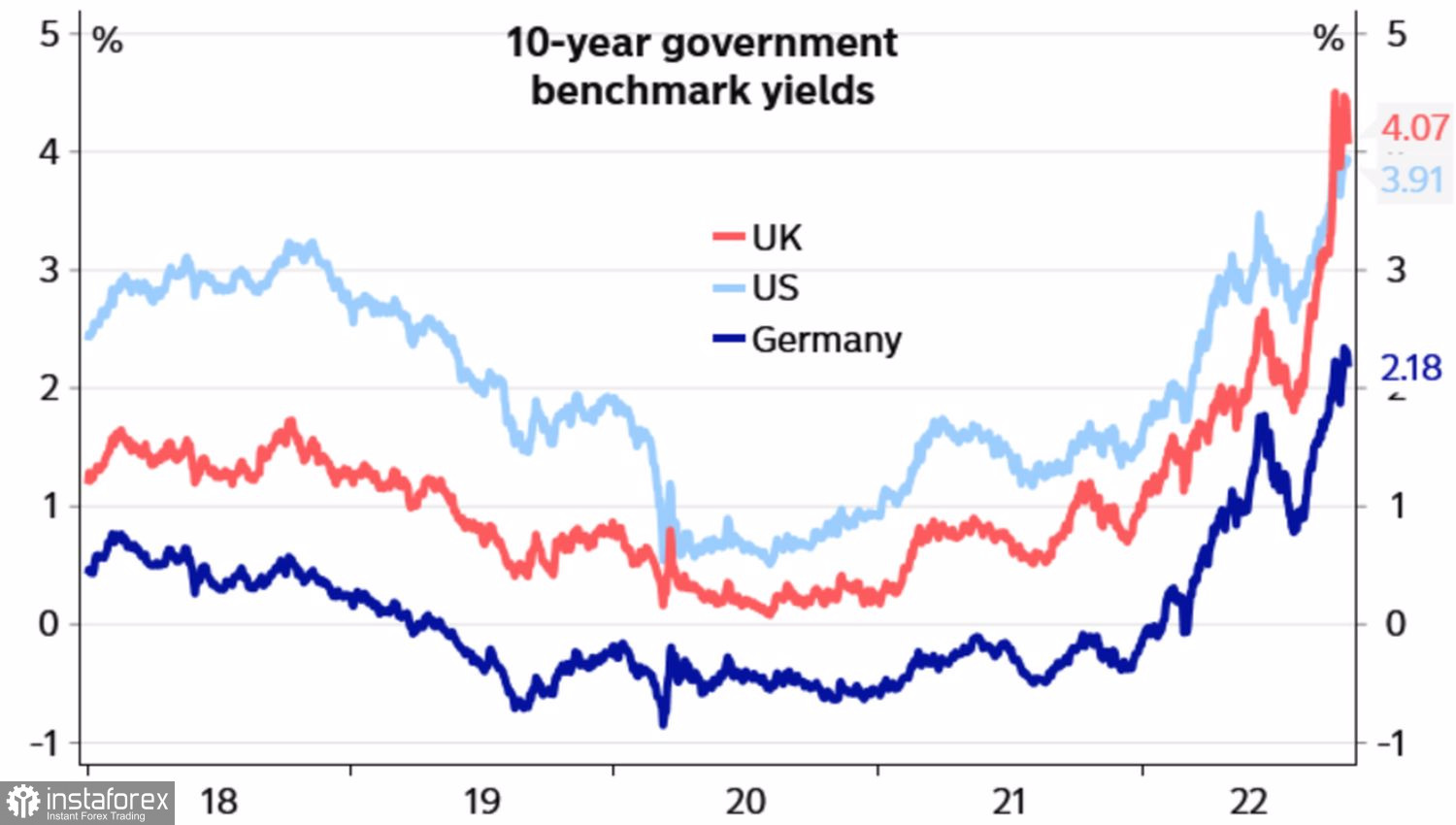

Bond yield dynamics

The government of British Prime Minister Liz Truss decided to turn it into a farce. They say that it is not the mini-budget that is to blame for the shocks, but the Bank of England, which raised rates more slowly than the Fed. In fact, as European Central Bank President Christine Lagarde says, during a period of monetary policy normalization, care must be taken to shift the focus of fiscal policy towards measures that keep debt sustainable. And what about Germany, which has announced a €200 billion stimulus package to support households hit by the energy crisis? A new fire could break out in the eurozone debt markets.

So it turns out that problems arise in the eurozone, and investors flee from them to America. This leads to the strengthening of the US dollar no less than the monetary policy of the Fed. Which, by the way, does not think to slow down. What did the financial markets come up with amid the acceleration of US inflation, but their next campaign against the Fed will most likely end in another fiasco.

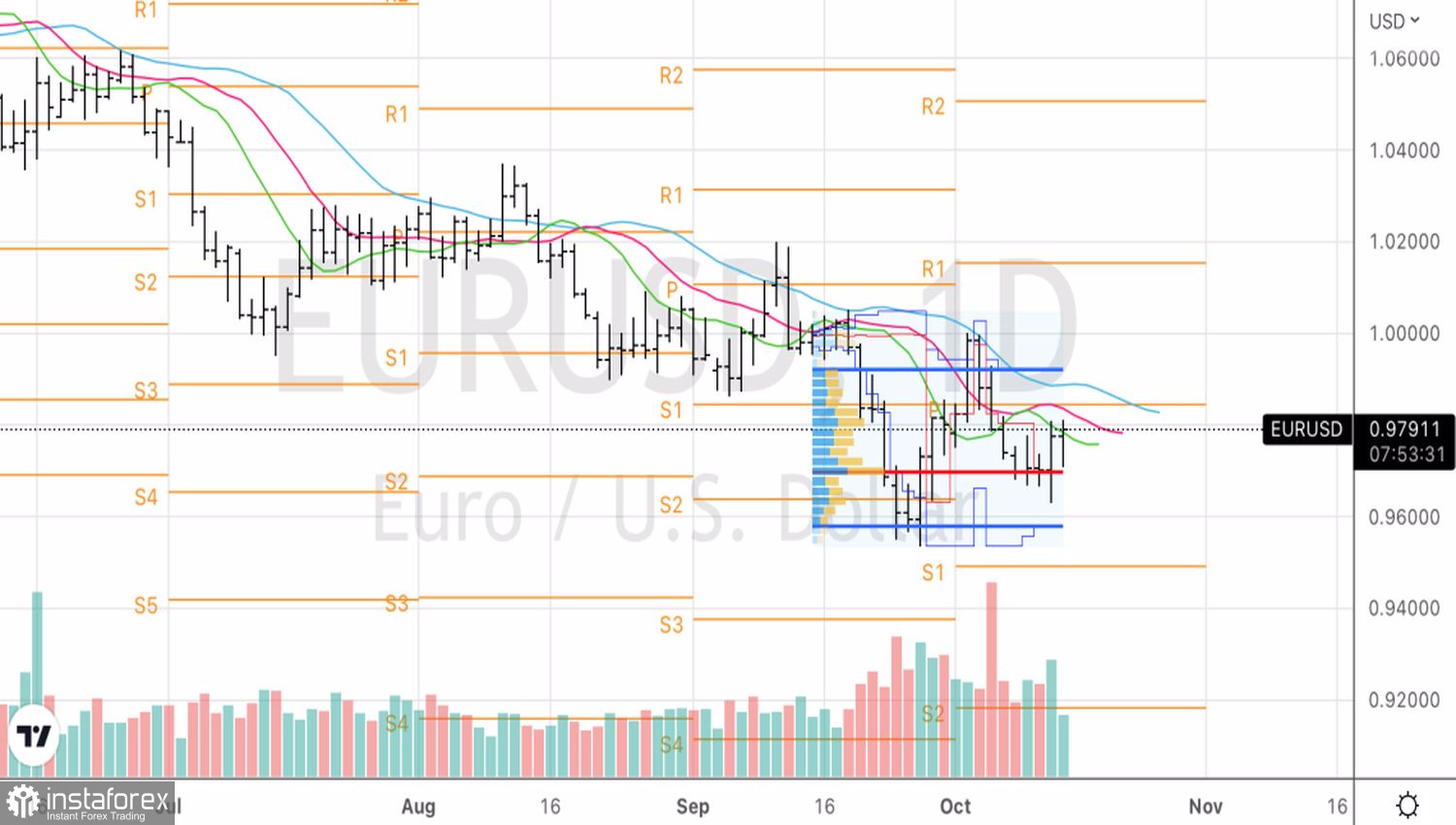

Of course, EURUSD's paradoxical rise in response to strong core inflation figures can be blamed on the "buy the dollar on the rumor, sell on the facts" principle, but smart people don't do that. They prefer to wait until the bears throw away the ballast, unsure of the continuation of the downward trend of traders, and then move down again.

In the end, nothing has changed. The eurozone economy looks worse than the American one, the Fed is already wrapping up the balance sheet, while the ECB is going to start doing this only in 2023, the armed conflict in Ukraine is not over, and there is no end in sight to the energy crisis.

Technically, on the EURUSD daily chart, the bulls are trying to start a correction. Their failure to do so will result in the pair closing below the moving average near 0.978. If this happens, the euro will need to be sold on a break of the fair value of 0.97.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română