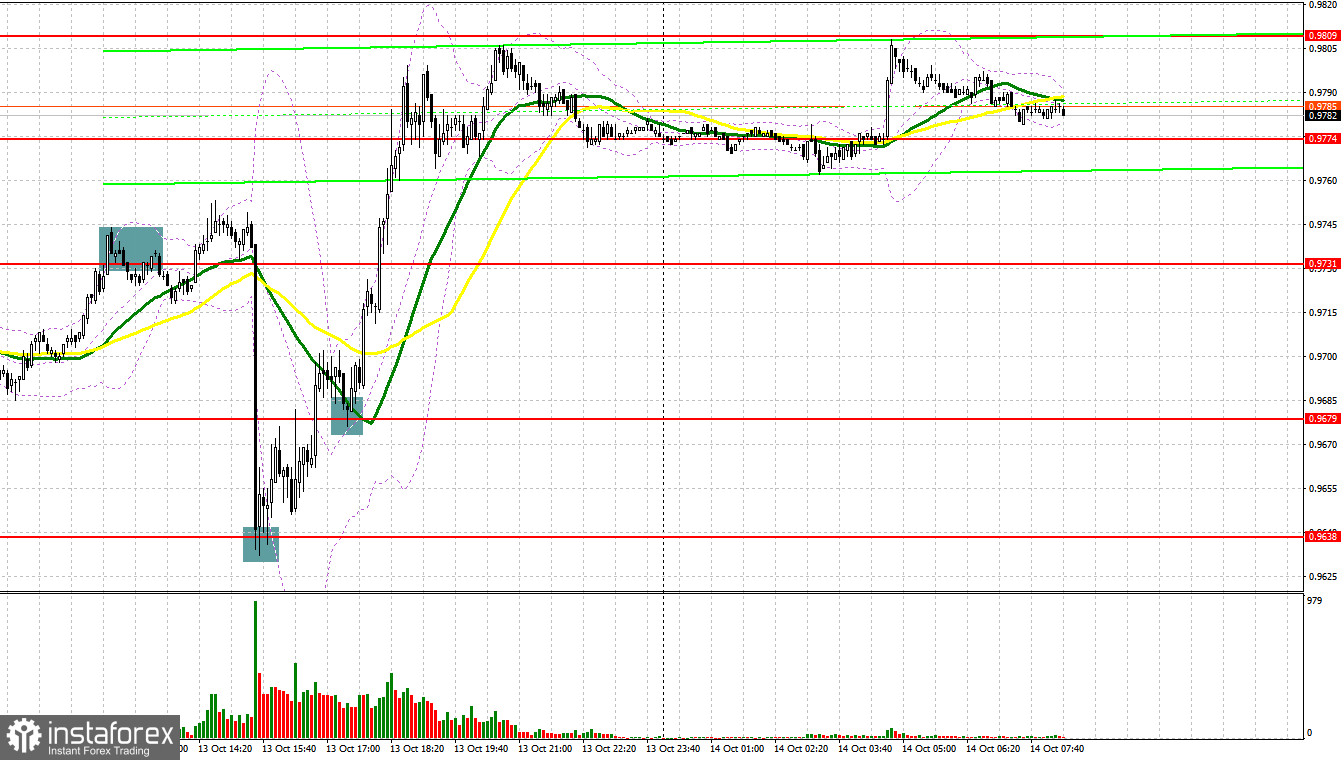

Several excellent market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 0.9731 level in my morning forecast and advised making decisions on entering the market there. As a result of the pair's growth to the area of 0.9731, the bulls once again failed to cling to this level, which led to a sell signal. The downward movement was about 15 points and that was it. After the release of the US inflation report in the afternoon, to which traders initially reacted by selling the euro, a false breakout was formed in the area of 0.9638, which led to a buy signal and the pair moved up by 60 points. A breakthrough and reverse test from top to bottom at 0.9679 is another buy signal with a growth by another 100 points.

When to go long on EUR/USD:

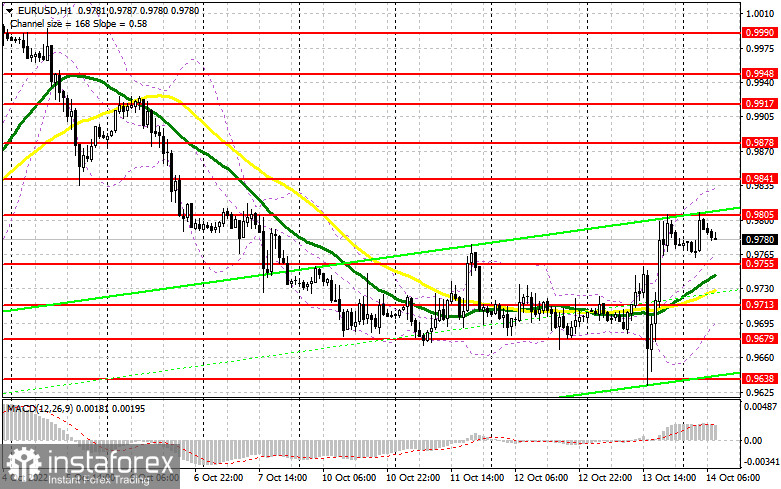

Inflation in the US, although it slowed down, turned out to be worse than economists' forecasts at its highs over the past 40 years. Thus, it is unlikely that anything will change in the Federal Reserve's policy, and at the next meeting in November this year we will see another increase in interest rates by 0.75%. Up to this point, it is hardly worth counting on a serious growth from the euro, although the single currency can return to parity with the US dollar rather quickly. Then a much more difficult confrontation between bulls and bears will begin.

There are no important statistics in the morning and only a report on the eurozone foreign trade balance is expected, which is unlikely to harm the euro. Therefore, I expect a surge upwards, counting on updating the weekly high and going beyond the resistance of 0.9805. In case the pair goes down, protecting and forming a false breakout around 0.9755 will be an excellent reason to increase long positions with the prospect of further recovery to 0.9805. It will be possible to talk about the bulls' attempts to maintain control over the market only after a breakthrough of 0.9805 and a test from the top to the bottom of this range, which will hit the stops of speculative bears and create another buy signal with the possibility of a surge up to the 0.9841 area. Consolidating above this level would reverse the market direction and reverse the bear market seen since October 4th. An exit above 0.9841 will serve as a reason for growth to the area of 0.9878, where I recommend taking profits.

If the EUR/USD falls and there are no bulls at 0.9755, the pressure on the euro will increase. This will lead to a fall to the 0.9713 area, where the moving averages play on the bulls' side. The optimal solution for opening longs there would be a false breakout. I advise you to buy EUR/USD immediately on a rebound only from 0.9713, or even lower - in the area of 0.9679, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Yesterday, the bears had no choice but to step aside. Although, objectively speaking, the downward trend is not significantly broken and it is very important to return the pair below 0.9755. The optimal scenario for opening short positions would be forming a false breakout at the level of 0.9805, which has already kept the euro from a new wave of growth several times. Therefore, during the next test, be careful with shorts there. A false breakout would provide an excellent entry point for shorts, allowing for a return to the 0.9755 area. Consolidation below this range, as well as a reverse test from the bottom up - a reason to continue selling EUR/USD in order to remove the stop orders of bulls and a larger fall to the area of 0.9713. The farthest target will be the area of 0.9679, where I recommend taking profits. We will be able to get to this level only in case we receive good statistics on retail sales in the US, which we will talk about in the forecast for the second half of the day.

In case EUR/USD moves up during the European session, as well as the absence of bears at 0.9805, the demand for the pair will increase, which will lead to a more powerful upward correction. In this case, I advise you not to rush into selling: I recommend opening shorts only if a false breakout is formed at 0.9841, by analogy with what I analyzed above. You can sell EUR/USD immediately for a rebound from the high of 0.9878, or even higher - from 0.9917, counting on a downward correction of 30-35 points.

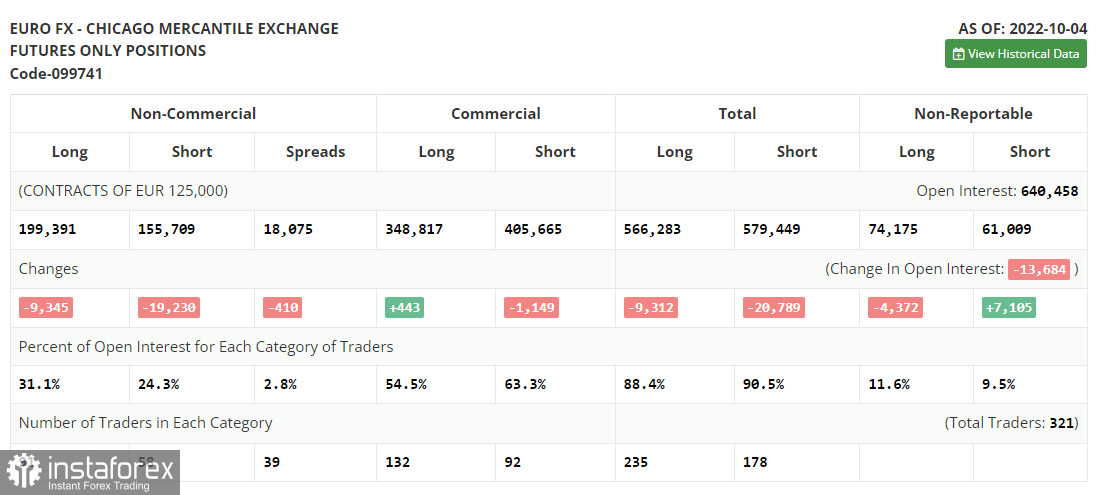

COT report:

The October 4 Commitment of Traders (COT) report logged a sharp decline in both short and long positions. Many investors and major players now prefer to take a wait-and-see attitude, especially given the extent to which geopolitical tensions have reached. Against this background, there is no doubt about the demand for the US dollar, and if we add here the latest data on the US labor market and the expected September inflation: we can confidently say that the euro has not yet reached final lows against the US dollar and that in the near future we can expect the final annual sale of risky assets. The COT report indicated that long non-commercial positions decreased by 9,345 to 199,391, while short non-commercial positions decreased by 19,230 to 155,709. At the end of the week, the total non-commercial net position remained positive and amounted to 43,682 against 33,797. This indicates that investors are taking advantage of the moment and continue to buy cheap euros below parity, as well as accumulate long positions, counting on the end of the crisis and the pair's recovery in the long term. The weekly closing price recovered and amounted to 1.0053 against 0.9657.

Indicator signals:

Moving averages

Trading is above the 30 and 50-day moving averages, indicating a victory for euro bulls.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator in the area of 0.9830 will act as resistance. In case of a decrease, the lower border of the indicator around 0.9713 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română