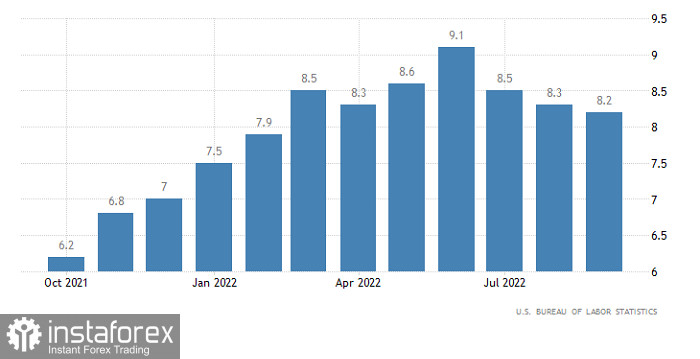

The extremely slow decline in the rate of growth in producer prices in the United States has almost convinced investors that inflation in the United States can remain unchanged. And this means that the Federal Reserve has every reason to continue raising interest rates at the same pace. That is 75 basis points during each subsequent meeting. At least until the end of this year. But to everyone's relief, inflation slowed down from 8.3% to 8.2%. Of course, this is slower than what the US central bank planned, but at least the movement is going in the right direction. And now there is hope that during the December meeting of the Federal Open Market Committee, the refinancing rate will be raised by only 50 basis points. That was the reason for the weakening of the dollar.

Inflation (United States):

Today, the dollar is likely to continue to lose its positions, already under the influence of data on retail sales, the growth rate of which should slow down from 9.1% to 8.0%. In other words, despite the slowdown in inflation, consumer activity continues to decline. But it is consumer activity that is the locomotive of economic growth.

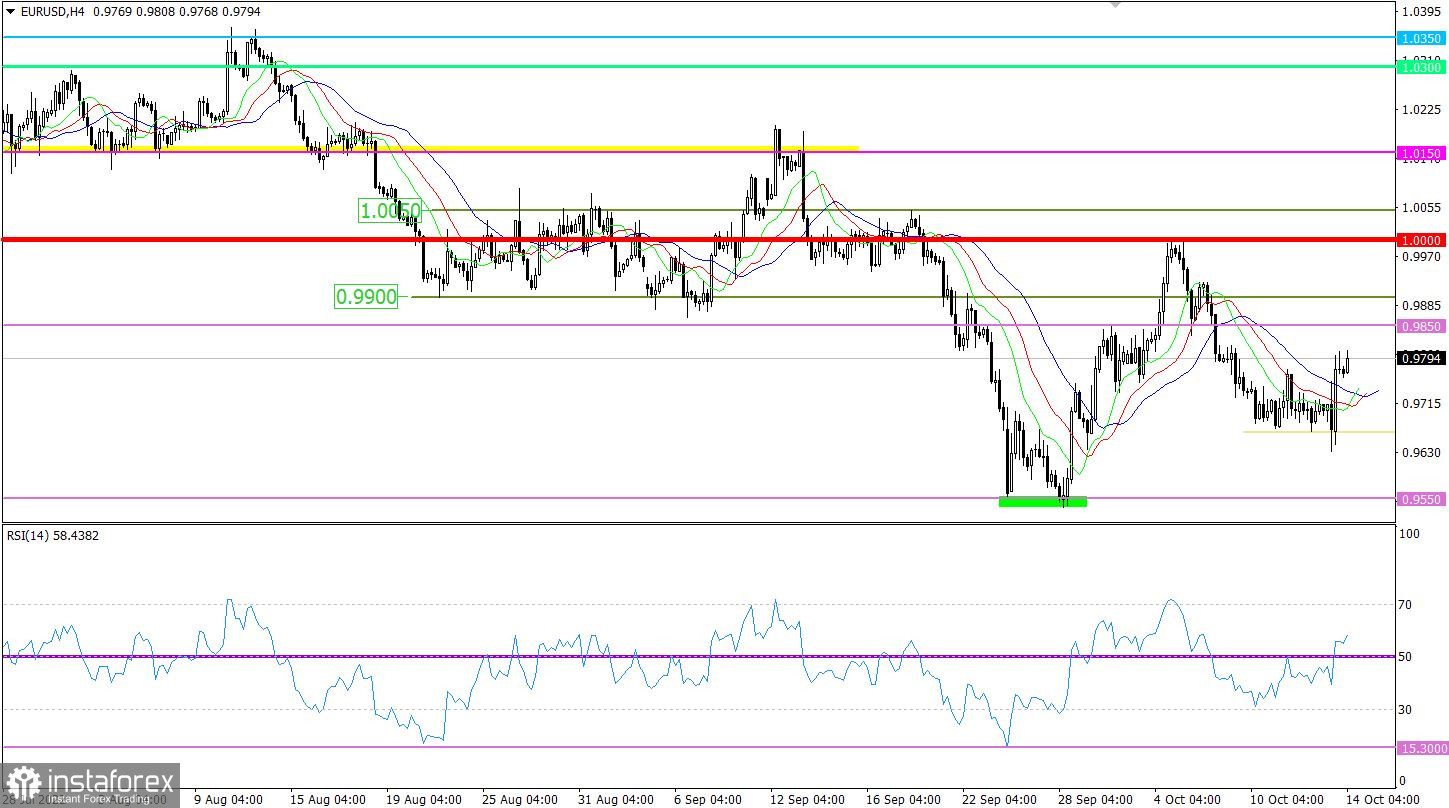

Retail Sales (United States):

The EURUSD currency pair broke the current stagnation along the 0.9700 value in the upward direction during strong market speculation. As a result, the quote jumped above the 0.9800 mark, which may indicate a subsequent recovery of the euro.

Technical instruments RSI H4 crossed the middle line 50 from the bottom up, which is considered a signal of the beginning of an upward cycle.

The moving MA lines on the Alligator H4 indicator have a primary signal of a change of direction. While Alligator D1 ignores all recent speculation, the sliding lines are directed downwards following the main trend.

Expectations and prospects

In order to strengthen long positions, the quote needs to stay above the value of 0.9850. In this case, there is a high probability of prolongation of the upward cycle in the direction of the parity level.

An alternative scenario considers a slowdown in the upward course relative to the 0.9800/0.9850 area. In this case, the quote may again return to the value of 0.9700.

Complex indicator analysis in the short-term and intraday periods has a buy signal due to the upward momentum.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română