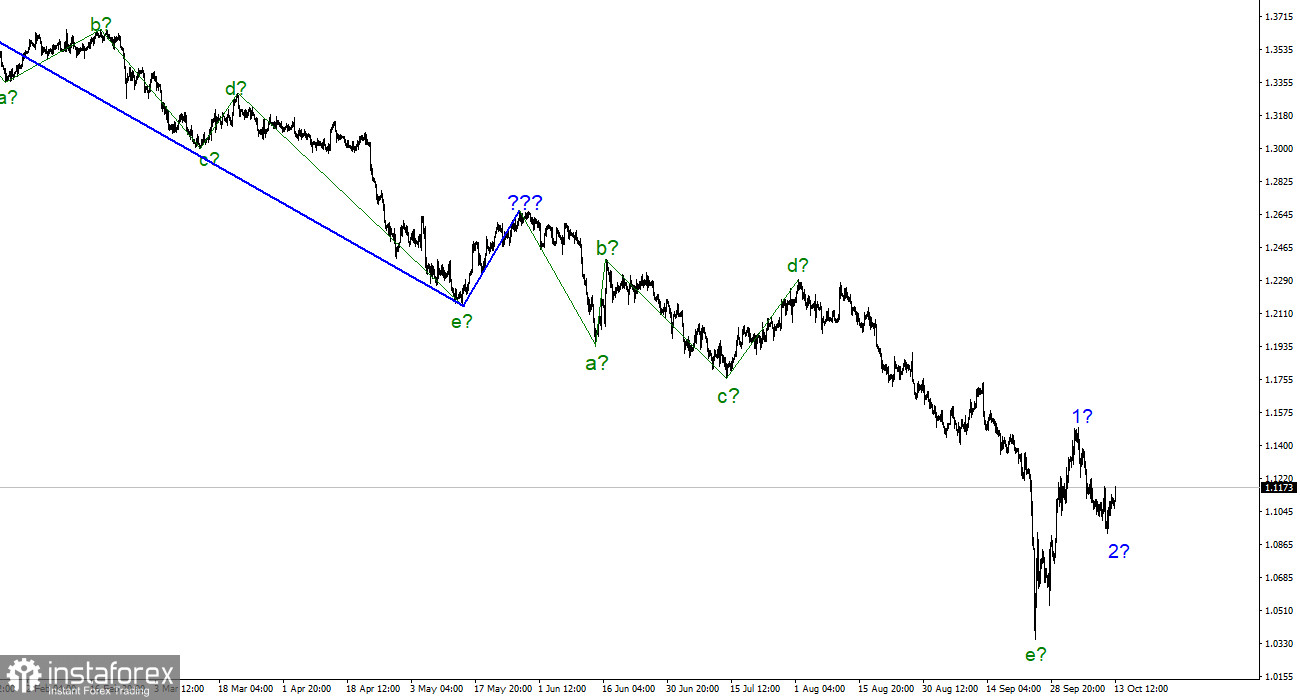

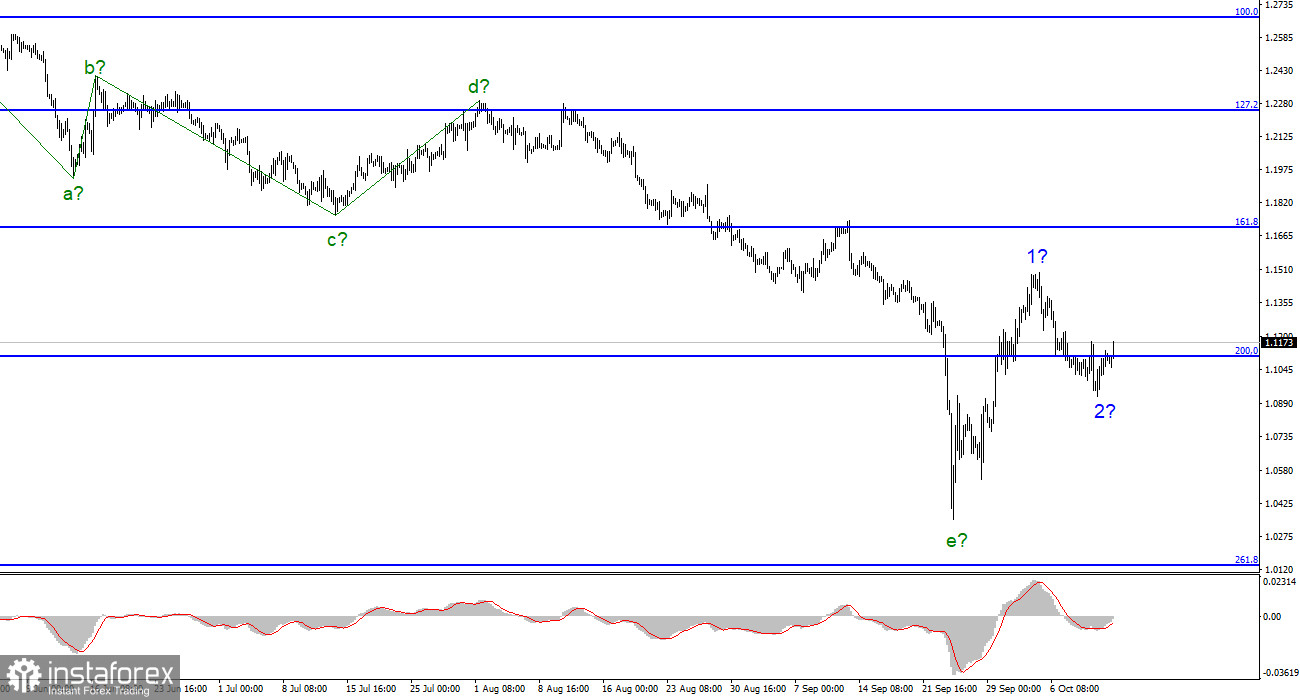

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but does not require any clarification. We have a supposedly completed downward trend segment consisting of five waves a-b-c-d-e. If this is indeed the case, then the construction of a new upward trend section has begun. Its first wave is supposedly completed, and the construction of wave 2 has begun. Unfortunately, there is no confidence in this particular scenario since the instrument must go beyond the peak of the last wave to show us its readiness to build an upward section of the trend and not complicate the downward one once again. The peak of the nearest wave is located at about 23 figures. Thus, even after the pound has increased by 1000 points, you need to go up another 1000 points to reach this peak. I also want to note that the wave markings of the euro and the pound are different now. Many have seen the strong growth of the British in a short period, so they are "itching" to make purchases. However, let me remind you that even if the upward section has started building now, we should see a downward correction wave (after completing 1). If the quotes do not fall below the low wave e (which is very difficult, but not impossible), then you can also expect to build a new upward wave 3 and buy.

The British pound waited for a free day and began to grow

The exchange rate of the pound/dollar instrument increased by 140 basis points on October 13. The demand for the British pound was slowly declining on Tuesday and Wednesday when several important reports were released in the UK. Still, when there was nothing interesting in the UK, the demand for it began to grow. Remember that this market behavior is needed now, and the increase in demand for the pound corresponds to the current wave picture. If the construction of the upward section of the trend is not canceled, as it has happened more than once, then the pound may drag the euro up with it, and it is for the euro that adjustments will have to be made to the current wave marking, which so far suggests a further decline. But I have already said that the probability of a different movement of the euro and the pound is quite low. Consequently, however, the wave markings should change.

Literally, at this very moment, an inflation report is expected in America, which everyone is talking about this week. Since this is almost the only important report of the week, it is clear why everyone is discussing inflation. From my point of view, inflation has been a huge problem for several states for a long time. If at the beginning of the year we heard positive statements by many politicians and economists that sooner or later inflation would begin to slow down by itself, now there is nothing of the kind. On the contrary, representatives of the Fed and the ECB directly or indirectly hint that rates will have to be raised very high and kept at this level for a very long time. Everything suggests that inflation will not decline quickly. Although we already see it perfectly. The Fed raised the rate above 3%, but inflation fell by only 1%.

General conclusions

The wave pattern of the pound/dollar instrument implies the construction of a new upward trend segment. Thus, now I advise buying a tool for MACD reversals "up" with targets located above the peak of wave 1. Buy and sell should be careful since it is unclear which wave markings (euro or pound) will require adjustments, and the news background may negatively affect both the euro and the pound. The decline within the corrective wave 2 may already have been completed.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. The downward section of the trend can turn out to be almost any length, but it may already be completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română