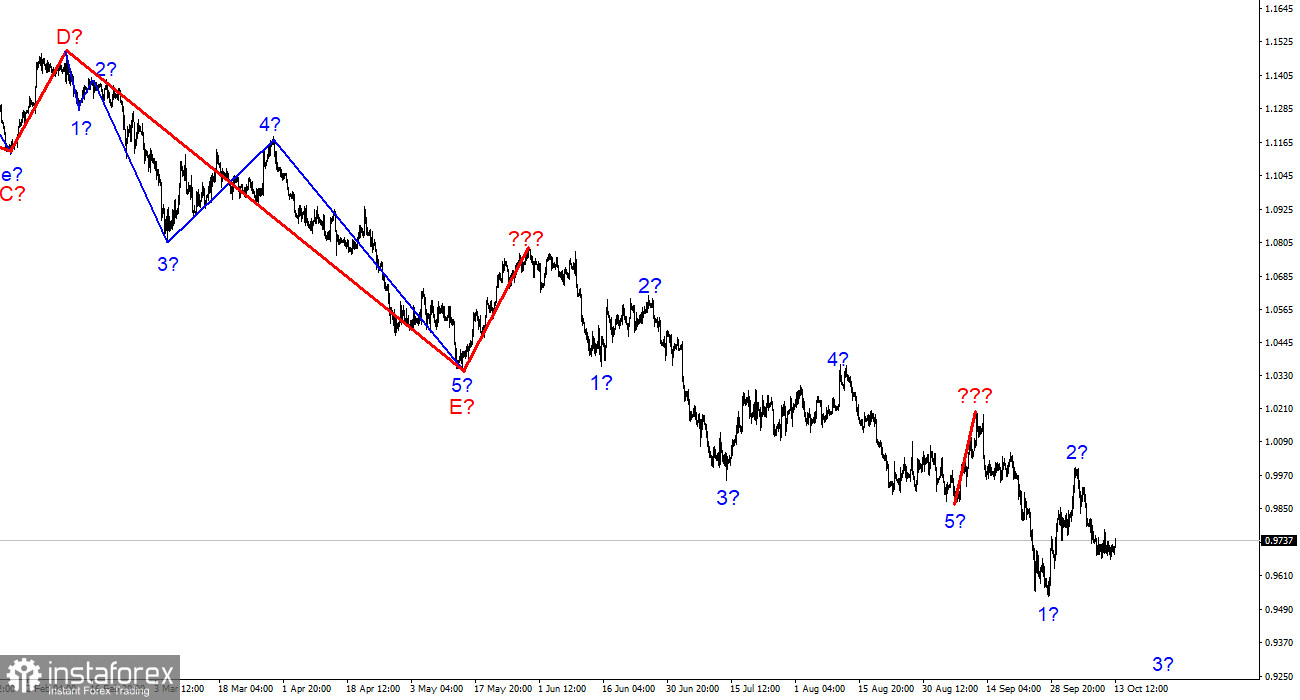

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may be more complicated than that in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one upward correction wave (marked with a bold line), after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There is no question of any classical wave structure (5 trend waves, 3 correction waves) right now. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture of "a strong wave down-a weak corrective wave up." The goals of the downward trend segment, which has been complicated and lengthened many times, can be found up to 90 figures or even lower. At this time, wave 3 of the descending trend section may be built (presumably), but the descending section may also transform into an ascending one.

The euro/dollar instrument rose by 30 basis points on Thursday. The amplitude is still very weak, but the situation may change this afternoon, as the US will release an inflation report, which the markets are very much waiting for. However, while it has not yet been released, let's pay attention to other events. By the way, there are very few of them.

Christine Lagarde, president of the ECB, said yesterday that the world's central banks should cooperate better in the joint fight against high inflation. She noted that the measures taken by some central banks in Europe only increased inflationary pressure in the European Union. In particular, the criticism affected France and Germany, whose governments have presented several programs to support households and businesses due to high electricity prices. Lagarde believes that such measures will lead not only to relief for consumers but also to a new acceleration of inflation as demand will grow again due to financial assistance from the state. According to Lagarde, a strong increase in electricity prices is bad for people but good for the fight against inflation since Europeans will have less money. Therefore, demand will not grow. She certainly doesn't say it out loud, but it's implied. Lagarde also said that financial markets and economies are very much integrated, so the monetary policies of certain states affect other states worldwide. Let me remind you that the ECB is still unsuccessfully struggling with inflation, which has already exceeded 10%. The regulator will raise the rate again by 75 basis points at the next meeting.

General conclusions

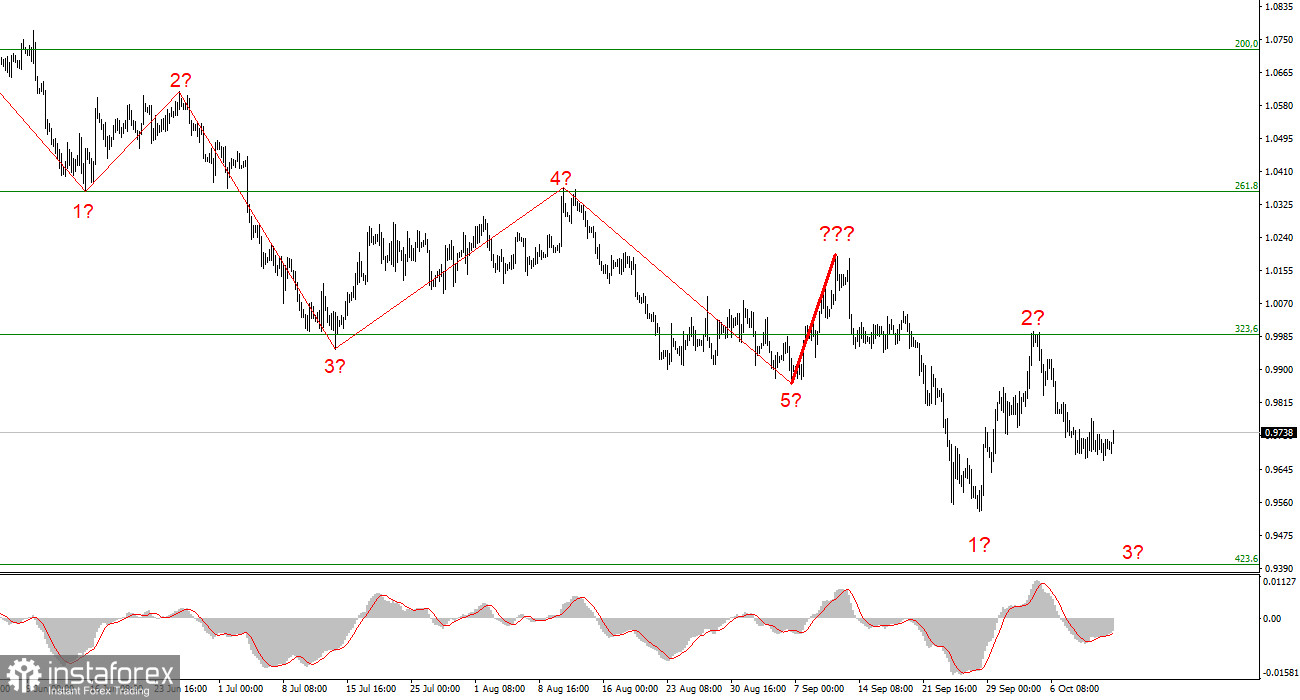

Based on the analysis, I conclude that the construction of the downward trend section continues but can end at any moment. At this time, the instrument can build a new impulse wave, so I advise selling with targets near the calculated mark of 0.9397, which equates to 423.6% by Fibonacci, by the MACD reversals "down." I urge caution, as it is unclear how much longer the overall decline of the instrument will continue.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three-and five-wave standard structures from the overall picture and work on them. One of these five waves has just been completed, and a new one has begun its construction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română