The Federal Reserve is faithful to aggressive monetary tightening despite cooling down in the labor market and a slowdown in the US economic growth.

The Fed's minutes of the September policy meeting released on Wednesday confirms the case that the Federal Reserve would continue its aggressive monetary policy on track in the long term until inflation declines to the annual target rate of around 2%. In this context, the US inflation data which is due today will determine the next Fed's policy move in terms of the rate hike's degree. According to the consensus, the annual CPI is expected to edge down in September to 8.1% following an 8.3% increase in August. On the contrary, the CPI could have climbed 0.2% on month following a 0.1% uptick in August.

The actual CPI readings will be on tap tonight. The factory inflation data released on Wednesday was dismal. Instead of the expected decline to 8.4% on year from 8.7% in the previous month, the actual PPI slipped to 8.5% in September. Besides, the PPI grew to 0.4% on month against the expected 0.2% rise.

How are financial markets and the currency market in particular likely to respond to the data on consumer inflation?

I assume that if the actual score reveals a similar dynamic as the factory inflation, namely a notably increase in September and the annual print higher than expected, the stock market will respond with a new wave of sell-offs. The commodity market will also be hit by selling. In contrast, the US dollar will again receive support as a safe haven asset.

In turn, stock indices will creep down because stocks will come under pressure from rising borrowing costs. Commodities can be also weighed down by the fact that the global economy is on the verge of a recession. Yields of the benchmark 10-year Treasuries could surpass the landmark level of 4% and grow higher which is another serious factor to reinforce the greenback's strength.

Intraday outlook

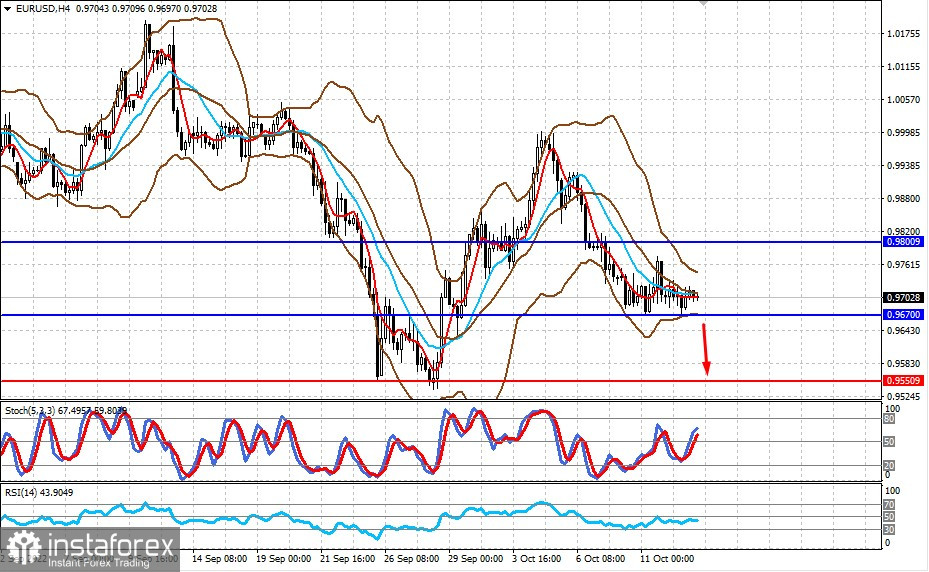

EUR/USD

The currency pair is consolidating slightly above 0.9670. The news of inflation acceleration in the US could boost demand for the US dollar. As a result, EUR/USD could break this level and fall to 0.9550.

USD/CAD

The currency pair is trading with minor fluctuations and might extend its growth to 1.3950 after the level of 1.3850 is broken after the release of the US inflation data.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română