According to the forecast, the UK industrial production growth should have accelerated to 1.3% from 1.1%. However, the previous data was downwardly revised to a 3.2% drop. Thus, in the previous month, the UK industrial production was falling instead of rising. What is more, the decline accelerated to 5.2%. There is no doubt that the Kingdom's economy is tipping into recession. In addition, the US PPI slid to 8.5% from 8.7% instead of falling deeper to 8.4%. It means that inflation in the US is slackening slower than expected. That is why the Fed will have to raise the benchmark rate at the same pace.

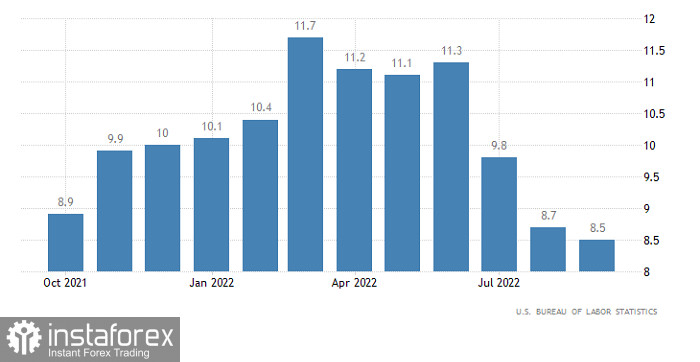

US Producer Price Index

Despite all these facts, the pound sterling was rising. The increase was boosted by rumors that the Bank of England will continue purchasing bonds after October 14. It will buy bonds from pension funds to prevent bankruptcy. Such rumors were enough to push the price higher since the financial condition of pension funds may pose serious threats to the British economy at least at the moment. If the BoE ends its bond-buying program, some pension funds may go bankrupt, thus damaging the UK economy.

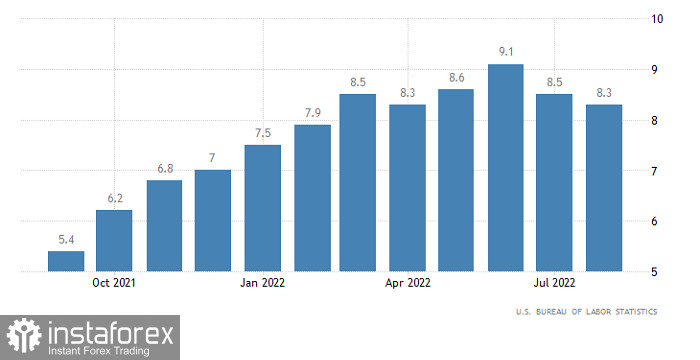

However, today, all these problems are of minor importance since traders will focus on the US inflation report, which will determine the further pace of the key interest rate hike. According to the forecast, consumer price growth may slacken to 8.2% from 8.3%. Although it is an insignificant change, inflation will still slow down. Notably, yesterday's PPI data points to the fact that inflation may remain unchanged. If the predictions come true, investors will make trading decisions based on the fact that the benchmark rate will rise by 150 basis points by the end of the year. Now, everyone expects that it will be increased by 125 basis points. It is a considerable difference that may cause a rise in the greenback.

US Inflation Growth

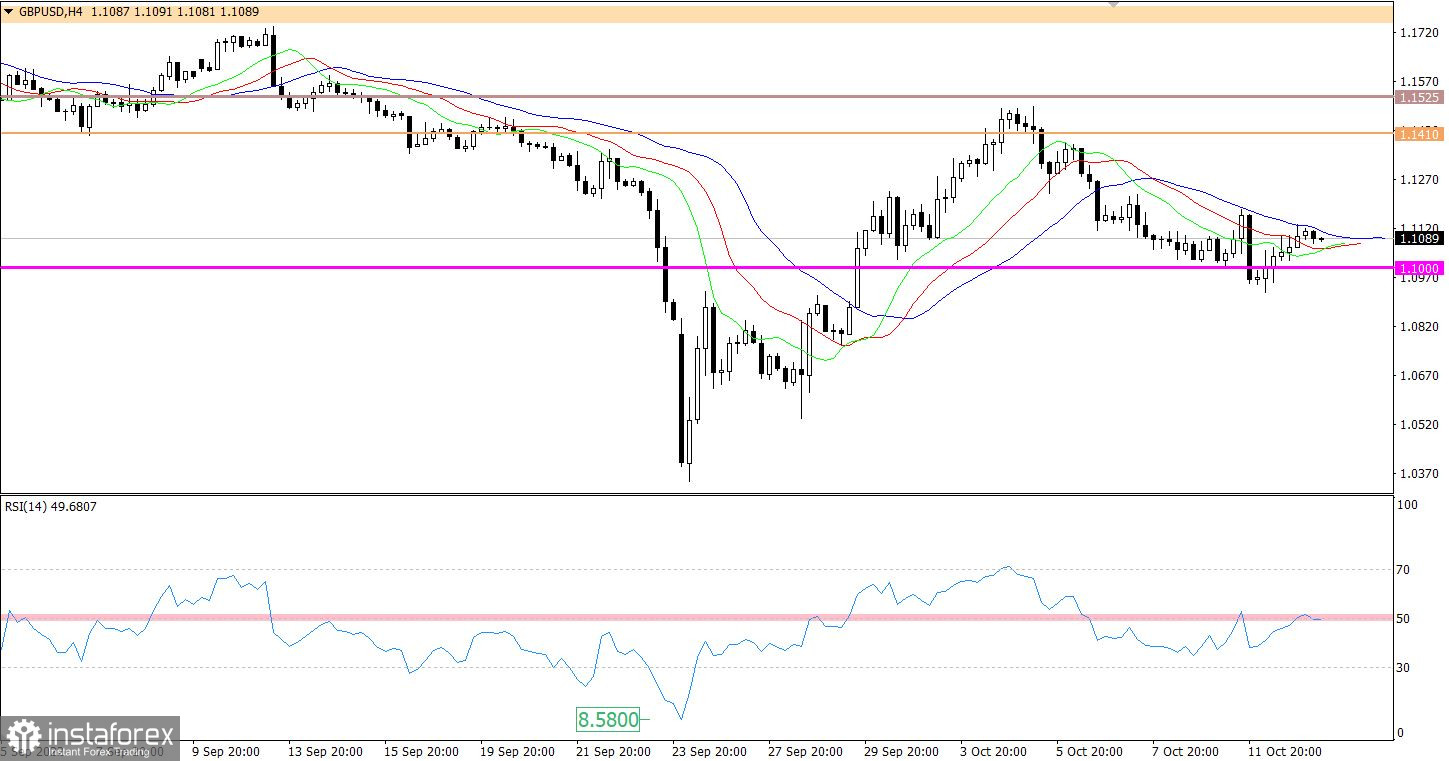

The pound/dollar pair changed its trend after a short-lived hovering near 1.1000. As a result, it rebounded to 1.1100 and got stuck.

On the four-hour chart, the RSI technical indicator returned to level 50, which points to a rebound. Meanwhile, on the daily chart, the indicator is still moving in the lower area of 30/50, thus reflecting the overwhelming bearish sentiment among traders.

In the same period, the Alligator's MAs are intersecting each other, which proves a slower decline in the intraday period. On the daily chart, the indicator is ignoring all the price fluctuations, MAs are headed downward.

Outlook

The recent rebound led to a change in the market sentiment. Now, the pair has a chance to return to the resistance level of 1.1410/1.1525. To prove the technical signal, the quote should consolidate above 1.1000 and break last week's high.

The downward scenario will become possible if the price drops below 1.1000 at least on the four-hour chart.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, indicators are pointing to an uptrend despite the current stagnation. In the mid-term period, the indicators are pointing to a downtrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română