According to Chicago Fed President Charles Evans, the Fed can still reduce inflation without a sharp rise in unemployment and without pushing the economy into recession. An assumption that only a few believe.

The September report on the number of jobs showed a decrease in monthly growth. Last month, 263,000 new jobs were added, down from the previous month's 315,000. However, the Federal Reserve, as well as members of the press, give these figures the significance that last week's employment report had strong employment figures that led stocks to fall. It also raised more concerns that future monetary tightening will continue and lead to a recession as the Federal Reserve fights inflation.

While market participants are waiting for the latest inflation data, economists predict that the report will probably indicate that prices in the world's largest economy remain high, which will force the Fed to continue its aggressive monetary policy, at least until next year. Currently, everyone agrees that September inflation will remain high at 8.1% year-on-year, which is slightly lower than the August report of 8.3%. Forecasts also indicate that core inflation is expected to rise from 6.3% to 6.5%. According to Crowd Wisdom, the forecast of inflation in the US in September is from 8.1% to 8.4%. The average estimate of other analysts at the moment is 8.1%.

At the same time, Fed members continue to promote the doctrine that they can aggressively raise interest rates without causing an economic downturn.

Evans said on Monday that inflation is much more resilient than the US central bank originally thought. But he noted that the Fed could still lower inflation without a sharp rise in unemployment and without pushing the economy into recession.

The fact that members of the Federal Reserve, along with many members of the press, are presenting Friday's jobs report as a report showing continued strength in the labor market, despite the fact that the number of jobs added was the lowest since 2020, is interesting to say the least.

However, some economists, such as Karl Schamotta, chief market strategist at Corepay in Toronto, have questioned the latest employment report. He rebutted the prevailing doctrine, saying, "By illustrating continued strength in the labor market, Friday's non-farm payrolls report gave the Fed carte blanche to continue raising rates."

He also added that the minutes of the last FOMC meeting are likely to show that politicians are still willing to cause serious economic damage to the US and global economy in an attempt to reduce inflation.

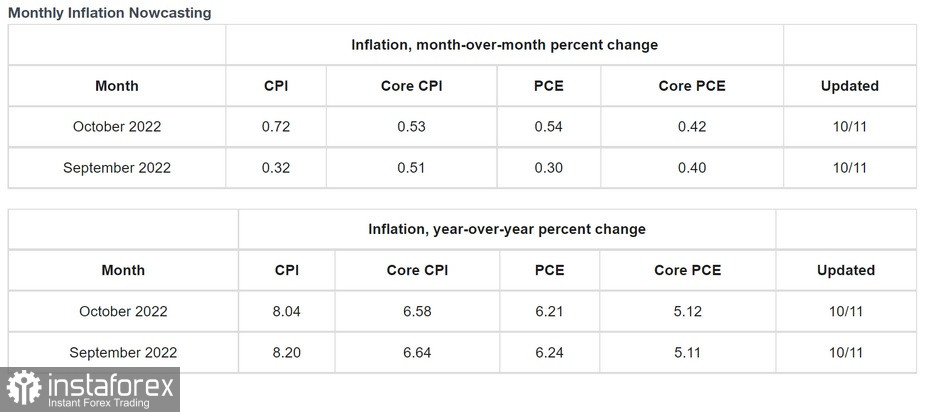

The bottom line is that the probability of a 75 basis point rate hike in November remains elevated at 78.4%. The Federal Reserve is not waiting for data from Thursday's CPI report. This is because the Federal Reserve Bank of Cleveland uses a simulation system that uses current data called "Inflation Nowcasting."

This advanced modeling system, which uses real-time data, predicts much higher inflation today than economists predict. Below is the latest data from the Federal Reserve Bank of Cleveland.

Based on this data from the Federal Reserve Bank of Cleveland, growth will be larger or continue through 2023. Thus, when members of the Fed, such as Chicago Fed President Charles Evans, want the public to believe that they can bring down inflation without causing widespread mistrust and recession, he is most likely just trying to reassure the public, and his information suggests the opposite.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română