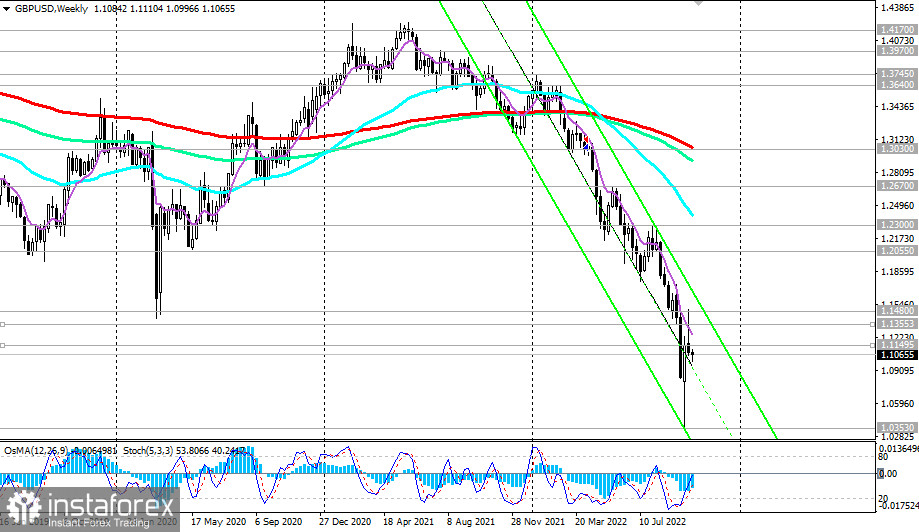

The GBP/USD pair is unlikely to be able to re-develop the upward momentum and rise to the intra-month high of 1.1495.

GBP/USD remains under pressure from the strengthening dollar, which is supported by demand for it as a defensive asset in the face of deteriorating global economic and geopolitical prospects. The breakdown of today's low at 1.0997 may be a signal to increase short positions.

In this case, the GBP/USD will head deeper into the downward channel on the weekly chart and to the level of 1.0353 (the local multi-year record low and the low of the previous month), through which the lower border of this downward channel also passes.

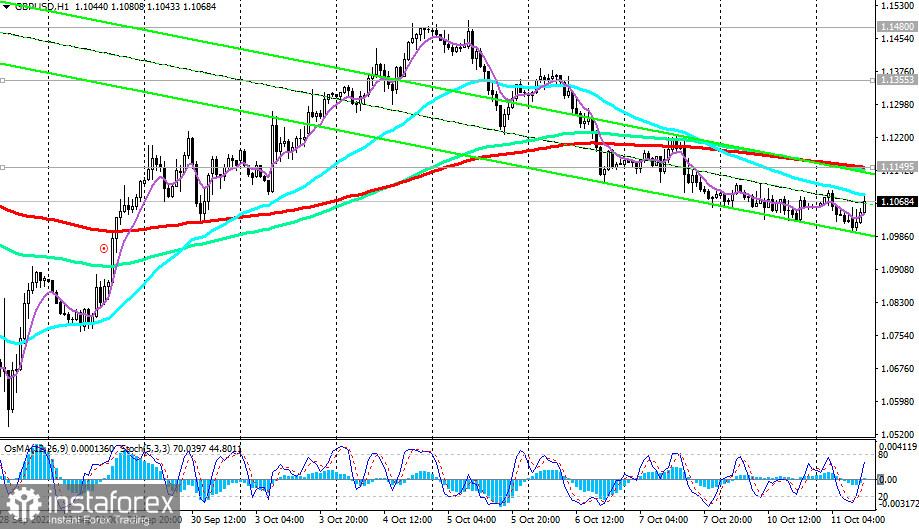

In an alternative scenario, a breakdown of the resistance level 1.1149 (200 EMA on the 1-hour chart) may provoke further corrective growth in GBP/USD, up to the resistance levels 1.1355 (200 EMA on the 4-hour chart), 1.1480 (50 EMA on the daily chart).

Further growth looks unlikely so far, while the US dollar is in the zone of highs of the last 20 years. In general, the downward dynamics of the GBP/USD remains, making short positions preferable.

Support levels: 1.0997, 1.0900, 1.0800, 1.0700, 1.0600, 1.0500, 1.0400, 1.0353

Resistance levels: 1.1100, 1.1149, 1.1355, 1.1480, 1.1500

Trading Tips

Sell Stop 1.0990. Stop-Loss 1.1120. Take-Profit 1.0900, 1.0800, 1.0700, 1.0600, 1.0500, 1.0400, 1.0353

Buy Stop 1.1120. Stop-Loss 1.1090. Take-Profit 1.1100, 1.1149, 1.1355, 1.1480, 1.1500

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română