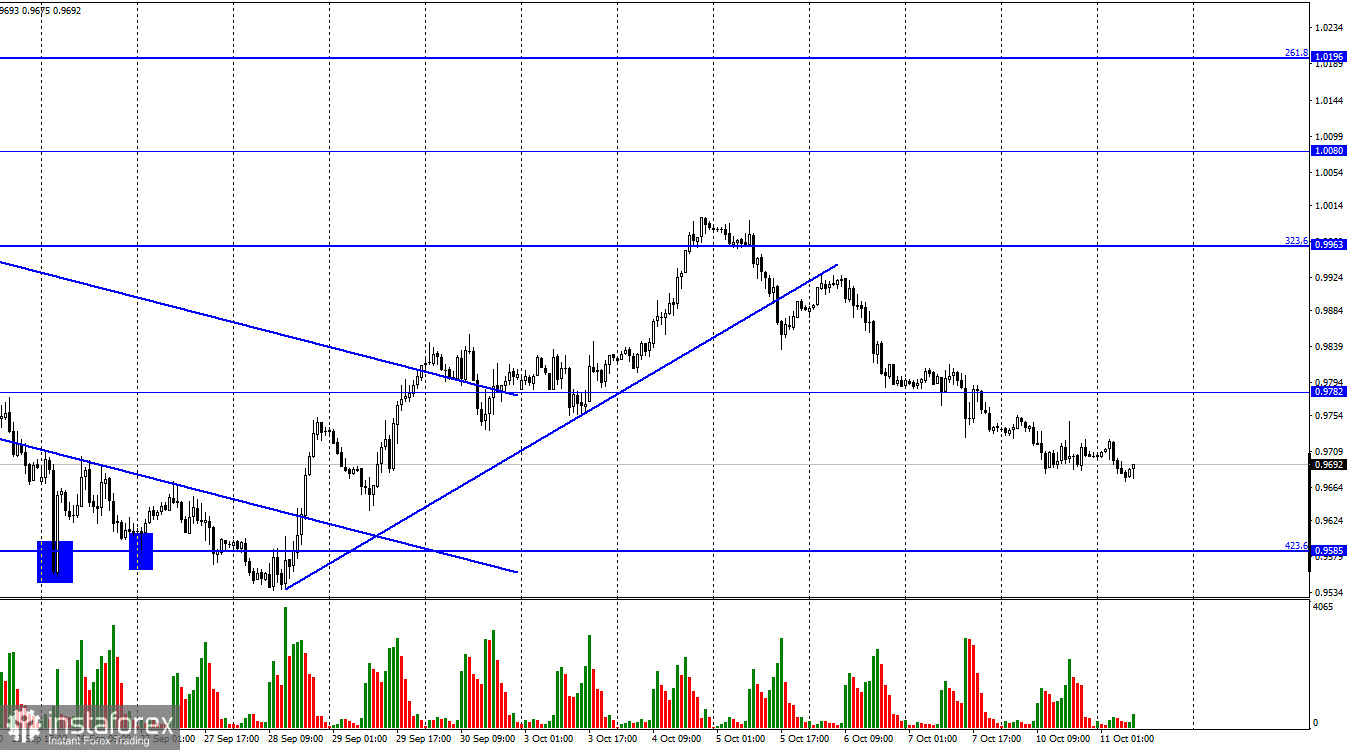

The EUR/USD pair continued on Monday, falling towards the corrective level of 423.6% (0.9585), near which, let me remind you, the pair's low for 20 years is located. Thus, that optimistic segment of the growth of the euro currency was very quickly "chewed up" by the bears, who again took the initiative in the market into their own hands. It will be possible to count on the growth of the euro currency in the presence of a strong information background or in the event of a rebound from the 0.9585 level. But even in this case, it is not a fact that the euro currency will show strong growth.

For the euro currency, the situation remains almost catastrophic. The deterioration of the geopolitical situation in the world means an increasing number of traders are trying to get rid of unstable euros and pounds and buy more dollars simultaneously. Nothing can be done about it. In difficult times, investors and traders are looking for protective assets for their capital, and even high inflation in the United States does not keep them from buying the dollar. However, it should be recognized that American inflation has a real chance of continuing to decline in the coming months.

This is supported by the fact that inflation in the US has already been slowing down for two months in a row. In the European Union, it continues to grow, and in the UK, it only stopped increasing last month. The interest rate will continue to rise because the Fed intends to raise the interest rate. All FOMC members openly state this. In particular, yesterday, the president of the Federal Reserve Bank of Chicago, Charles Evans, said that the rate would reach the level of 4.5-4.75% next year. According to Evans, most FOMC members support this position, and very good reasons will be needed for the committee to back away from this plan. Thus, at the next Fed meeting, the rate may rise again by 0.75% for the fourth time in a row. The Fed fears that OPEC's decision to reduce oil production will raise energy prices and accelerate inflation again. Therefore, it is going to act proactively.

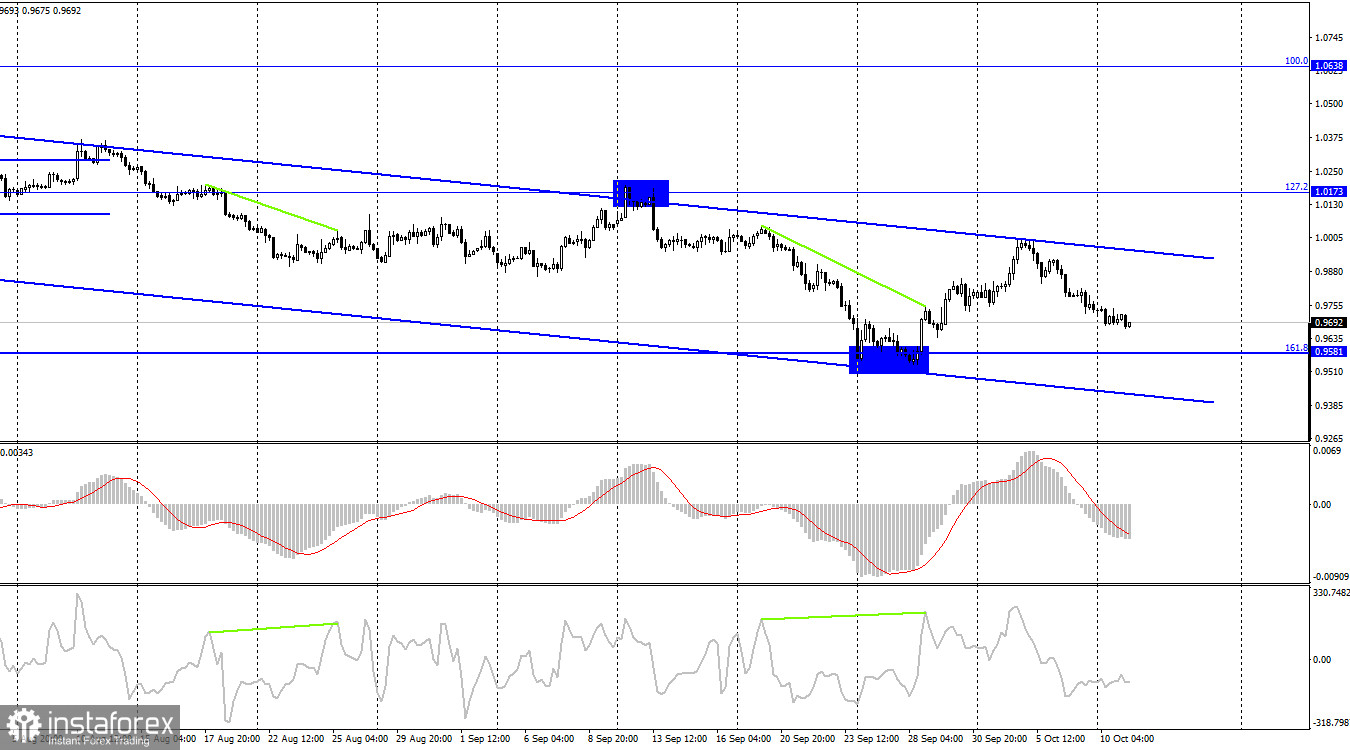

On the 4-hour chart, the pair reversed in favor of the US dollar and began a new process of falling toward the Fibo level of 161.8% (0.9581) and within the descending trend corridor. Thus, the mood of traders on this chart remains "bearish" without any questions. Only consolidation above the descending corridor will allow us to count on the tangible growth of the euro currency.

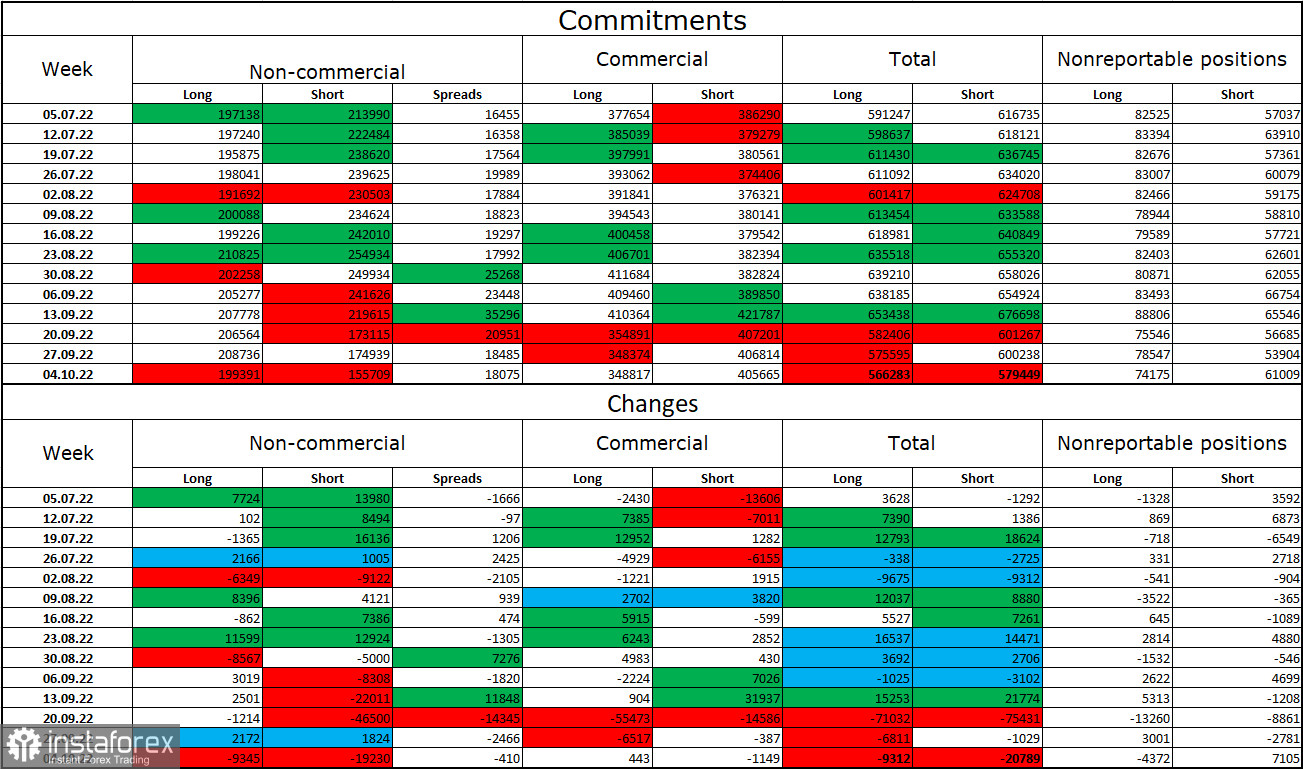

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 9,345 long contracts and 19,230 short contracts. This means that the mood of large traders has become even more "bullish" than before. The total number of long contracts concentrated in the hands of speculators is now 199 thousand, and the total number of short contracts – 155 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the euro's growth have been increasing, but traders are more actively buying up the dollar than the euro. Therefore, I would now bet on an important descending corridor on the 4-hour chart, over which it was impossible to close. I also recommend carefully monitoring the news of geopolitics, as they greatly affect the mood of traders.

News calendar for the USA and the European Union:

On October 11, the calendars of economic events of the European Union and the United States do not contain a single interesting entry. The influence of the information background on the mood of traders today will be absent.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair when rebounding from the upper line of the corridor on the 4-hour chart with a target of 0.9581 or when anchoring under the trend line on the hourly chart. I also recommended selling at the close under the 0.9782 level with a target of 0.9585. I recommend buying the euro currency when fixing quotes above the upper line of the corridor on a 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română