Oil retreated from 5-week highs as the number of COVID-19 infections in China increased to the highest level since August and the US dollar continued to rally. The US currency is now acting as the horseman of the Apocalypse—its strengthening brings the global economy closer to recession. The USD index is rising due to the Fed's intention to act aggressively, and the Fed's intention to act aggressively brings the decline in US GDP closer. The reduction in global demand is a "bearish" factor for Brent. However, investors have been keen on the offer lately.

US Treasury Secretary Janet Yellen called the OPEC+ decision to cut production by 2 million bpd useless and unreasonable. The White House responded by selling 10 million bpd of strategic reserves, but interventions had little effect on oil prices. The very fact that the Alliance decided to go further than the 1 million bpd expected by Bloomberg experts had a positive effect on the oil market.

Most of the cuts will come from Saudi Arabia. And even though 526,000 bpd is only a quarter of the allies' set commitments, OPEC+ is already producing less anyway. So, Yellen is partly right—the solution looks useless. Is it unreasonable? I do not think so. Obviously, the fall of Brent did not suit the producing countries. They needed to do something.

Riyadh is playing a subtle game. It is well aware that domestic demand against the background of lower temperatures will also decrease. At the same time, Saudi Arabia does not want to lose its market share in Asia. It has kept prices flat for buyers in the region, although a massive cut in production should theoretically increase premiums. In fact, the Saudis are pushing out Russia, which is already having a hard time.

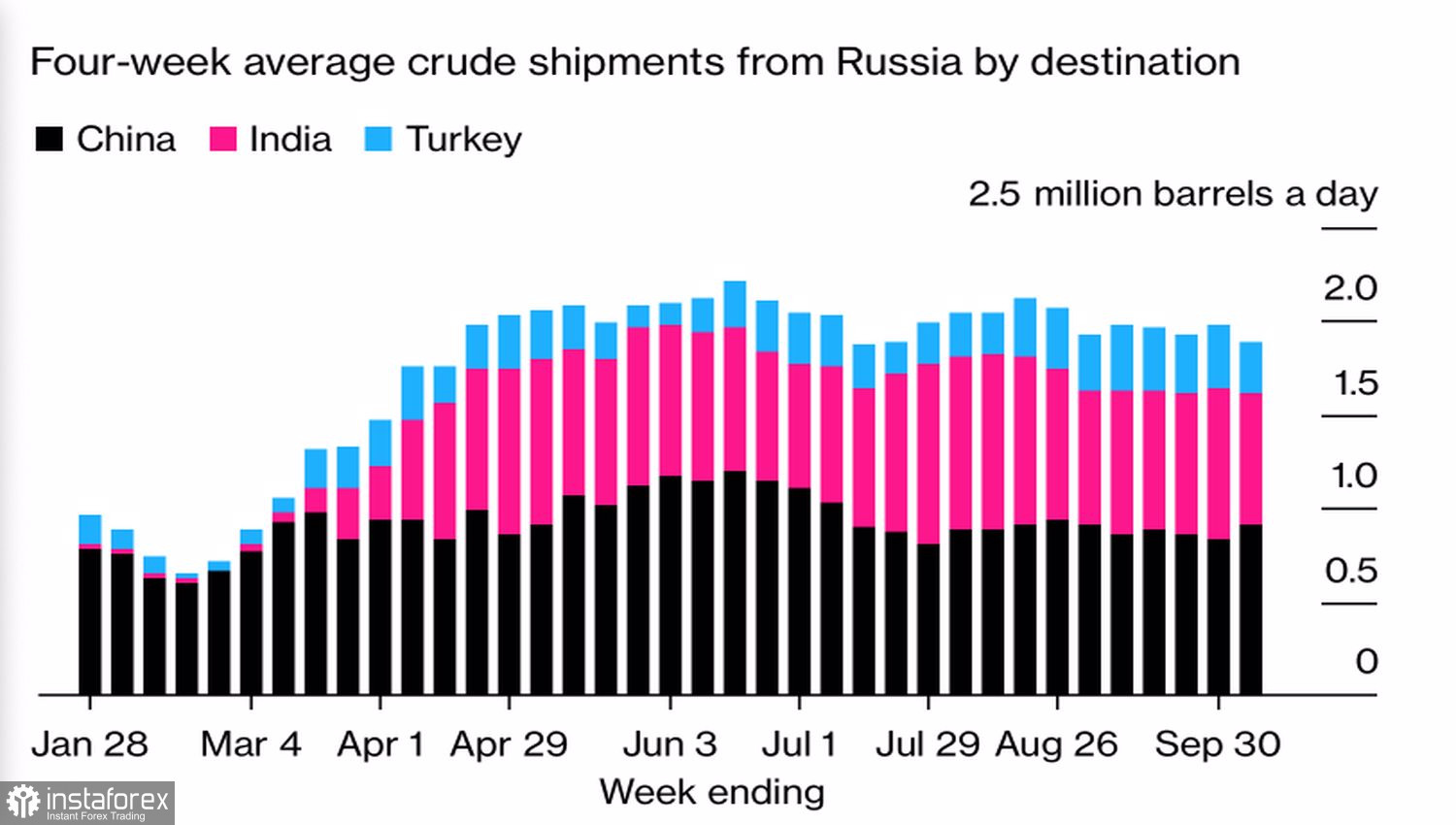

Dynamics of offshore flows of Russian oil

Before the armed conflict in Ukraine, Moscow supplied 1.62 million bpd to Europe by sea. By October 7, this figure had fallen to 630,000 bpd. Over the next eight weeks, it will completely disappear. At the same time, the transportation of oil to Asia takes 10 times more time, and flows to the three largest buyer countries in the face of India, China and Turkey are constantly declining. Russia's statement that it will not sell oil to those states that will use the price ceiling looks like a farce. Delhi, Beijing, and Ankara have new opportunities to negotiate contract price cuts.

Thus, the reduction in supply appeases the "bulls" in the North Sea variety. On the contrary, the worsening of the epidemiological situation in China and the strengthening of the US dollar, indicating the approach of a recession in the global economy, are on the side of the bears.

Technically, there was a breakdown of the upper limit of the downward trading channel on the daily chart of Brent, which made it possible to take profits on previously formed longs. A retest in the form of a rebound from the pivot point at $93.5 per barrel is a reason to buy oil.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română