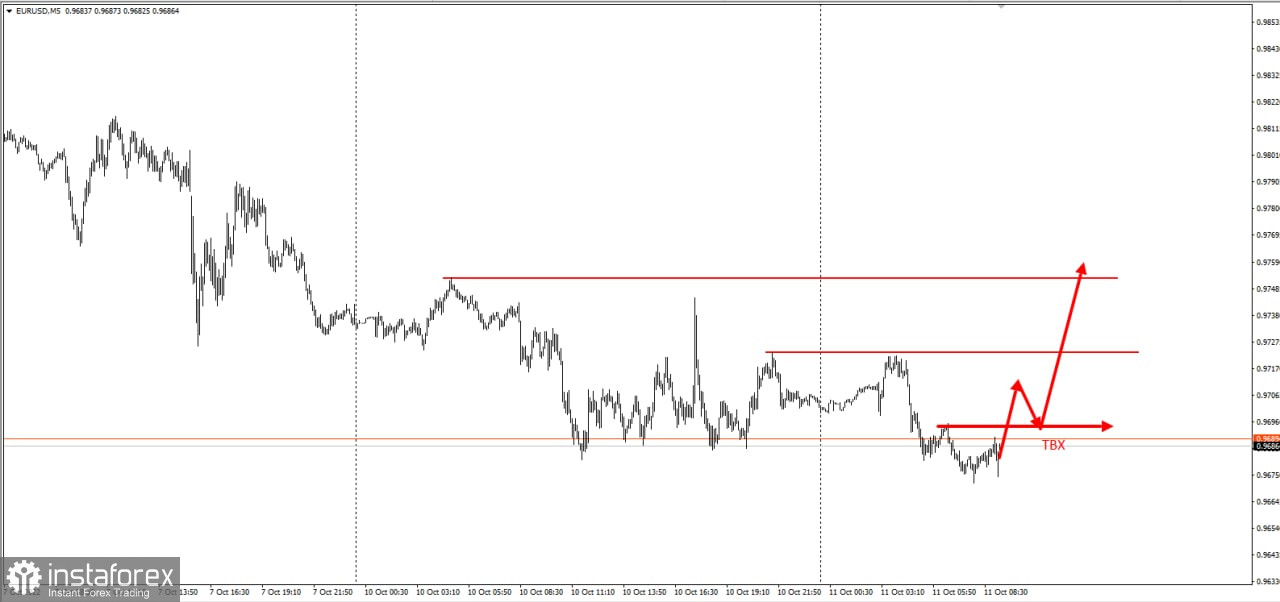

EUR/USD has declined by 3,000 pips over the past 5 trading days. There is a clear trend towards a decrease in the daily ATR, which indicates the fatigue of sellers and a potential correction.

Most likely, market corrections will occur ahead of this week's release of CPI data in the US. And with the areas left by traders from the fall last week, there are excellent levels for liquidity, as well as places for stop orders.

Long positions should be taken to break the bearish trend.

Traders should look out for signals before breaking through the above levels.

This trading idea is based on the "Price Action" and "Stop Hunting" methods.

Good luck and have a nice day! Don't forget to control the risks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română