The trading week began with real stagnation largely due to the absence of macroeconomic data. However, this changed after the release of reports on the UK labor market.

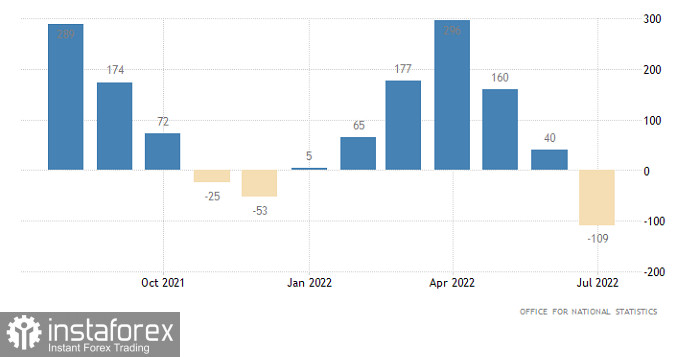

Although the unemployment rate declined from 3.6% to 3.5%, the pound fell because employment dropped by 109,000. The data was quite surprising because a month before, the figure had already fallen so much. That is why many are skeptical with the latest report.

Employment report (UK):

EUR/USD is now in an active phase of decline from parity, trading over 300 pips below. This is quite a lot and could lead to an oversold signal. It could become an argument for speculators if the price returns above 0.9750. Otherwise, all available signals from technical analysis can be ignored, and the quote will go towards the bottom of the downward trend.

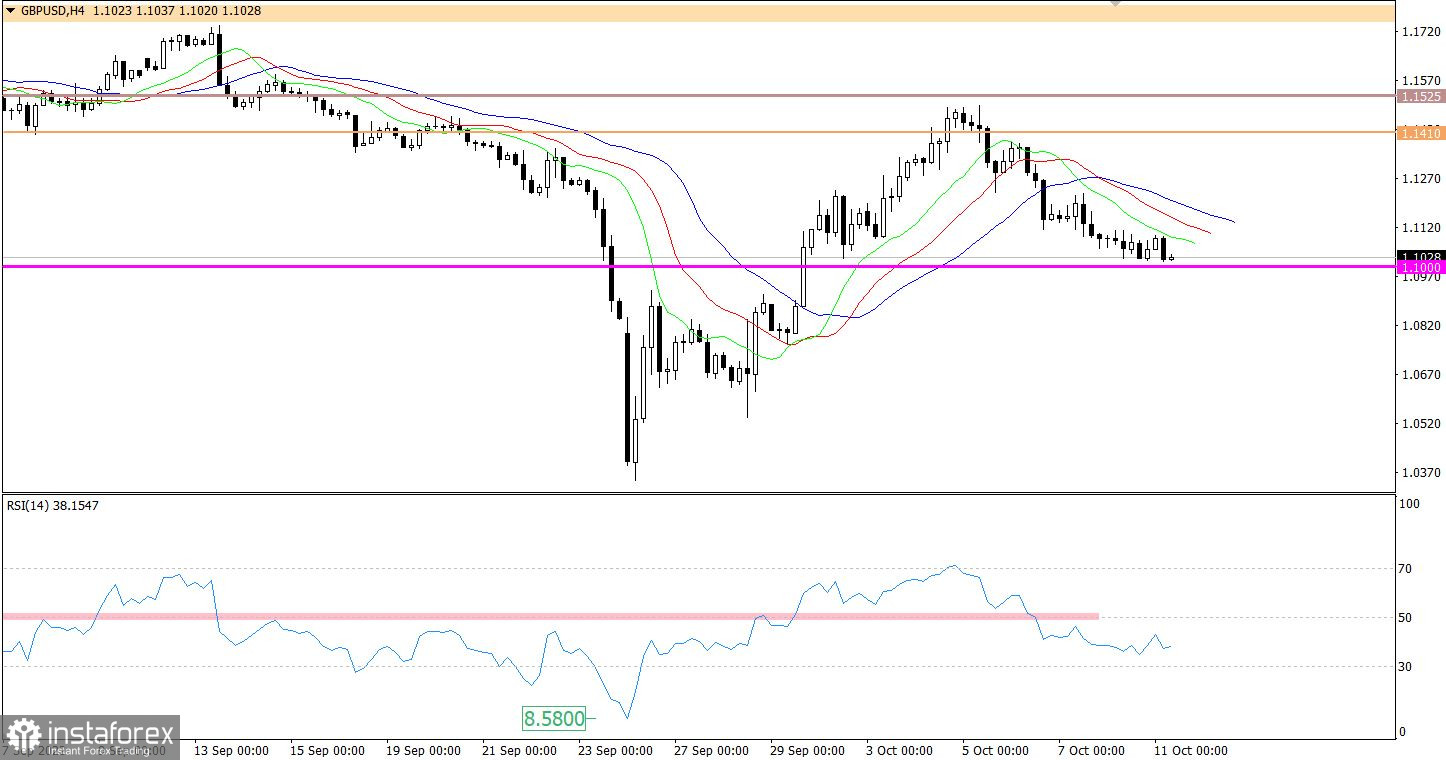

GBP/USD came close to the support level of 1.1000, which provoked a stagnation. To prolong the downward movement, traders must keep the pair below the control level, otherwise, the opposite scenario could occur. That may open the way for a rebound.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română