Global fundamental factors are now weighing on the market. These are macro data, the statements of presidents, finance ministers, and central bank governors, geopolitical and political news, and even space news that says there are now risks of collision with asteroids. All these factors have an effect on market sentiment. Some of these events will be 100% priced in by the market, while others will go unnoticed.

In higher time frames, instruments usually move in a certain direction. Sometimes, these are weak movements and sometimes, there are none at all. At times when the market is flat, there are usually no factors that could drive the market. Currently, there are such factors. Therefore, the wave structure of the analyzed instruments has become even more complex. The Russia-Ukraine conflict has had a significant influence on global markets and particular countries, which means it is not just a geopolitical conflict in a certain territory. The consequences of this conflict will be felt across the world. They are already reflected in the price of commodities.

In other words, in light of such a strong factor as a geopolitical conflict, currencies like the euro and the pound can hardly fall for any other reason. Weaker currencies such as the yen, the yuan, and the lira are on a losing streak as well. Some analysts and traders try to justify certain movements from time to time. However, the charts show that the greenback has been strengthening for seven months now, which is in line with the timeline of the conflict in Ukraine. Clearly, there are also other factors. For instance, it is the rate hike cycle in the United States, which is of greater importance than similar processes in the European Union and the United Kingdom. This is because there are more dollars than there are euros or pounds as well as because the American economy is the largest in the world. Therefore, the market is watching the Federal Reserve's action more closely than the ECB's or the Bank of England's.

Given all the factors, what should happen so that the trend could reverse? Clearly, things should make a U-turn. The Federal Reserve should finish the tightening of monetary policy, and the conflict should de-escalate. The whole world is like Titanik now. In order to avoid a collision with an iceberg, incredible efforts are needed. Otherwise, the consequences will be tragic. Alas, world leaders have no intention to resolve the conflict peacefully. Therefore, the euro and the pound are likely to stay bearish for the next few months.

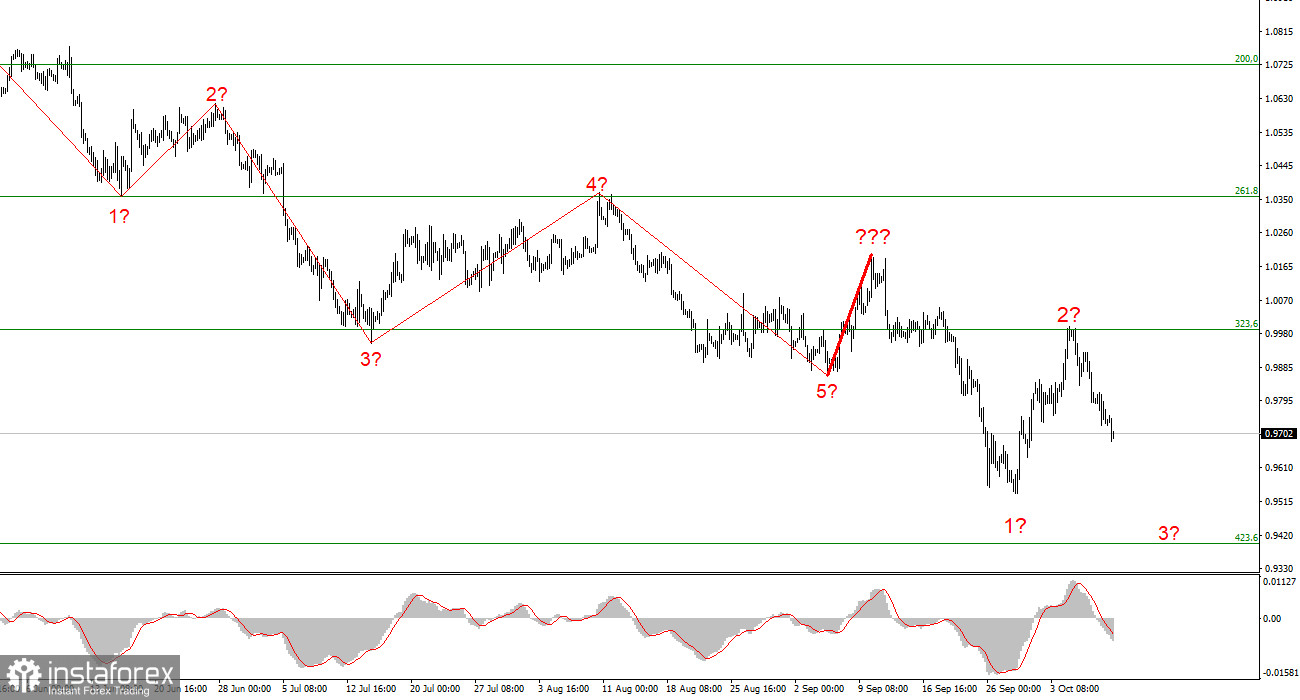

In this light, the formation of the downtrend goes on but may stop at any moment. The instrument may end its corrective move to the upside. That is why selling could be considered with targets around 0.9397, in line with the 423.6% Fibonacci retracement, when the MACD indicator reverses to the downside. Since it remains to be seen how long the euro will be in the downtrend, traders should be extra careful.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română