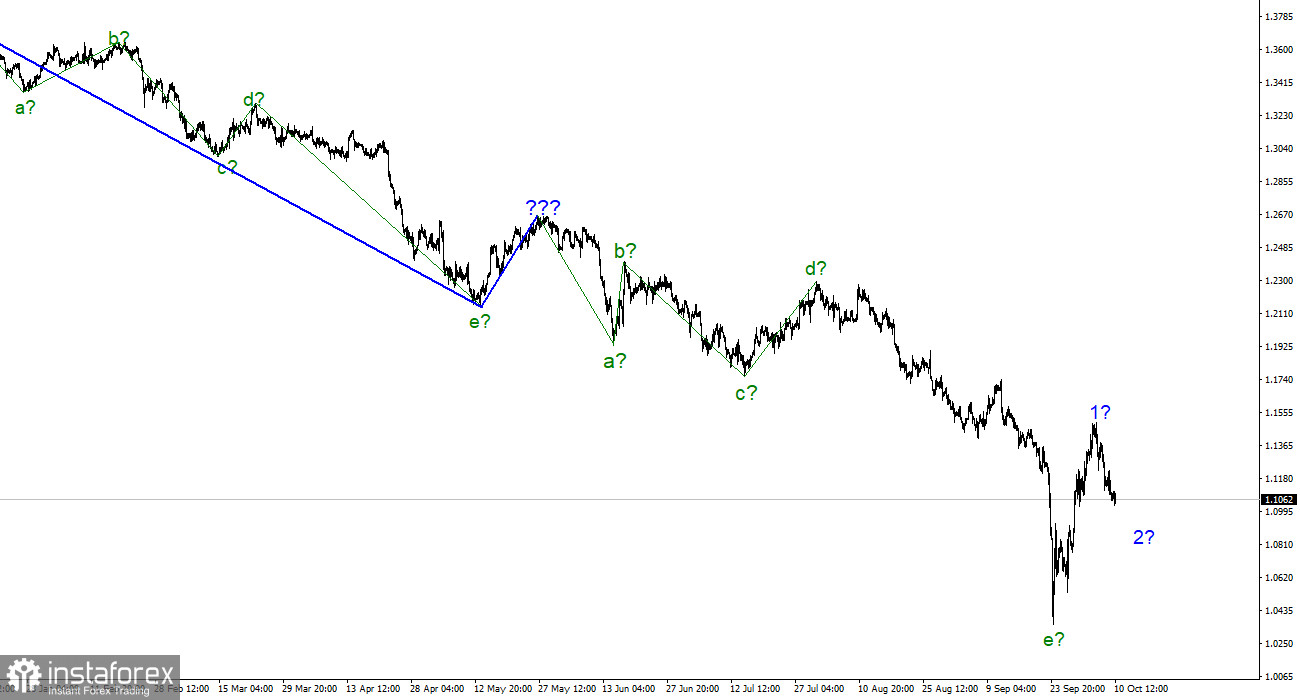

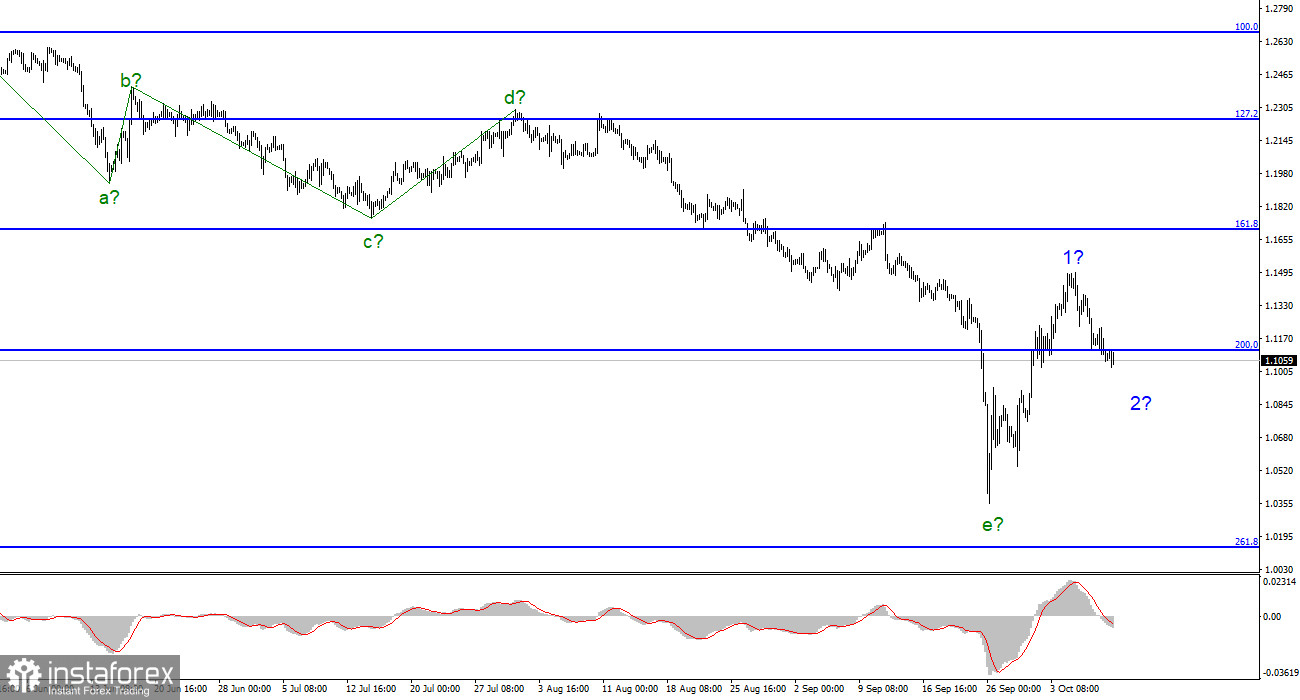

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. We have a supposedly completed downward trend segment consisting of five waves a-b-c-d-e. If this is indeed the case, then the construction of a new upward trend section has begun. The first wave is supposedly completed, and the construction of wave 2 has begun. Unfortunately, there is no confidence in this particular scenario since the instrument must go beyond the peak of the last wave to show us its readiness to build an upward section of the trend and not complicate the downward one once again. The peak of the nearest wave is located at about 23 figures. Thus, even after the pound has increased by 1000 points, you need to go up another 1000 points to reach this peak. This is a very significant distance. I also want to note that the wave markings of the euro and the pound are now radically different. I understand that many have seen strong British growth in a short time, so they are "itching" to make purchases. However, let me remind you that even if the upward section has started building now, we should see another downward correction wave (after completing 1). If the quotes do not fall below the low wave e (which is very difficult, but not impossible), then you can also expect to build a new upward wave 3 and buy.

The currency is different, the country is different, and the problems are the same.

The exchange rate of the pound/dollar instrument decreased by 30 basis points on October 10 and generally feels more comfortable compared to the euro/dollar instrument. Do not forget that the British still grew by more than 1000 points, which you can't just close your eyes to. The wave marking of the pound implies its further growth, in contrast to the wave marking of the euro currency. Although I do not believe that the euro and the pound will move differently in the coming months, this option should not be completely ruled out. The market has repeatedly shown that such scenarios can be implemented, which cannot be in principle.

The British pound suffers from the same factors as the euro currency. Although it has a real opportunity to complete the construction of a downward trend segment, the news background can send it far below the low of the wave e. The actions of the Bank of England in the long term continue to be ignored. The market does not even pay attention to rumors that claim an increase in the interest rate in the UK by 100 basis points all at once in November. But the market continues to follow the Fed and its plans with interest. And these plans are simple – the continuation of the rate increase without slowing down. And it seems that this factor can further increase the demand for the US currency. And, of course, geopolitics. Many military experts predicted that the situation would worsen in October. It remains to be hoped that their forecasts regarding November will also come true and a ceasefire will come. However, I don't see any reason for this.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a new decline in demand for the pound. I advise now selling the instrument, as before, on the MACD reversals "down." It is necessary to sell more cautiously since constructing a downward trend section could be completed. In any case, there should be a decrease since a corrective wave 2 is needed. This wave can also be impulsive, and the entire descending wave structure is transformed in this case.

The picture is very similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. The downward section of the trend can turn out to be almost any length, but it may already be completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română