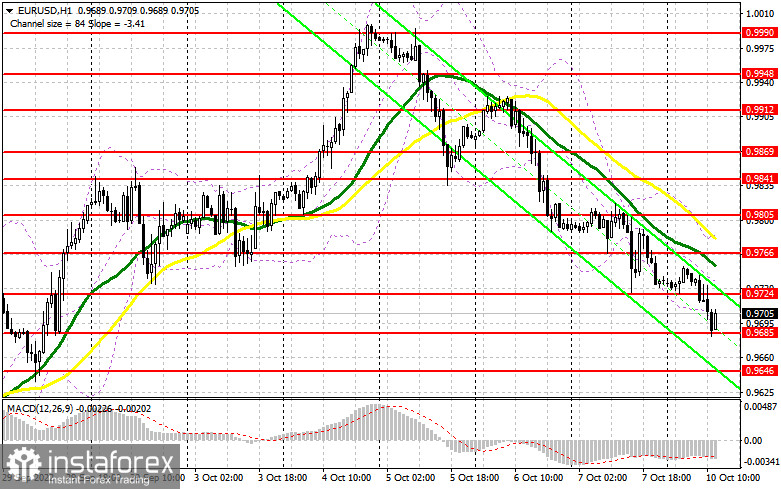

In the morning article, I turned your attention to the level of 0.9687 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and try to figure out what actually happened. After a decline to 0.9687, the bulls asserted strength. A false breakout occurred at this level, which gave a buy signal. The pair went up about 20 pips. For the second half of the day, the technical outlook has remained almost unchanged.

Conditions for opening long positions on EUR/USD:

As long as trading is carried out above the 0.9687 level, which has been shifted to 0.9685, bulls will have the chance to push the pair to 0.9724. However, the economic calendar is empty for the afternoon, except for the speeches of several Fed officials. So, the likelihood of a rebound is slim. A new buy signal may appear only if bulls protect the support level of 0.9685 and a false breakout of this level takes place. A similar situation occurred the morning. In this case, the euro is likely to rise to 0.9724. Consolidation above this level and a downward test will negate the bears' efforts to control the market. It will generate a buy signal. The pair could approach 0.9766 where the moving averages are passing in negative territory. A breakout of this level will open the path to 0.9805. If so, it will significantly undermine the bearish bias. If EUR/USD decreases after the speeches of Chicago Fed President Charles Evans and Fed Governor Lael Brainard, the pair is likely to fall below 0.9685 and to the support level of 0.9646. It is better to open long positions at this level only after a false breakout occurs. You can buy EUR/USD immediately at a bounce from a low of 0.9596 or 0.9540, keeping in mind an upward intraday correction of 30-35pips.

Conditions for opening short positions on EUR/USD:

Sellers managed to push the pair to the weekly low in the morning, cementing the downward movement. The most important task for the second half of the day is to protect the nearest resistance level of 0.9724, which acted as support in the morning. A false breakout of this level will provide an excellent sell signal with the prospect of a drop to 0.9685. A breakout below this level will exert more pressure on the euro. An upward test will give a sell signal, forcing the bulls to close Stop Orders. The pair could sink to a low of 0.9646. A more distant target will be the support level of 0.9596 where I recommend locking profits. If EUR/USD grows during the US session and bears show no energy at 0.9724, which is more likely, buyers will be able to take the upper hand. An upward correction to a high of 0.9766 may take place. It is recommended to open short positions on the euro at this level also only after a false breakout occurs. You can sell immediately at a bounce from 0.9805 or 0.9841, keeping in mind a downward intraday correction of 30-35 pips.

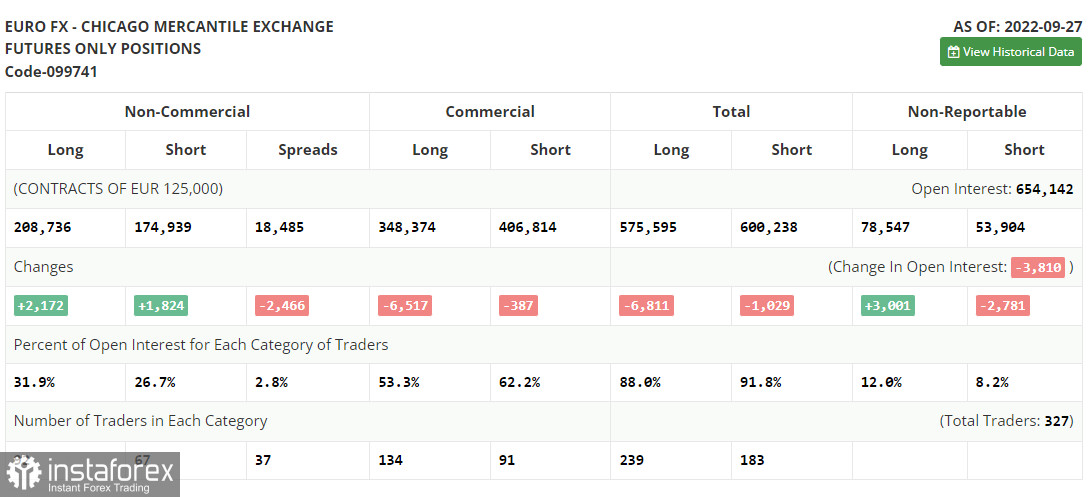

COT report

According to the COT report from September 27, the number of both short and long positions increased. After the central banks' meetings, the euro was under considerable pressure caused by the comments provided by European and US politicians. However, the currency managed to cope with it and now it has every chance to cover, though for a short period of time. The fact is that inflation in the EU has already exceeded 10.0%. In autumn and winter, the situation will only aggravate. That is why the euro will hardly show considerable growth. The worsening geopolitical situation in the world, which is mainly affecting the eurozone, may cause a considerable slowdown in the local economy, which is likely to slip into recession as early as next spring. Soon, the eurozone will disclose reports on activity in various sectors. A decline may cap the pair's upward potential. The COT report unveiled that the number of long non-commercial positions increased by 2,172 to 208,736, whereas the number of short non-commercial positions surged by 1,824 to 174,939. At the end of the week, the total non-commercial net position remained positive and amounted to 33,797 against 33,449. This indicates that investors are taking advantage of the moment and continue to buy the cheap euro below parity, as well as accumulate long positions, expecting the end of the crisis and the pair's recovery in the long term. The weekly closing price collapsed to 0.9657 from 1.0035.

Signals of technical indicators

Moving averages

EUR/USD is trading below 30- and 50-period moving averages, signaling the continuation of bearish pressure on the pair.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

If EUR/USD advances, the indicator's upper border at 0.9770 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted in yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română