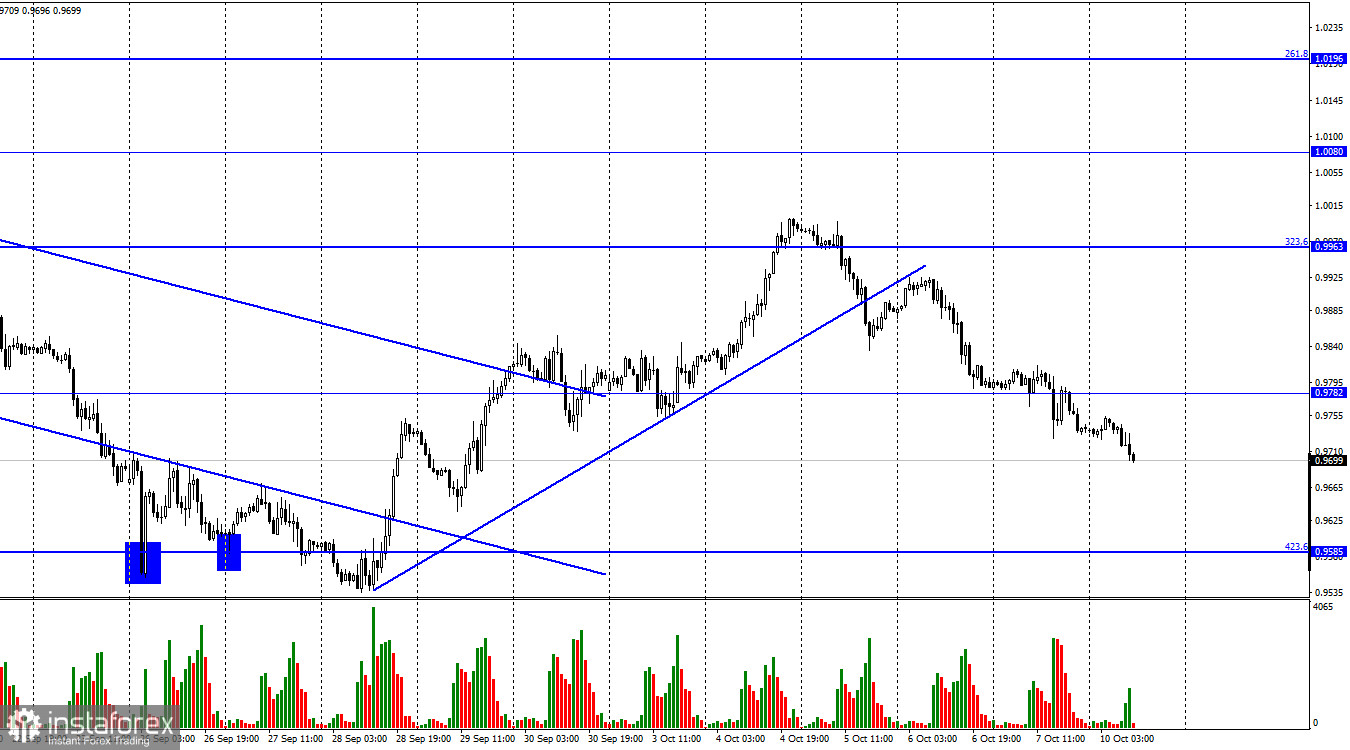

The EUR/USD pair continued the process of falling on Friday and secured below the level of 0.9782. Thus, the fall in quotations can continue toward the next corrective level of 423.6% (0.9585), near which the last fall ended. As you can see, bear traders retreated only for a short period, but now they are attacking again. Therefore, we can expect a new low update in 20 years.

On Friday, all the attention of traders was focused on America. Three important reports became known at once, and their meanings can be called interesting. The greatest interest was piqued not even by payrolls but by unemployment. A month earlier, it rose to 3.7%, but Friday's report showed its decline back to 3.5%. Thus, unemployment is not growing, and the Fed has no reason to worry about the "bad" state of the US labor market.

The payroll report also turned out to be pretty good. Traders' expectations were met when two hundred sixty-three thousand new jobs were created. Wages rose by 0.3% in September, which was also in line with expectations. Thus, none of the three reports was weak, and new dollar growth was expected against such an information background. However, a new week has begun, and the dollar continues to grow. I can assume that we are still seeing the reaction of traders to Friday's data, but the euro may fall without this influence as the geopolitical situation worsens.

As for the Fed, we are likely to see a fourth consecutive rate hike of 0.75%, which is the maximum possible tightening of monetary policy under the current conditions. This fact may continue to support the US currency. A report on inflation in the US will be released this week, but traders do not expect a strong decline. And this fact also plays in favor of the dollar. The slower inflation falls, the more reason the Fed has to keep raising the rate, which is very good for the dollar.

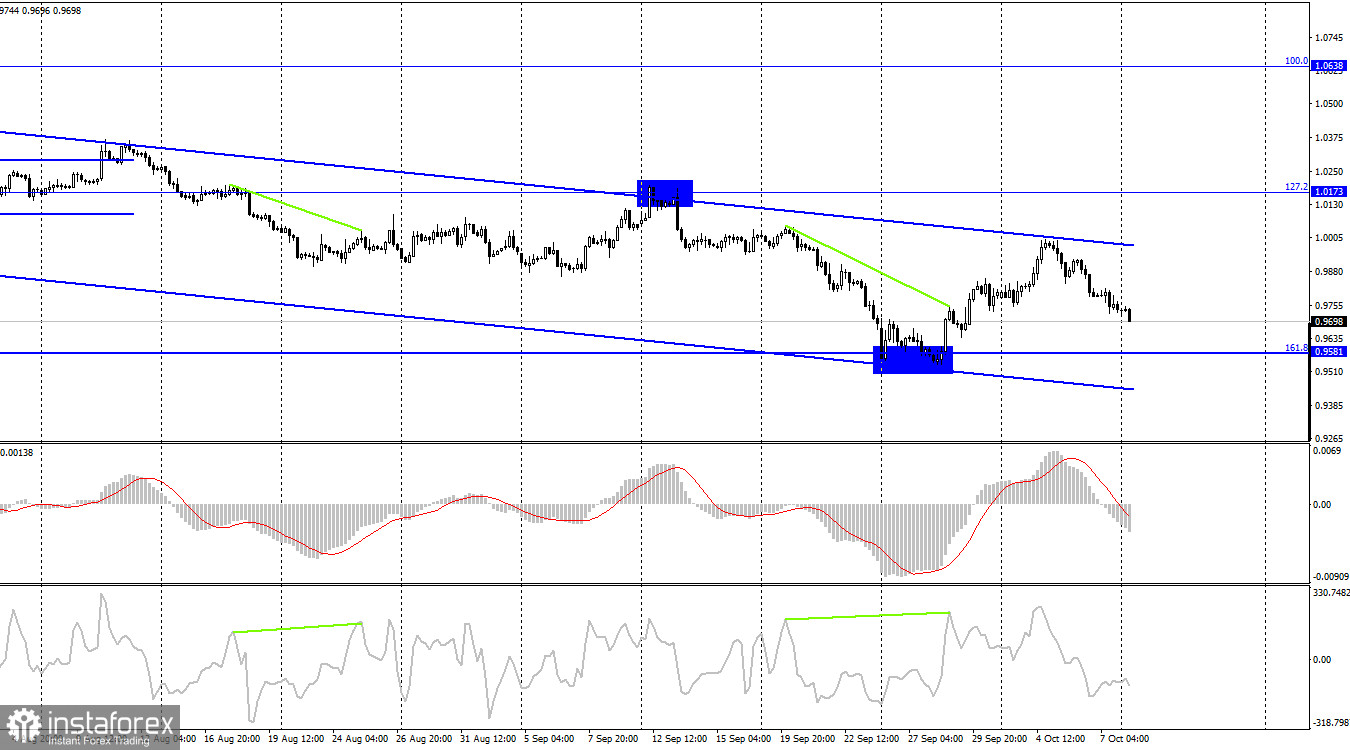

On the 4-hour chart, the pair reversedreversed in favor of the US dollar and began a new process of falling in the direction of the Fibo level of 161.8% (0.9581) and within the descending trend corridor. Thus, the mood of traders on this chart remains "bearish" without any questions. Only consolidation above the descending corridor will allow us to count on a tangible growth of the euro currency.

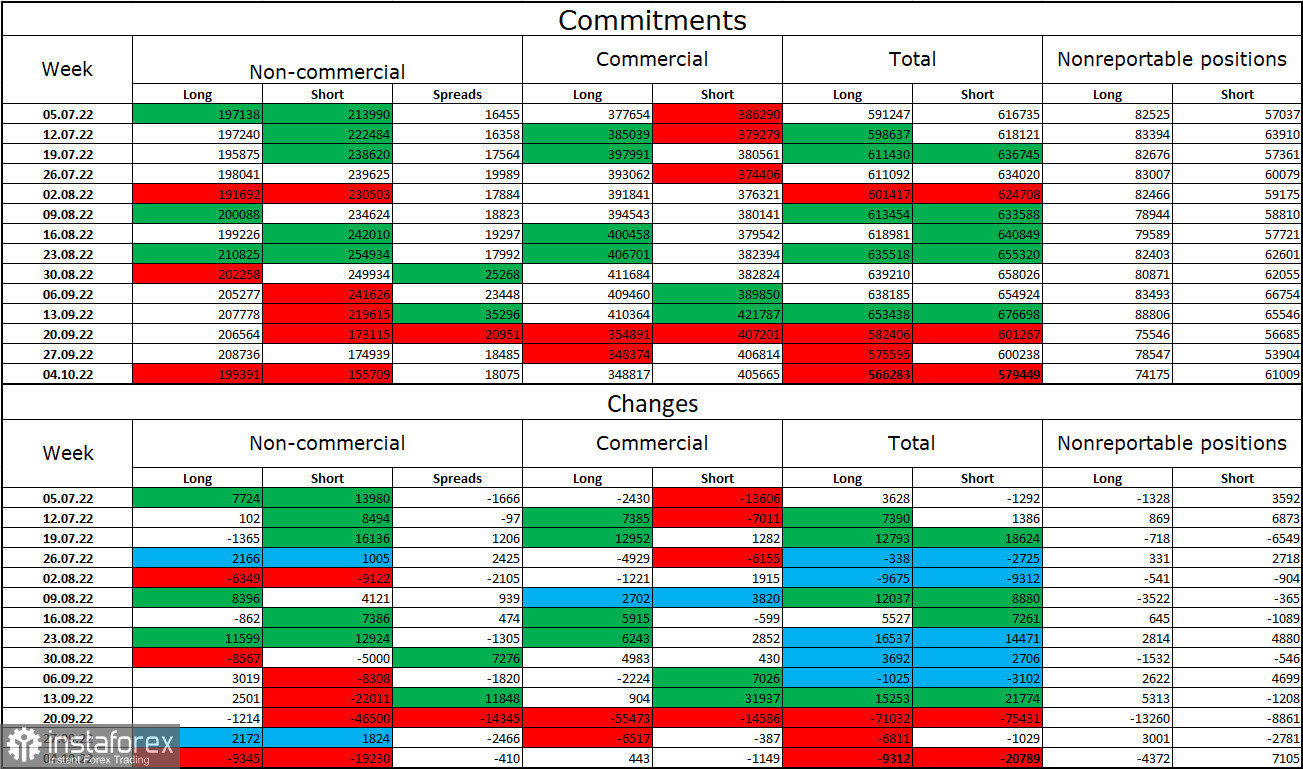

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 9,345 long contracts and 19,230 short contracts. This means that the mood of large traders has become even more "bullish" than before. The total number of long contracts concentrated in the hands of speculators is now 199 thousand, and the total number of short contracts – 155 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the euro's growth have increased, but traders are more actively buying up the dollar than the euro. Therefore, I would now bet on an important descending corridor on the 4-hour chart, over which it was impossible to close. I also recommend that you carefully monitor the news of geopolitics, as it greatly affects the mood of traders.

News calendar for the USA and the European Union:

On October 10, the calendars of economic events of the European Union and the United States do not contain a single interesting entry. The influence of the information background on the mood of traders today will be absent.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair now when rebounding from the upper line of the corridor on the 4-hour chart with a target of 0.9581 or when anchoring under the trend line on the hourly chart. I also recommended selling at the close under the 0.9782 level with a target of 0.9585. I recommend buying the euro currency when fixing quotes above the upper line of the corridor on a 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română