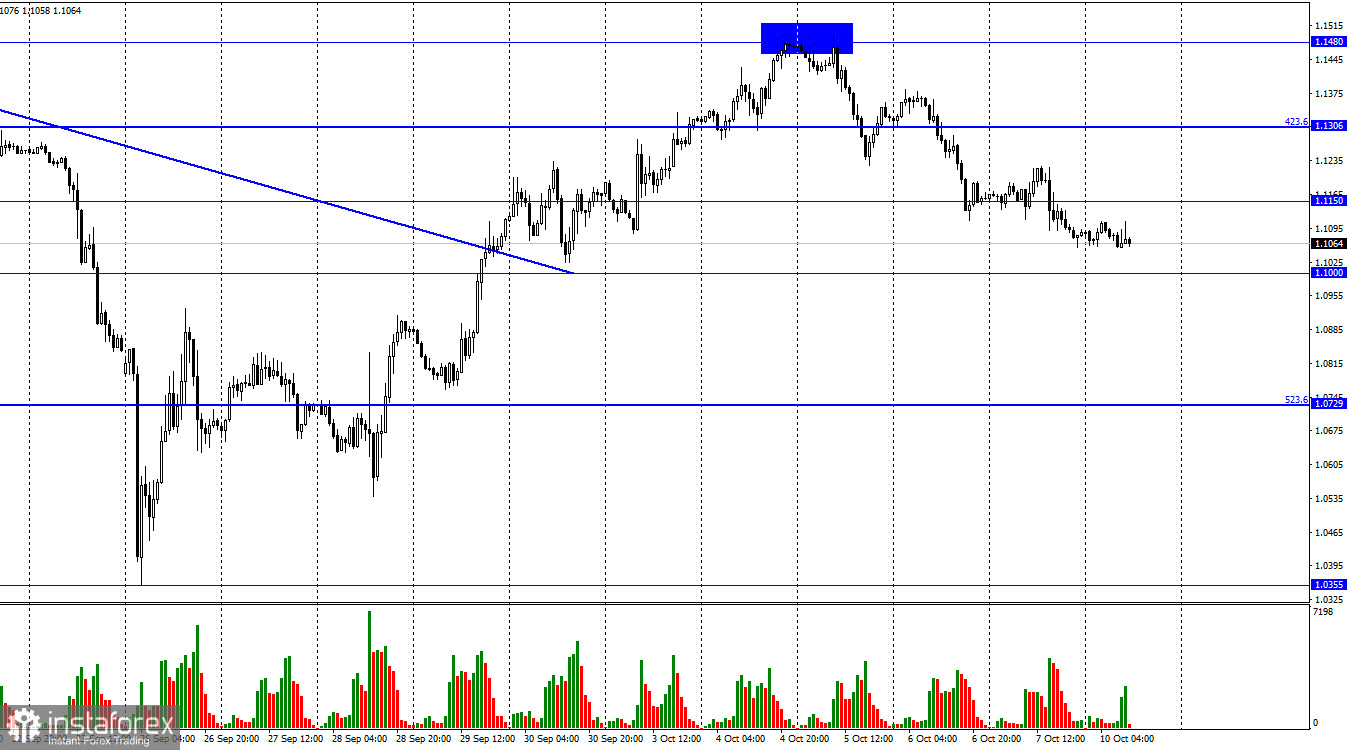

According to the hourly chart, the GBP/USD pair secured on Friday under 1.1150 and continued to fall towards 1.1000. Closing below this level will also favor a further fall of the pair in the direction of the Fibo level of 523.6% (1.0729).

On Friday, the information background for the British pound was similar. The pretty good statistics on the labor market, unemployment, and wages in the United States caused new purchases of the dollar, but they were observed before the release of these reports. Bull traders managed to bring the pair to the level of 1.1480, but now bears have returned to the market, which is stronger now as the information background is working on them. It's not even that traders ignore all the positive actions of the Bank of England or buy the dollar based on the tightening of the Fed's monetary policy. The fact is that the military conflict in Ukraine is gaining new momentum. The European Union and the United States have introduced a new package of sanctions against Russia. The Crimean bridge is damaged. The Nord Stream gas pipelines are damaged. On Monday morning, rocket attacks were launched on Ukrainian cities. All this may continue to lead to traders preferring to deal with a safe dollar rather than the pound or euro.

This week, we can expect new important events and news concerning the Ukrainian-Russian conflict. The main problem for the whole world is that Kyiv and Moscow have already officially abandoned any negotiations, stating that negotiations are, in principle, impossible under the current government of the opposite side. So, there will be new strikes, new battles, new sanctions, sabotage, and so on. After seven months of this conflict, it is hardly worth repeating, and it is hardly worth repeating that any escalation of it can and will lead to new growth of the US currency.

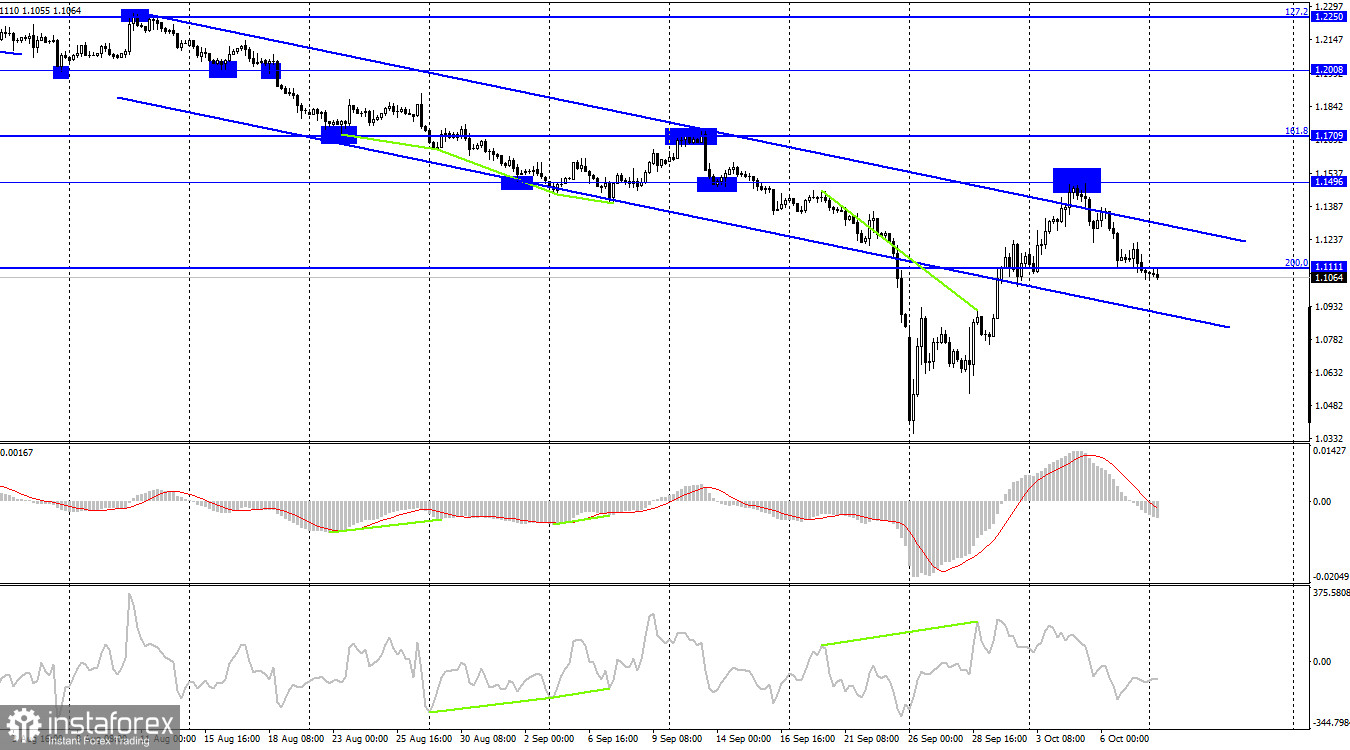

On the 4-hour chart, the pair reversed in favor of the US dollar and anchored under the Fibo level of 200.0% (1.1111). Thus, the process of falling can be continued in the direction of the 2022 low. Although the pair has closed over the descending corridor, I believe that the mood of traders remains "bearish" for now. The rebound from the level of 1.1496 allowed bear traders to return to the market.

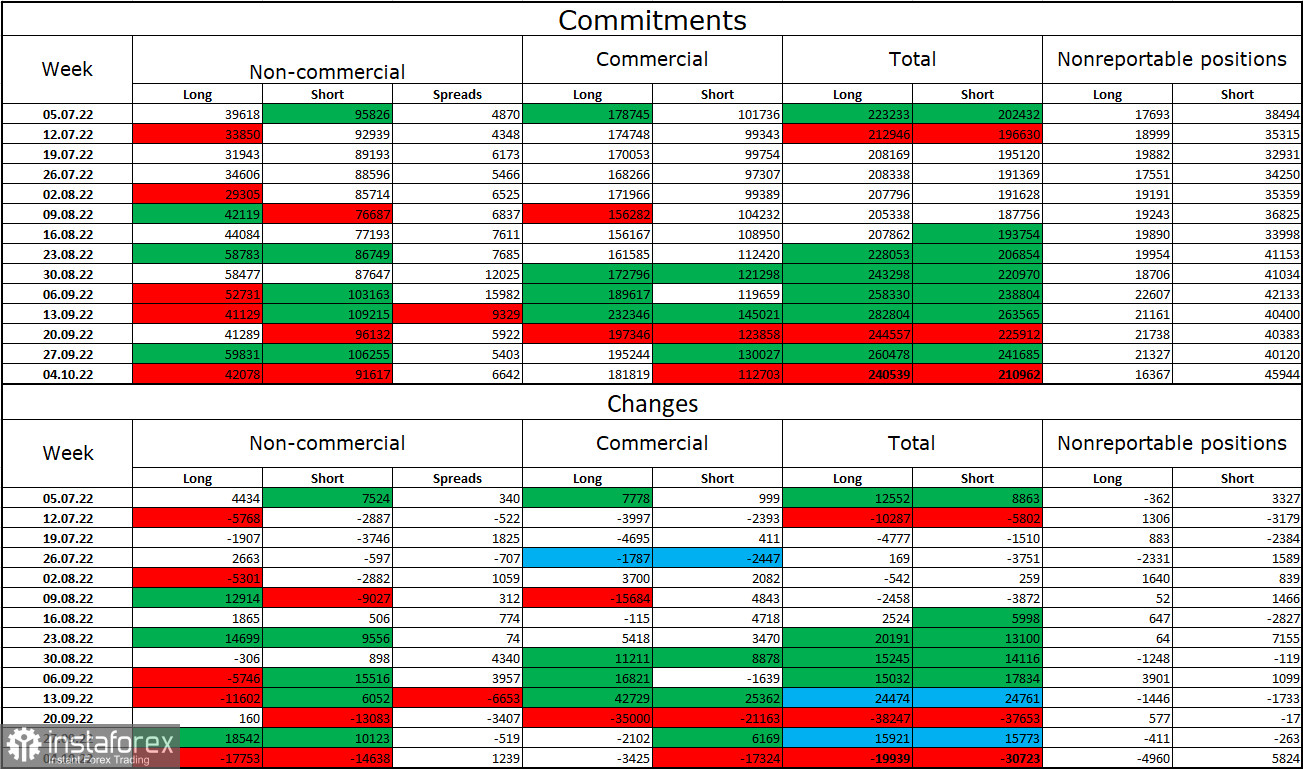

Commitments of Traders (COT) Report:

Over the past week, the mood of the "non-commercial" category of traders has become more "bearish" than a week earlier. The number of long contracts in the hands of speculators decreased by 17,753 units, and the number of short-term contracts by 14,638. But the general mood of the major players remains the same – "bearish," and the number of short contracts is still much higher than the number of long contracts. Thus, in general, large traders remain mostly in the pound sales, and their mood is gradually changing towards "bullish" in recent months, but this process is too slow and long. The pound can continue to grow if there is a strong (for itself) information background, with obvious problems observed in recent months. I draw attention to the fact that the mood of speculators on the euro is already "bullish," but the European currency is still falling in tandem with the US dollar. And for the pound, even COT reports do not give grounds to buy it.

News calendar for the USA and the UK:

On Monday, the calendars of economic events in the UK and the US are empty. The influence of the information background on the mood of traders will be absent today.

GBP/USD forecast and recommendations to traders:

I recommended selling the pair with a target of 1.1111 when rebounding from the level of 1.1496 on the 4-hour chart. This goal has been achieved. New sales at the close under 1.1111 with targets of 1.1000 and 1.0729. I recommend buying a Brit with a new fixation over a descending trend corridor on a 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română