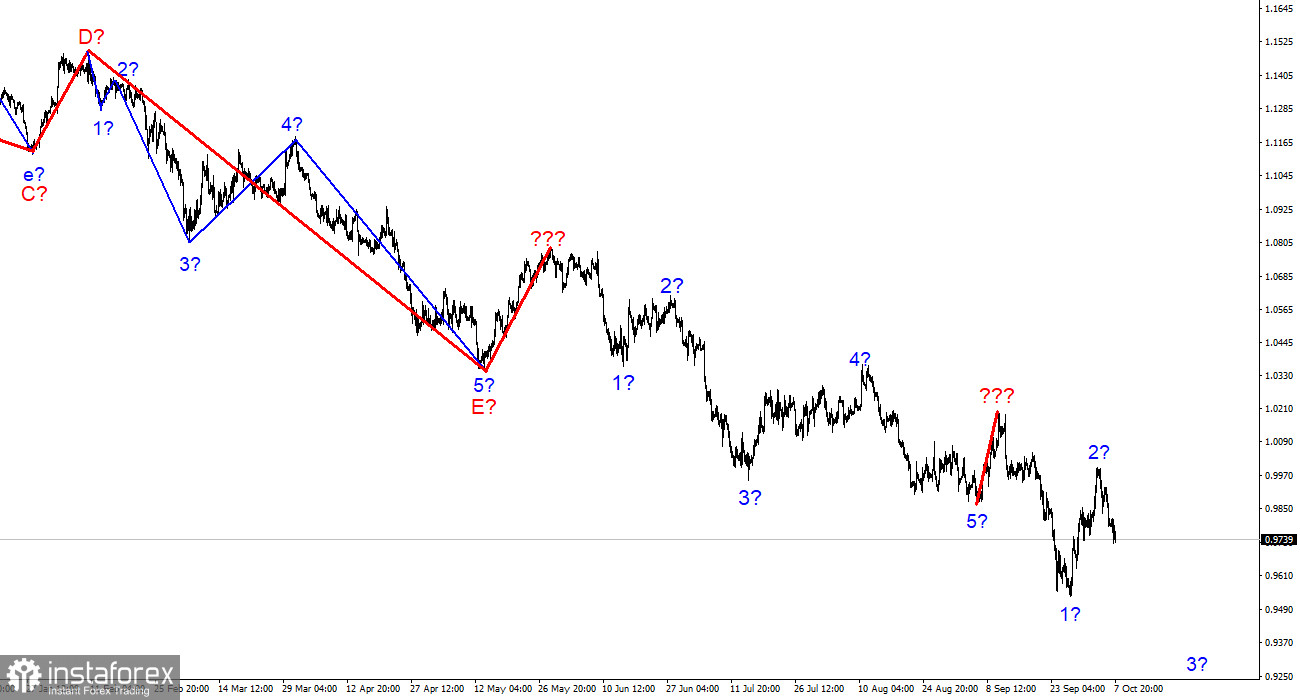

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may be more complicated than that in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one upward correction wave (marked with a bold line), after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There is no question of any classical wave structure (5 trend waves, 3 correction waves) right now. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture of "a strong wave down-a weak corrective wave up." The goals of the downward trend segment, which has been complicated and lengthened many times, can be found up to 90 figures or even lower. At this point, the (presumably) wave 3 of the downward trend section can be built.

Reports on the labor market supported the demand for the dollar.

The euro/dollar instrument fell by 60 basis points on Friday. The amplitude of movements decreased on Friday, which is very strange since it was the most important day of the week from the point of view of the news background. From Monday to Thursday, the market could only study business activity data, which is objectively less important than nonfarm payrolls and unemployment reports. Nevertheless, the market did not find any grounds for active trading on Friday evening. Perhaps the close at the end of the trading week played a role.

Let's move on to the reports themselves. The number of jobs created in September amounted to 263 thousand. I note that this value can be considered consistent with market expectations, which fluctuated between 250 and 300 thousand. In my opinion, this is quite a good value since the Fed has been tightening monetary policy for almost a whole year, which should worsen the state of the economy and the labor market. However, we do not see any (serious) deterioration yet. The labor market is stable, and GDP is declining within expectations. The unemployment report turned out even better, showing a decrease to 3.5%. Thus, the unemployment rate of 3.7% lasted only one month. I interpret both reports as positive for the US currency, so the increased demand for it does not surprise me. Surprisingly, the dollar rose only by 60 points, although the instrument moved much more actively during the week. Both reports supported the current wave markup, which suggests a decline.

General conclusions.

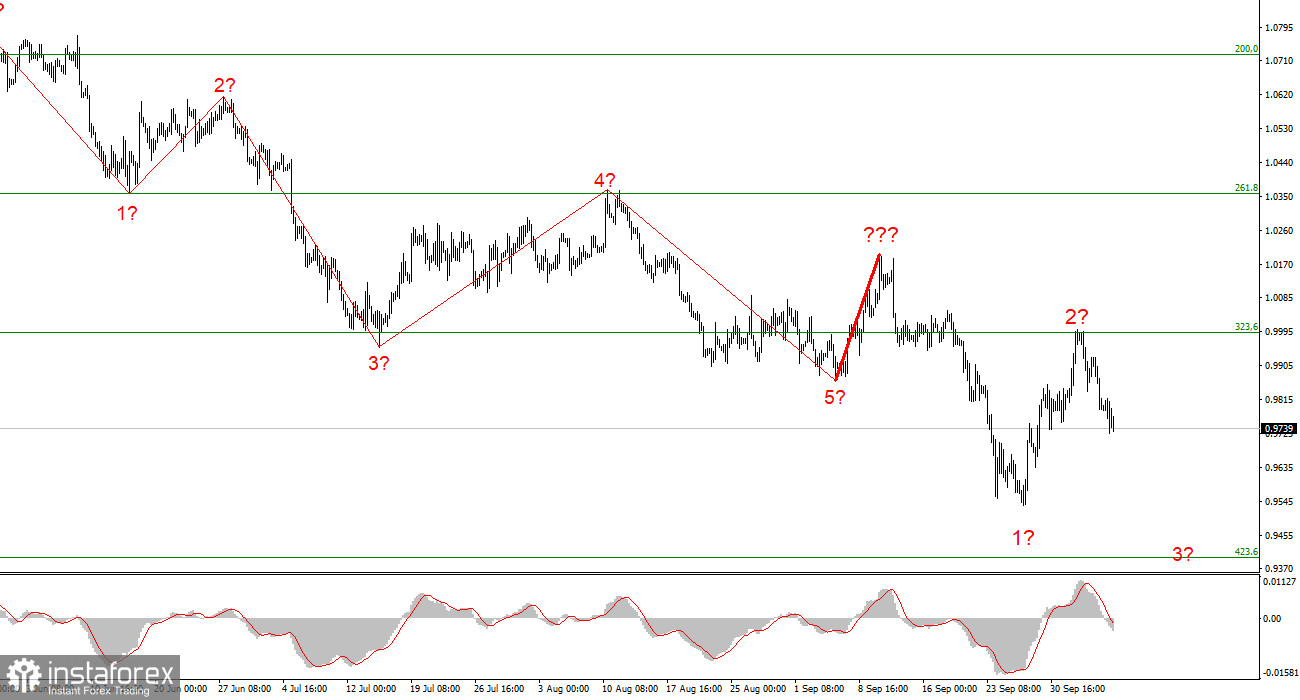

Based on the analysis, I conclude that the construction of a downward trend section continues but can end at any moment. At this time, the instrument can build a new impulse wave, so I advise selling with targets near the calculated mark of 0.9397, which equates to 423.6% by Fibonacci, by the MACD reversals "down." I urge caution, as it is unclear how much longer the decline of the euro currency will continue.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves has just been completed, and a new one has begun its construction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română