Long-term perspective.

The GBP/USD currency pair has been rising for two days and falling for three during the current week. Unlike the euro at the end of the week, the price did not go below the critical line, so the prospects for further growth of the British currency remain. We have already said earlier that the pound took a significant step towards the end of the downward trend since the last update of the absolute lows was sharp, and the subsequent pullback was no less sharp and strong. It turned out to be a "point injection," best suited for the title of the final segment of the trend. Nevertheless, if the pair gains a foothold below the Kijun-sen line next week, this will speak in favor of resuming the downward movement with a possible new descent to absolute lows. The fact is that, technically, now everything looks as if the downward trend is over. But there is no denying the presence of a very difficult geopolitical and fundamental background for the pound. If the "foundation" is at least slightly improving (the Fed will not raise its rate forever, and the Bank of England may raise its rate for the eighth time in a row at the next meeting), then geopolitics remains very difficult. Although European gas problems do not concern the UK, there are enough problems in the UK. The crisis, we can say, began with the Kingdom's withdrawal from the European Union. Even then, many economists predicted a recession for the British economy. As we can see, Brexit, the pandemic, and the geopolitical conflict in Ukraine provoked the strongest depreciation of the national currency, problems in financial markets, a strong increase in the cost of living, and the highest inflation. The energy price for consumers will have to be artificially limited, creating a "hole" in the budget. Some taxes will have to be reduced, creating a second "hole" in the budget. These "holes" will have to be covered by issuing new long-term Treasury bonds, that is, in other words, borrowing money. However, at current inflation levels, few people want to buy these bonds, as their yield is much lower. If the yield increases (which the Central Bank would like to avoid), the burden on the budget will increase even more since the interest rates will be higher.

COT analysis.

The latest COT report on the British pound showed minimal changes. During the week, the non-commercial group closed 17.7 thousand buy contracts and 14.6 thousand sell contracts. Thus, the net position of non-commercial traders decreased by 3.1 thousand, which is not very much for the pound. One could assume that the actions of major players and the pound's movement have finally begun to coincide. Still, the pound has already begun a new decline, which risks turning into a continuation of the global downward trend. The net position indicator has been growing slightly in recent weeks. Still, the mood of major players remains "pronounced bearish," which is seen by the second indicator in the illustration above (purple bars below zero = "bearish" mood). And, if we recall the situation with the euro currency, there are big doubts that, based on COT reports, we can expect strong pair growth. How can you count on it if the market buys the dollar more than the pound? The non-commercial group has opened 91 thousand sales contracts and 42 thousand purchase contracts. The difference, as we can see, is still very big. The euro cannot show growth in the "bullish" mood of major players, and the pound will suddenly be able to grow in a "bearish" mood. We remain skeptical about the long-term growth of the British currency, although there are certain technical reasons for this.

Analysis of fundamental events.

There were practically no interesting events or publications in the UK this week. Business activity indices continue to decline slowly or remain below 50.0. And there were simply no other publications or reports. In the States, too, most business activity data was published this week. Recall that every day the pair passes 200-300 points. On Friday, it became known about a good report on nonfarm and a decreased unemployment rate, which is also very positive for the dollar, not for the pound. We believe that everything will depend on the critical line on the 24-hour TF now. If the price is fixed below it, there will be grounds for new pound sales. If the price remains higher, the pound will tend to grow for some time.

Trading plan for the week of October 10th–14th:

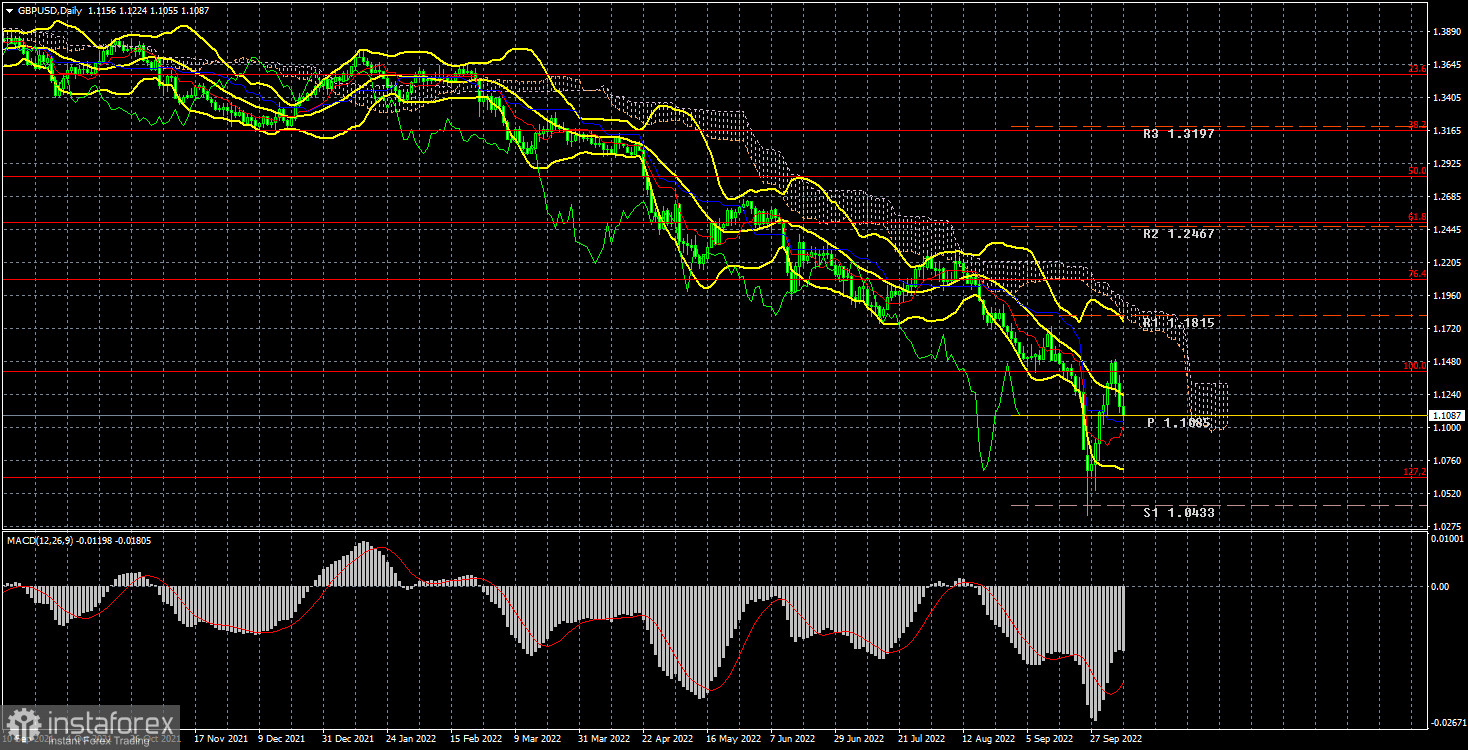

1) The pound/dollar pair maintains a long-term downward trend but is already located above the critical line. Therefore, small purchases can now be considered if the price bounces off this line. The target is the Senkou Span B line, which runs at 1.1843. There are some reasons for the pair's growth, but there are still more reasons for a new fall. Be careful with your purchases!

2) The pound sterling has made a significant step forward but remains in a position where it is difficult to wait for strong growth. If the price fixes below the Kijun-sen line, the pair's fall can quickly and cheerfully resume with targets in the area of 1.0632–1.0357.

Explanations of the illustrations:

Price levels of support and resistance (resistance/support), Fibonacci levels – target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română