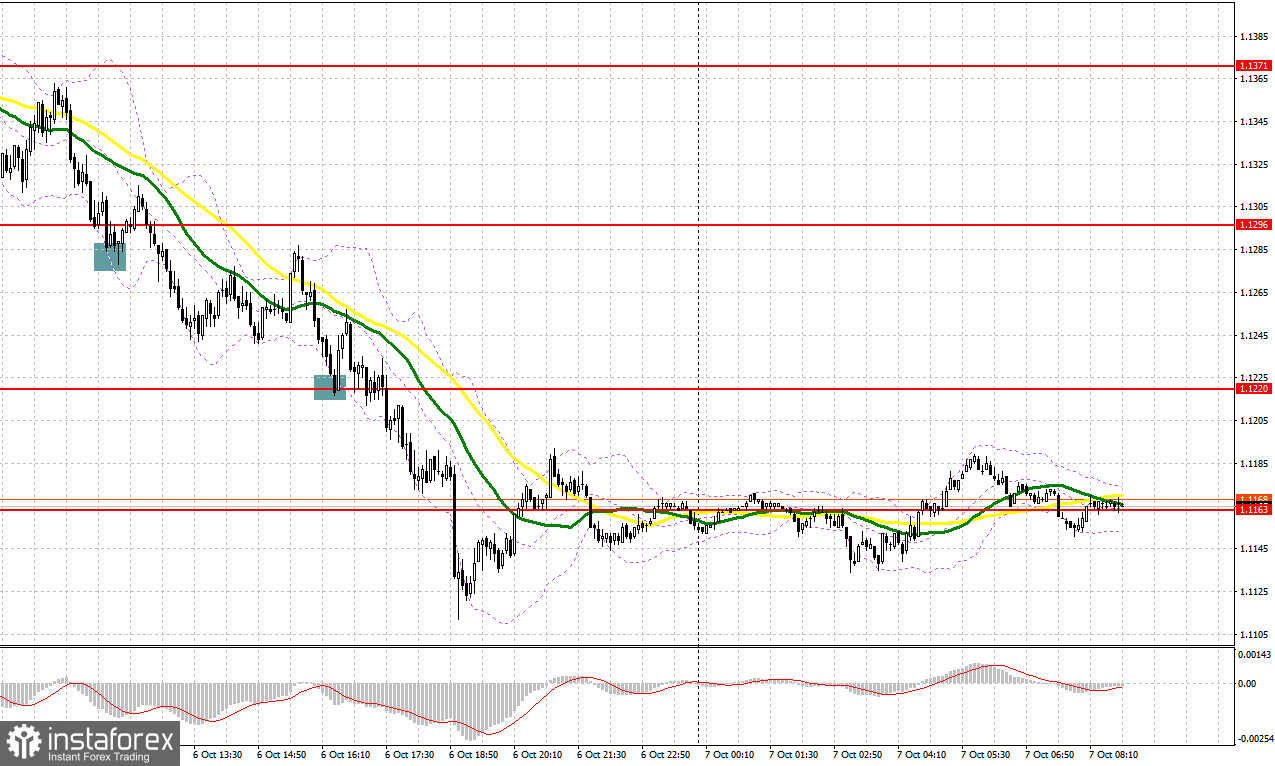

Yesterday, GBP/USD generated a few signals for the market entry. Let's analyze the 5-minute chart and try to figure out what actually happened. In the morning review, I turned your attention to 1.1284 and recommended making decisions with this level in focus. The nearest support of 1.1334 was broken without an opposite test, so we couldn't open short positions there. After a move to 1.1284, the bulls tried to defend this area and even created a buy signal. As a result, the currency pair climbed 30 pips. From the second attempt, the bears pushed the price below 1.1284. In the second half of the day, a false breakout of 1.1220 after a GBP slump generated a sell signal. Hence, the price dropped 40 pips.

What is needed to long positions on GBP/USD

The market sentiment today depends entirely on the US nonfarm payrolls. We will discuss this event in the later forecast for the second half of the day. Now we should consider the UK house price index by Halifax and absorb comments by Bank of England Deputy Governor for markets and banking Dave Ramsden who will speak in the afternoon.

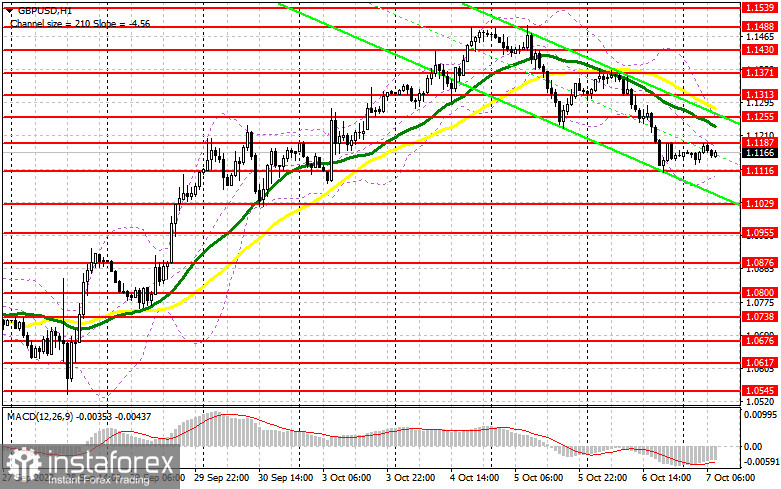

Apparently, the bears aim to go ahead with the correction and are ready to break the nearest support 1.116 anytime soon. This scenario is realistic. Therefore, a false breakout there will provide a buy signal with a view to rebounding to 1.1187 which is nice resistance formed in the Asian trade. A breakout and test of this level downwards on the back of decent statistics could activate the sellers' stop orders, thus creating a new buy signal betting on the growth to 1.1255 where bearish moving averages are passing. The highest target is seen at 1.1313 where I recommend profit-taking. If the bulls don't cope with this task and miss 1.1116, the currency pair might come under selling pressure again with the prospects of printing a lower low at 1.1029. I would recommend buying there only during a false breakout. We could open long positions on GBP/USD immediately at a dip off 1.0955 or from a lower level of 1.0876, bearing in mind a 30-35-pips intraday correction.

What is needed to open short positions on GBP/USD

GBP/USD is in the bears' grips ahead of the crucial report on the US labor market. Their major task is to break 1.1116 and also to defend 1.1187. The reasonable scenario will be to sell at a false breakout from resistance at 1.1187 created during the Asian trade. The bears should try not to miss this level. Otherwise, GBP/USD will gain ground and traders will revise the market situation in favor of the buyers. A breakout of 1.1116 and the opposite test upwards will provide a good entry point for short positions with the intent to sell the pair at about 1.1029. The sell-off could take place on the condition of the upbeat US nonfarm payrolls. The door will be open to a lower target at 1.0955. The lowest target is defined at 1.0876 where I recommend profit-taking.

In case GBP/USD grows and the bears lack activity at 1.1187, the buyers will enter the market because of the weak US statistics which will push the pair to the high at 1.1255. Only a false breakout at this level will provide the point for opening short positions on the assumption of a new move downwards. In case the bulls don't assert themselves, I recommend selling GBP/USD immediately at a bounce off 1.1313, bearing in mind a 30-35-pips drop intraday.

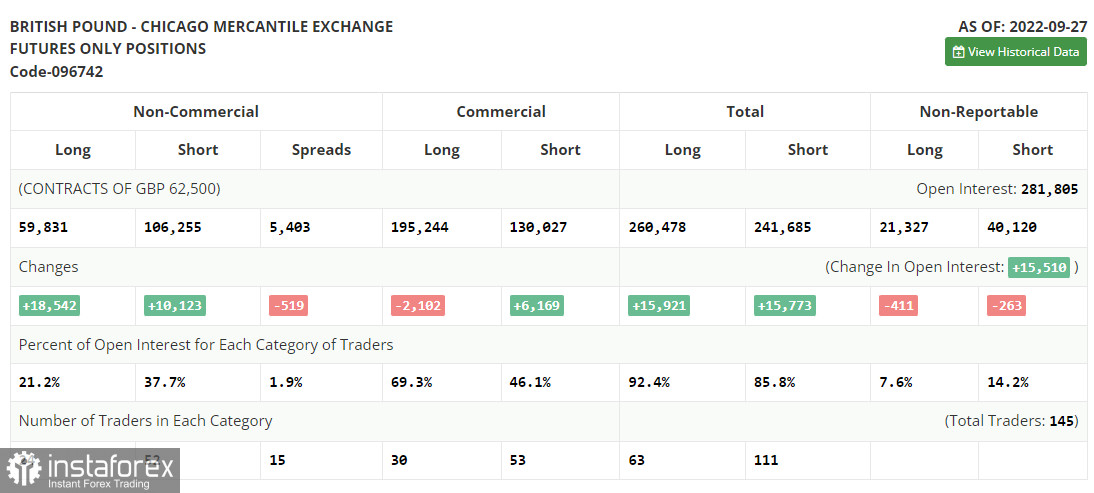

The COT report from September 27 logs a sharp increase both in long and short positions. The Bank of England had to intervene after the sterling had slumped almost 10% in just two days. This move accounts for growing demand for GBP which increased long positions which now outweigh short ones. After the Bank of England raise interest rates lower than expected by 0.5%, the pound sterling plunged to historical lows against the US dollar. Many experts brought up the issue of the pending parity level. Nevertheless, interference of the British regulator in the bond market helped to stabilize the GBP's forex rate which enabled the bulls to win back some losses.

The question is still open how long the Bank of England's support will be able to support the sterling in the course of further rate hikes. Some economic data which is due this week could hurt GBP and put a lid on its further climb.

According to the last COT report, long non-commercial positions rose by 18,831 to 59,831 whereas short non-commercial positions grew by 10,123 to 106,355 which led to a modest decline in the negative delta on non-commercial net positions to -46,424 against -54,843. GBP/USD closed last week with a slump to 1.0738 against 1.1392 a week ago.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages. It indicates the bears' attempts to regain their control over the market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD grows, the indicator's middle line at 1.1255 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română