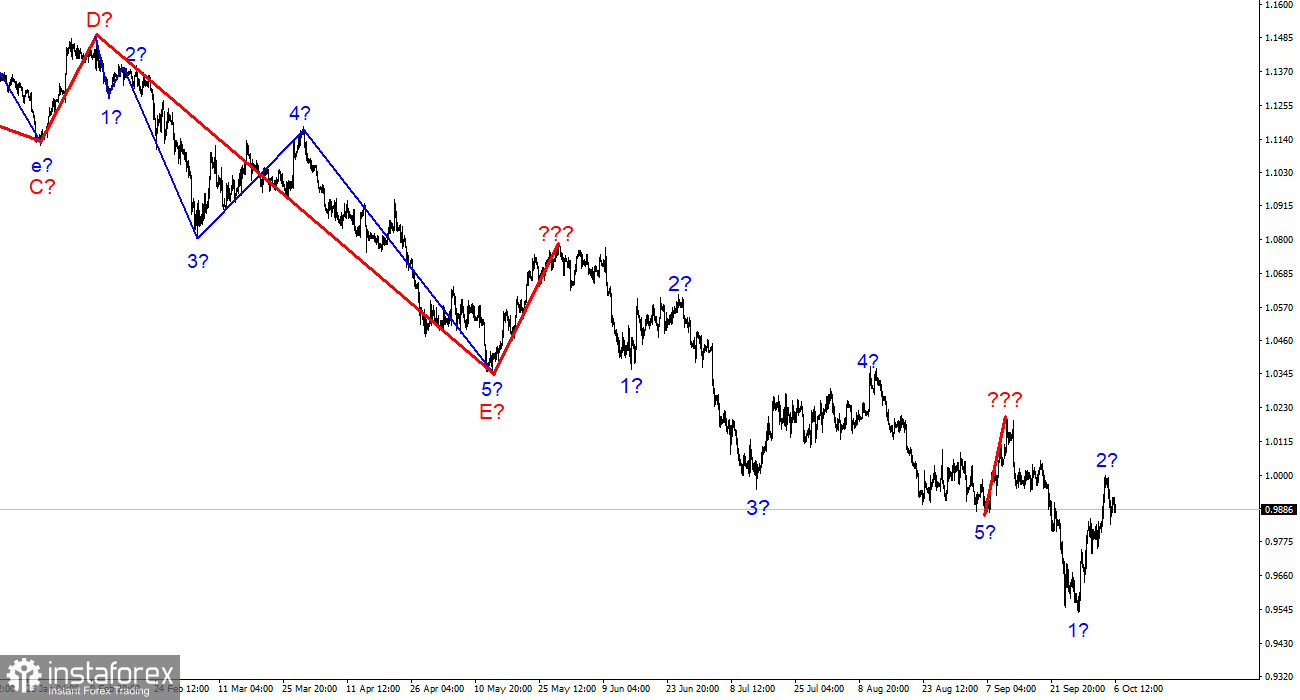

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may become more complicated than ever in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one upward correction wave (marked with a bold line), after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There is no question of any classical wave structure (5 trend waves, 3 correction waves) right now. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture of "a strong wave down-a weak corrective wave up." The goals of the downward trend segment, which has been complicated and lengthened many times, can be located up to 90 figures or even lower. At this time, a (presumably) corrective wave 2 of a new downward trend segment may be being built.

The dollar may fall after data on the US labor market.

The euro/dollar instrument has not yet declined or increased by a single point on Thursday. This certainly does not mean that the instrument did not move today. This means that at the time of writing, the price and opening levels of the day coincided. The amplitude of movements has decreased significantly today compared to previous days, which may be due to the absence of a news background on Thursday. However, it's too early for the market to relax because Friday is ahead, and the most important reports of this week come with it.

Tomorrow in America, there will be two reports that deserve attention. First, these are Nonfarm Payrolls. Second, the unemployment report. Previously, unemployment was not always paid attention to since this indicator has been at its lowest value for decades for a long time. However, last month it showed growth, which may be due to the tightening of the Fed's monetary policy in 2022. Unemployment is now an important indicator since its growth will indicate the beginning of a recession in the American economy, which Fed officials continue to deny, referring to low unemployment. In addition to unemployment, the Nonfarm Payrolls report will be released. With this report, everything is more complicated.

In October 2021, the number of new jobs amounted to 677 thousand. Since then, the indicator has been steadily falling, and only two months have been out of sync with the general trend. In August, 315 thousand of jobs were already created, and in September, there may be even fewer. The drop in this indicator also indirectly indicates an approaching recession. The lower we see nonfarm, the higher the probability of a new decline in demand for the dollar.

General conclusions.

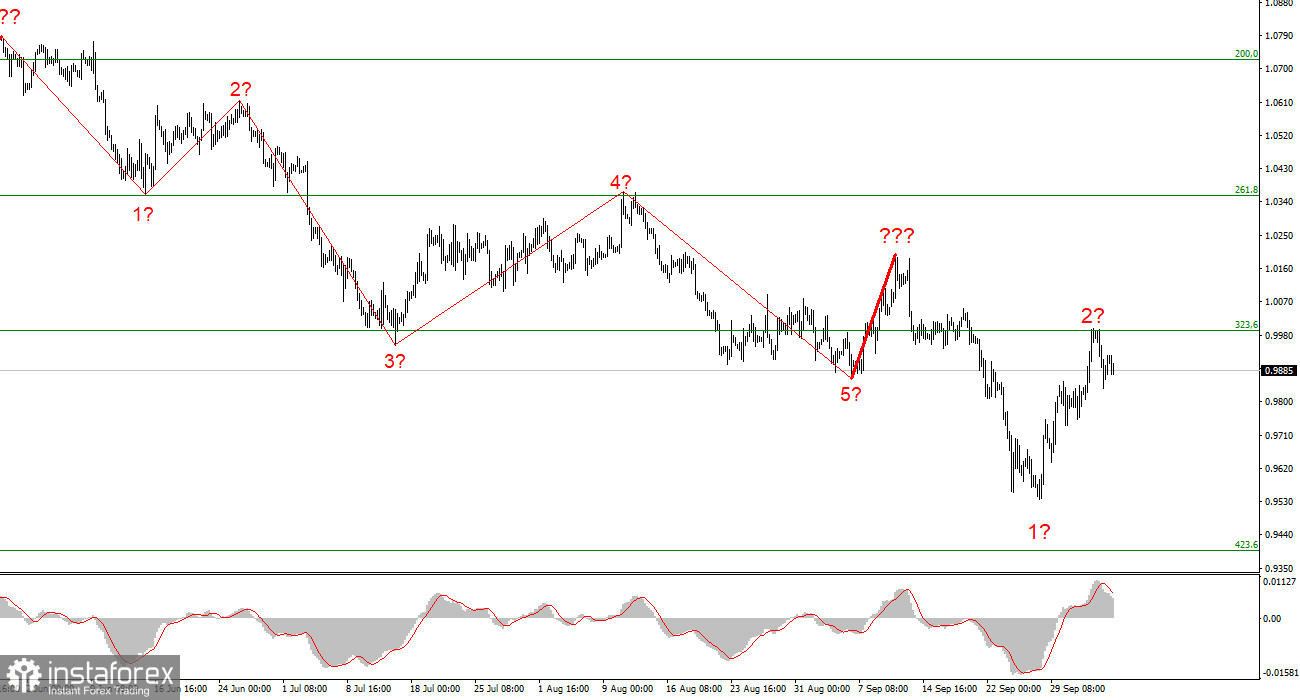

Based on the analysis, I conclude that the construction of a downward trend section continues but can end at any time. At this time, the tool can build a corrective wave, so I advise selling with targets near the estimated 0.9397 mark, which is equal to 423.6% by Fibonacci, and by MACD reversals "down." I urge caution, as it is unclear how much longer the decline of the euro currency will continue.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves has just been completed, and a new one has begun its construction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română