Yesterday, the greenback strengthened on the positive economic data from the US. The ADP employment report showed that the private sector added 208K new jobs, which exceeded the previous reading for August and traders' expectations. The trade deficit declined to $67.4 billion in August, which is also better than previously estimated. The S&P Global Services PMI came in at 49.3, far exceeding the previous level of 43.7. The ISM Services PMI was reported at 56.7. So, all four reports turned out to be positive for the US dollar.

No important data releases are expected today. Yet, the ADP report suggests that Nonfarm Payrolls that are due on Friday will also be positive. These two reports do not always show the same reading. However, the US economy is definitely not in a dire state. Therefore, nonfarm payrolls are unlikely to drop sharply. I think that the unemployment report will be of more importance to the market. A month earlier, this indicator went up. Even if it continues to rise, this won't be a critical factor for the US economy as the number of unemployed stays at its lowest levels in 50 years. At the same time, this can be a signal for the Fed to adjust its policy. The regulator plans to raise the rate at least two more times until the end of 2022. Then a break may follow. Markets should be getting ready for this break as the US dollar's rise in the past 6-8 months was mainly fueled by Fed's aggressive actions. As for the pound sterling, it is still vulnerable. GBP's recent surge doesn't mean that this trend will continue.

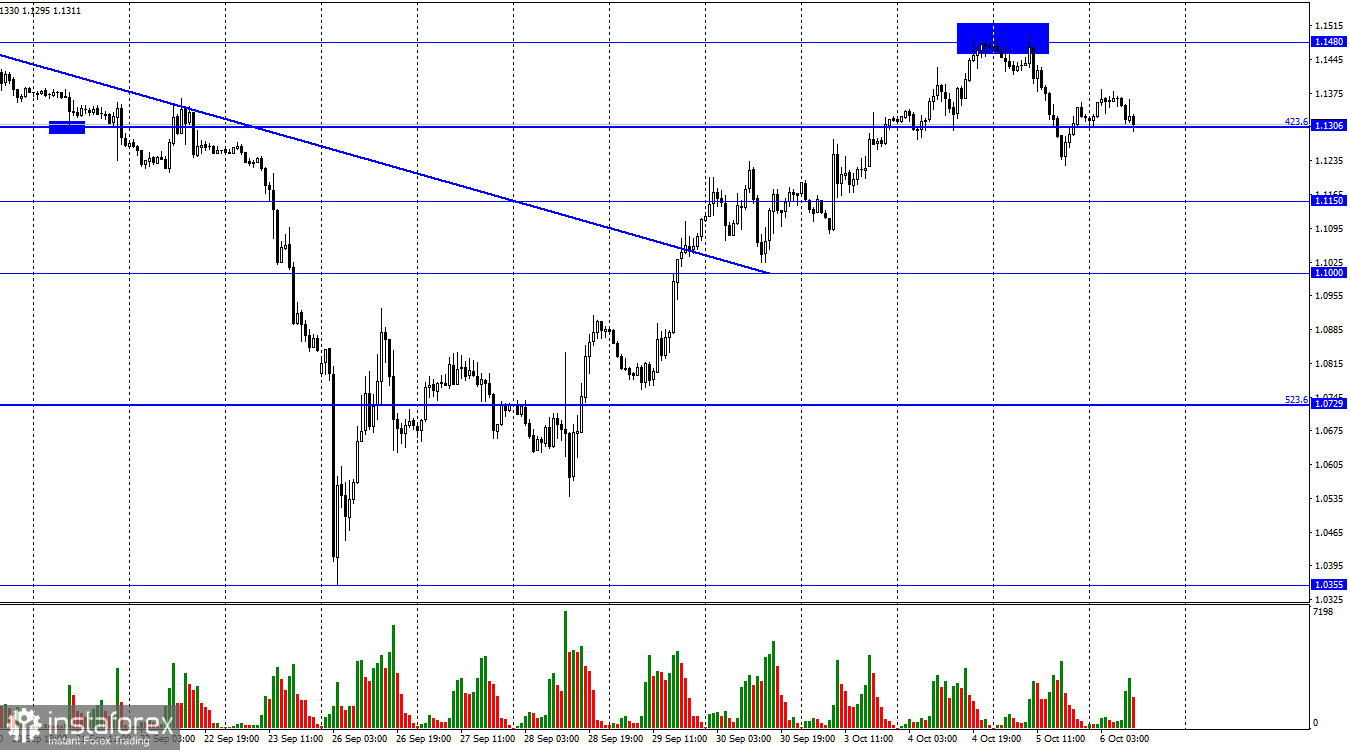

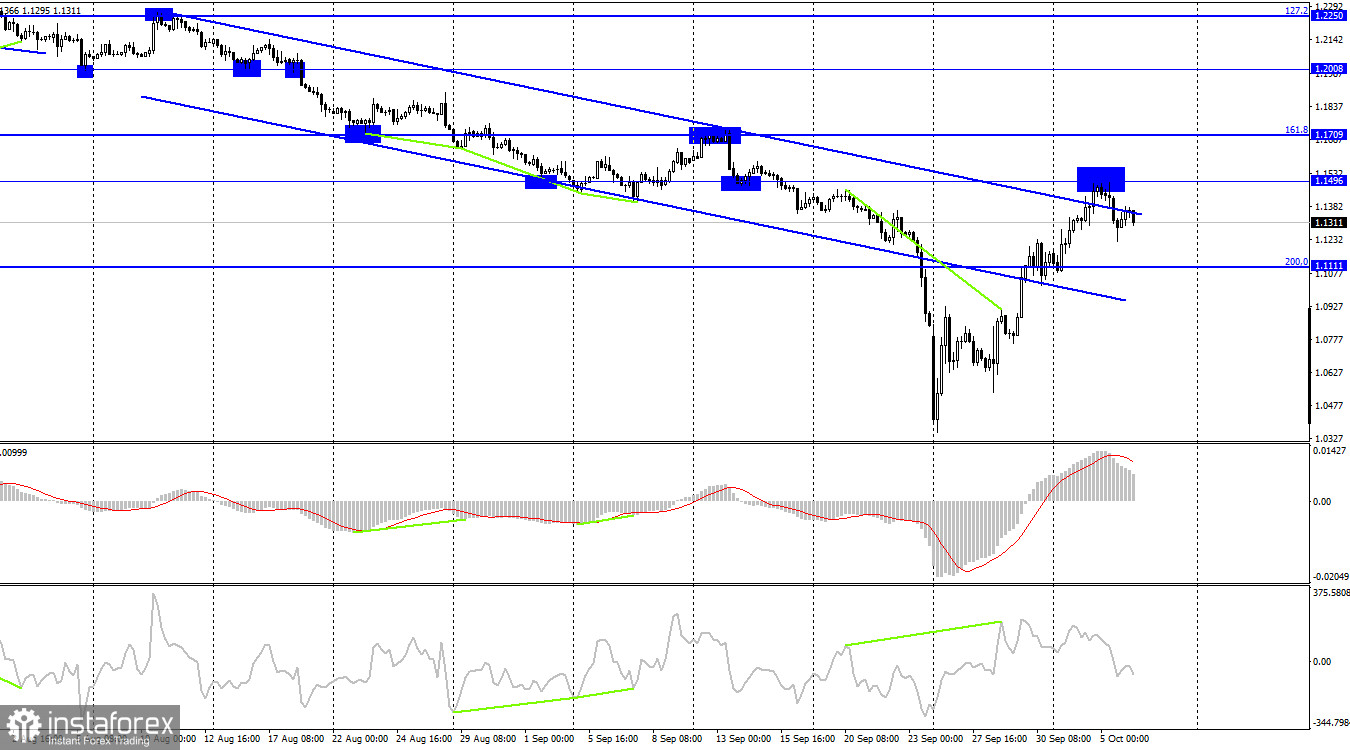

On the 4-hour chart, the pair advanced to the level of 1.1496 and rebounded from there. As a result, the pair resumed its decline towards the Fibonacci retracement level of 200.0% located at 1.1111. The decline happened even though the price settled above the descending trend channel. The pound's uptrend was too rapid, so a slight fall is ok here.

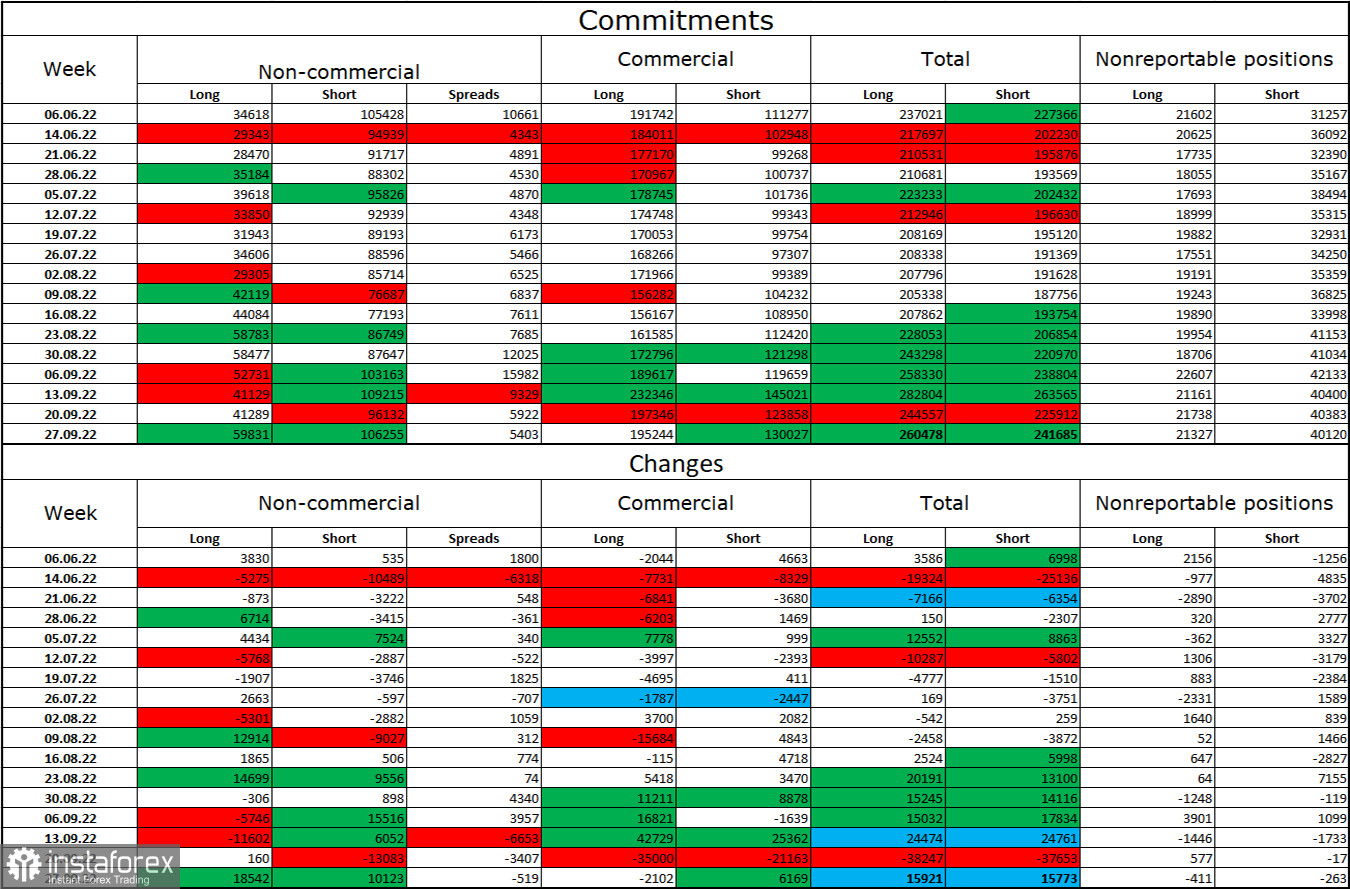

Commitments of Traders (COT) report:

Over the past week, the non-commercial group of traders became less bearish on the pair than a week earlier. Traders added 18,542 long contracts and 10,123 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. The total amount of long contracts is a bit higher than that of the short ones which indicates a bullish market. At the same time, any negative news may quickly reverse the trend to the opposite.

Economic calendar for US and UK:

US - Initial Jobless Claims (12-30 UTC).

The UK economic calendar on Thursday is totally uneventful. The US has one important report today. The impact of the information background on the market sentiment may be very weak or even zero.

GBP/USD forecast and trading tips:

I would recommend selling the pair with the target at 1.1111 when the price rebounds from 1.1496 on the 4-hour chart. Buying the pound is possible when the price rebounds from 1.1111 to the target of 1.1496.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română