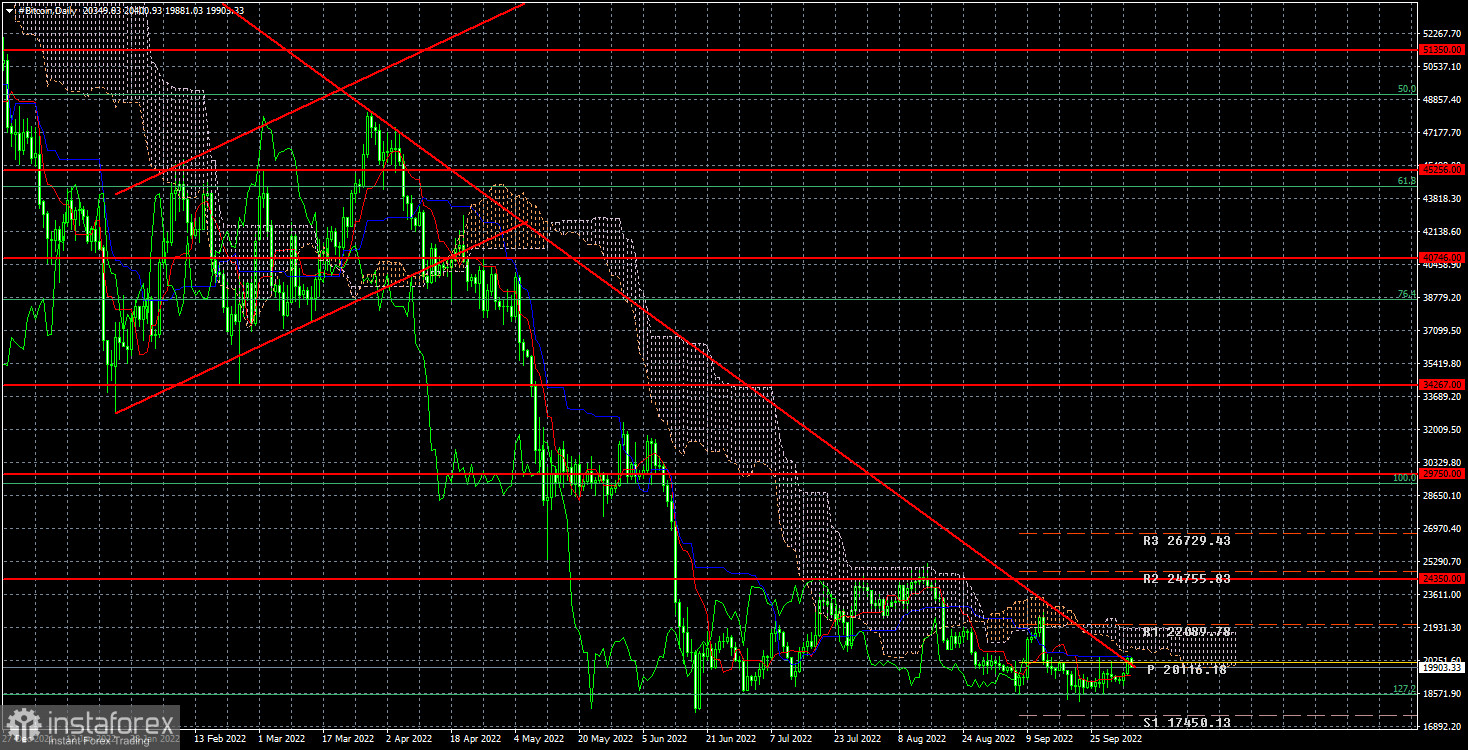

Bitcoin has not shown any signs of life in the last few weeks. Many traders regarded yesterday's growth as a new round in the rise of the first cryptocurrency in the world. However, it remains below the critical line and above the Fibonacci level of 127.2%. Inside the narrow side channel, it has spent the last three weeks. Moreover, the price has finally crossed the downward trend line, so now we have this collision and a collision with the critical line. Either bitcoin will overcome these two resistances (but at the same time will remain in the side channel of $ 18,500–$ 24,350) and can count on several thousand more dollars of growth, or a new round of falling back to $ 18,500 will begin.

Meanwhile, one of the most famous investors, Peter Schiff, a big fan of gold, accused the former CEO of Microstrategy, Michael Saylor, of "pumping" bitcoin. Recall that "pump" is an artificial acceleration of the value of an asset; it has actively begun to be used in the era of digital assets, which in themselves have no real value, so theoretically, they can be "dispersed" or "lowered" to any price value. This is what Schiff accused Saylor of through his Twitter. Saylor's company not only actively buys bitcoin coins (which means it is interested in the growth of the cryptocurrency), but also actively advertises certain cryptocurrency platforms, fueling interest in the asset itself. Schiff said that Saylor gets a lot of money for "pumping" cryptocurrencies, but at the same time, no one punishes him, for example, Kim Kardashian recently. Saylor replied via social networks that bitcoin is a commodity, not a security (Kim Kardashian was fined for overclocking the EthereumMax security, which is also a crypto asset, but the SEC considered it a security). The former head of Microstrategy compared bitcoin to steel, gold, or concrete and asked Schiff whether someone was fined for promoting and advertising these things. Schiff replied that bitcoin does not have any of the characteristics of a real commodity. Peter also said that bitcoin is not a protection against inflation and will not grow even when the Fed stops raising the rate.

In the 24-hour timeframe, the quotes of the "bitcoin" could not overcome the $ 24,350, but they also cannot yet overcome the $18,500 (127.2% Fibonacci). Thus, we have a side channel, and it is unknown how much time Bitcoin will spend on it. We recommend not rushing to open positions. It is much better to wait for the price to exit this channel and only then open the corresponding transactions. Overcoming the $18,500 level will open the way to the $12,426 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română