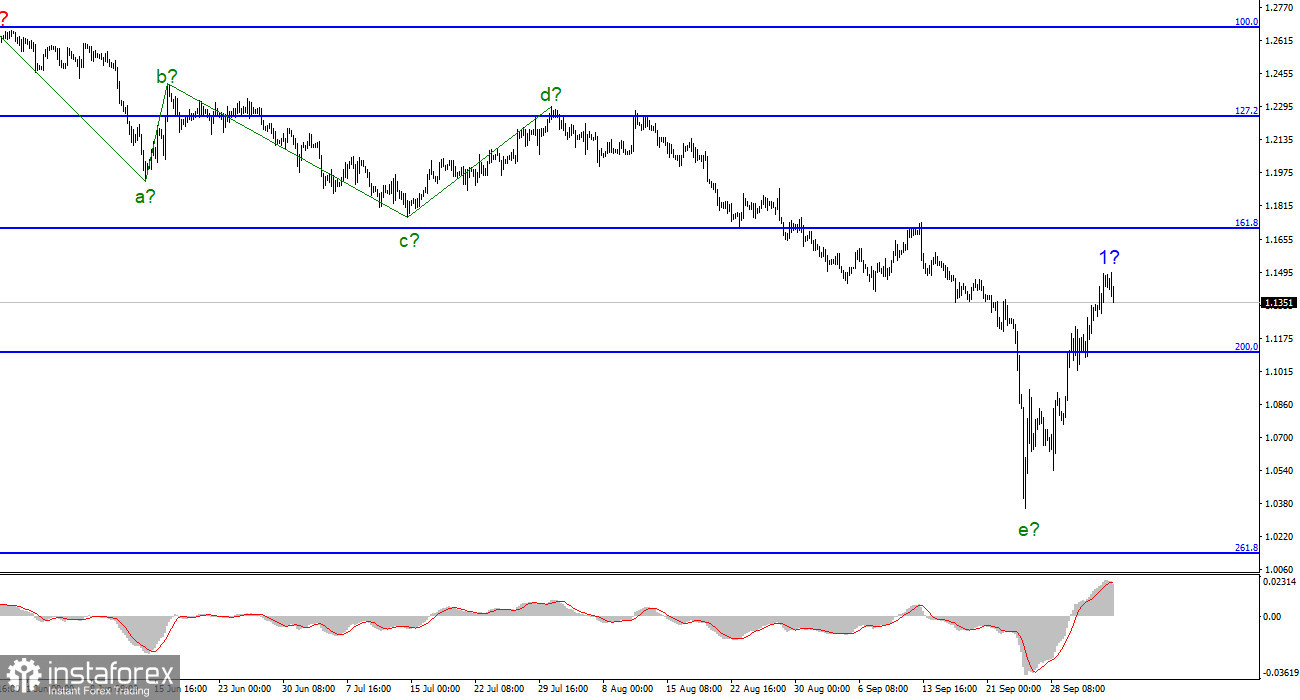

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. We have a supposedly completed downtrend segment consisting of five waves a-b-c-d-e. If this is true, the increase in quotes has begun and continues within the framework of wave 1 of a new upward trend segment. Unfortunately, there is no confidence in this particular scenario since the instrument must go beyond the peak of the last wave to show us its readiness to build an upward section of the trend and not complicate the downward one again. And the peak of the nearest wave is located around the 23rd figure. Thus, even after the pound has increased by 1000 points, you need to go up another 1000 points to reach this peak. This is a very significant distance. I understand that many have seen strong growth of the British dollar in a short time, so "hands itch" to open purchases. However, let me remind you that even if the upward section has started building now, we should see another downward correction wave (after completion of 1). If the quotes do not fall below the low wave e (which is very difficult but not impossible), then you can also expect to build a new upward wave 3 and buy.

American statistics are upsetting this week. Ahead are the Payrolls.

The exchange rate of the pound/dollar instrument decreased by 120 basis points on October 5. This distance cannot be called small, but it should be remembered that the market has been actively trading the British pound in the last two weeks. In the current reality, 120 points are not so much. In the last two weeks alone, the pound has grown by 1,000. The first two days of the week contributed to a further increase in demand for the British pound. American statistics turned out to be weak. The indices of business activity in the manufacturing sector continued to decline, and the number of open vacancies in the United States fell to 10.053 million in August. However, a month earlier, this figure was 11.17 million. There is a deterioration in the dynamics of the labor market. Let me remind you that at the end of August, the unemployment rate also increased, which has not happened for a long time. Some analysts immediately concluded that the Fed would be forced to "slow down" and stop aggressively raising the interest rate, but I think this is not the case.

Jerome Powell has repeatedly made it clear that inflation is the Fed's main goal for the coming years. At the moment, only two months have shown a decline in the consumer price index. In my opinion, this is an insignificant reduction, and the regulator is unlikely to abandon its plans to raise the rate by another 125 basis points in 2022. It seems to me that nothing will affect this plan, no matter what the figures on the labor market and unemployment are. The Fed expected that the labor market would shrink and GDP would fall. Therefore, a certain decline in the economy was included in the plan to stabilize inflation. At the same time, this plan could have already been worked out by the market. If so, then we are now witnessing the beginning of a new upward trend.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a new decline in demand for the pound. I advise now to sell the instrument, as before, on the MACD reversals "down." It is necessary to sell more cautiously since, despite a strong decline, a downward trend section could be constructed. There should be a decline in any case, as a corrective wave is needed. And this implies a reduction of the instrument by 300-400 basis points.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. The downward section of the trend can be almost any length, but it can also be completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română