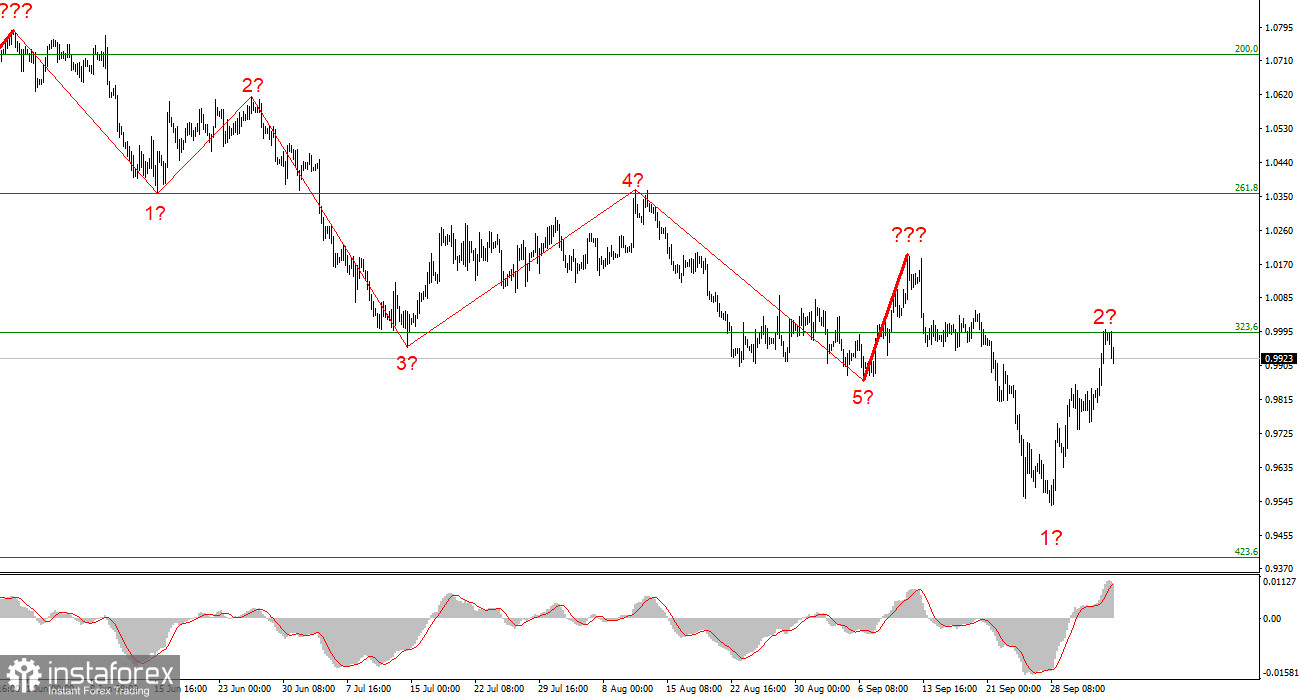

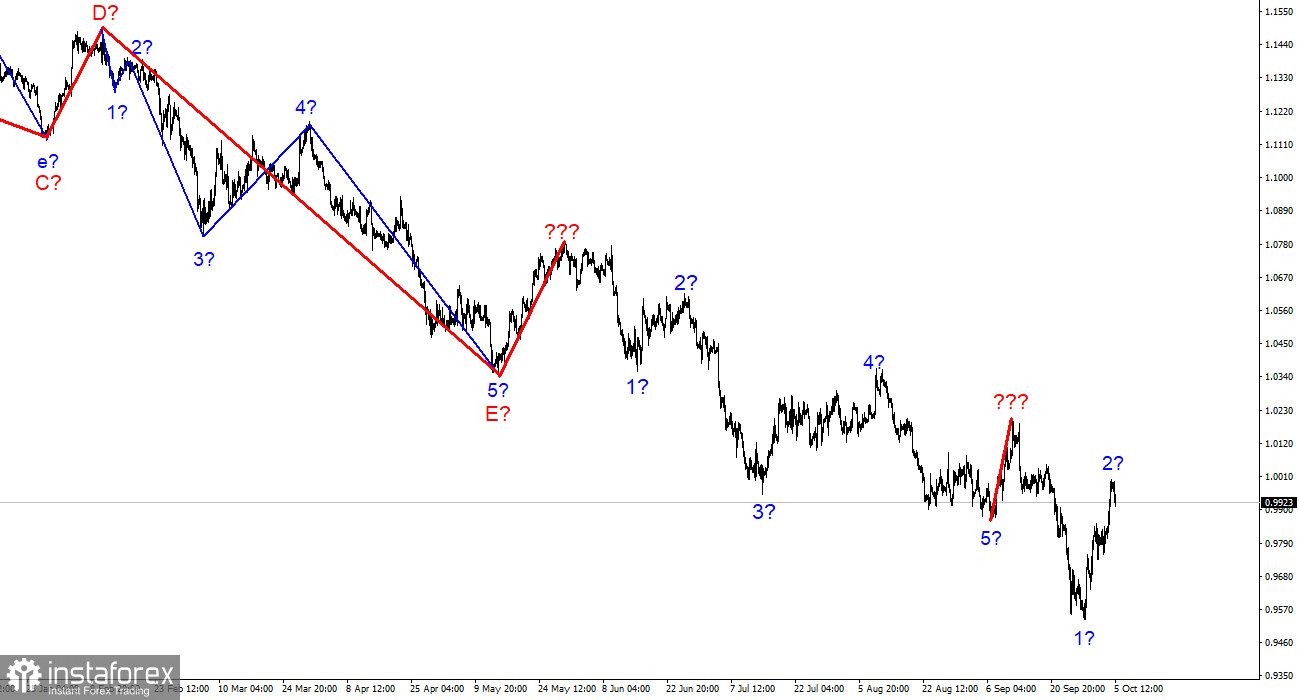

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may become more complicated than once in the future. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one correction wave upward, after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There is no question of any classical wave structure (5 trend waves, 3 correction waves) right now. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture of "a strong wave down - a weak corrective wave up." The goals of the downward trend segment, which has been complicated and lengthened many times, can be located up to 90 figures or even lower. At this time, a (presumably) corrective wave 2 of a new downward trend section may be being built.

Christine Lagarde spoke, but there was no market reaction.

The euro/dollar instrument fell by 60 basis points on Wednesday, although it rose by 170 a day earlier. An unsuccessful attempt to break through the 323.6% Fibonacci mark indicates that the market is not ready for new purchases of the euro currency. Near this mark, the construction of the current rising wave can be completed. And if this wave 2 is part of a new downward trend segment, then the instrument may drop to the 94th figure in the coming weeks and months. If the next attempt to break through the 0.9990 mark is successful, this, on the contrary, will indicate a high probability of completing the construction of a downward trend section.

Yesterday was quite interesting. In particular, Christine Lagarde's speech took place in the evening. The ECB President was laconic this time and noted only that the minimum task of the ECB is to limit demand, which stimulates inflation. Lagarde also noted that the peak values of inflation may still be ahead. These two statements were supposed to instill confidence in the markets that the European regulator would continue to raise the interest rate. However, does it matter now for the market? The demand for the European currency has been declining for a long time, even when the ECB has already started to raise the rate. From my point of view, the further growth of the European currency is in doubt. One way or another, a downward wave should be built now. If the trend's downward section is completed, it will be shallow and three-wave. Such a structure will make it possible to understand that we are facing a correction wave, not an impulse wave. In this case, the wave marking is transformed, considering the low of September 28, which will be the starting point for a new upward trend segment.

General conclusions.

Based on the analysis, I conclude that the construction of the downward trend section continues but can end at any time. At this time, the tool can build a corrective wave, so I advise selling with targets near the estimated 0.9397 mark, which equals 423.6% by Fibonacci, by MACD reversals "down." I urge caution, as it is unclear how much longer the decline in the euro currency will continue.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five–waves can be just completed, and a new one has begun its construction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română