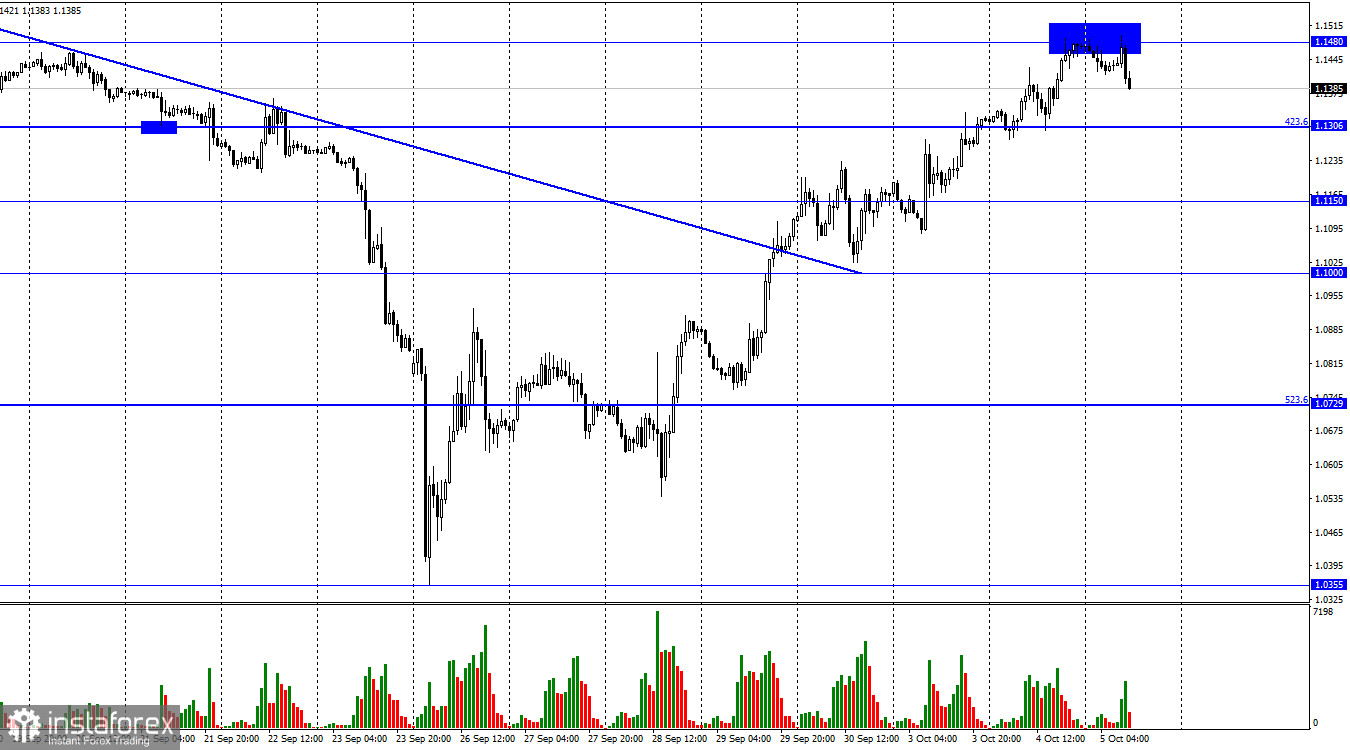

Good afternoon, dear traders! On the 1H chart, the GBP/USD pair rose to 1.1480. It bounced off twice from this level. The pound sterling weakened against the US dollar. For the first time in almost two weeks, the US currency may grow to 1.1306, the Fibo level of 423.6%. If so, it is sure to climb higher. If the greenback consolidates above 1.1480, it may reach 1.1684. The pound sterling is now drifting higher. The bears will have to try hard to regain control over the pair. The economic calendar for the UK is almost empty this week. The UK PMI Services Index was published today. It decreased to 50.0. The Composite Index fell to 49.1. Thus, the PMI indices continue to take a nosedive. The US and the EU are dealing with the same problem.

However, the most anticipated reports are on tap today in the afternoon as well as on Friday. The ADP National Employment Report, which tracks levels of nonfarm private employment in the US, has shown a drop for four months in a row. At the same time, the Nonfarm Payrolls report, which represents the number of new jobs created outside of the agricultural sector has remained stable. However, in August, the US unemployment rate rose to 3.7%. So, I believe that the situation in the labor market is deteriorating, judging by the dynamic of all three indicators. This is a normal reaction of the economy to the rate increases. Something similar may occur in the following months both in the European Union and in the UK. For this reason, the pound/dollar pair is unlikely to lose ground amid weak labor market data. However, bears may enter the market even if the report is positive. After the strong growth, a downward correction looks possible.

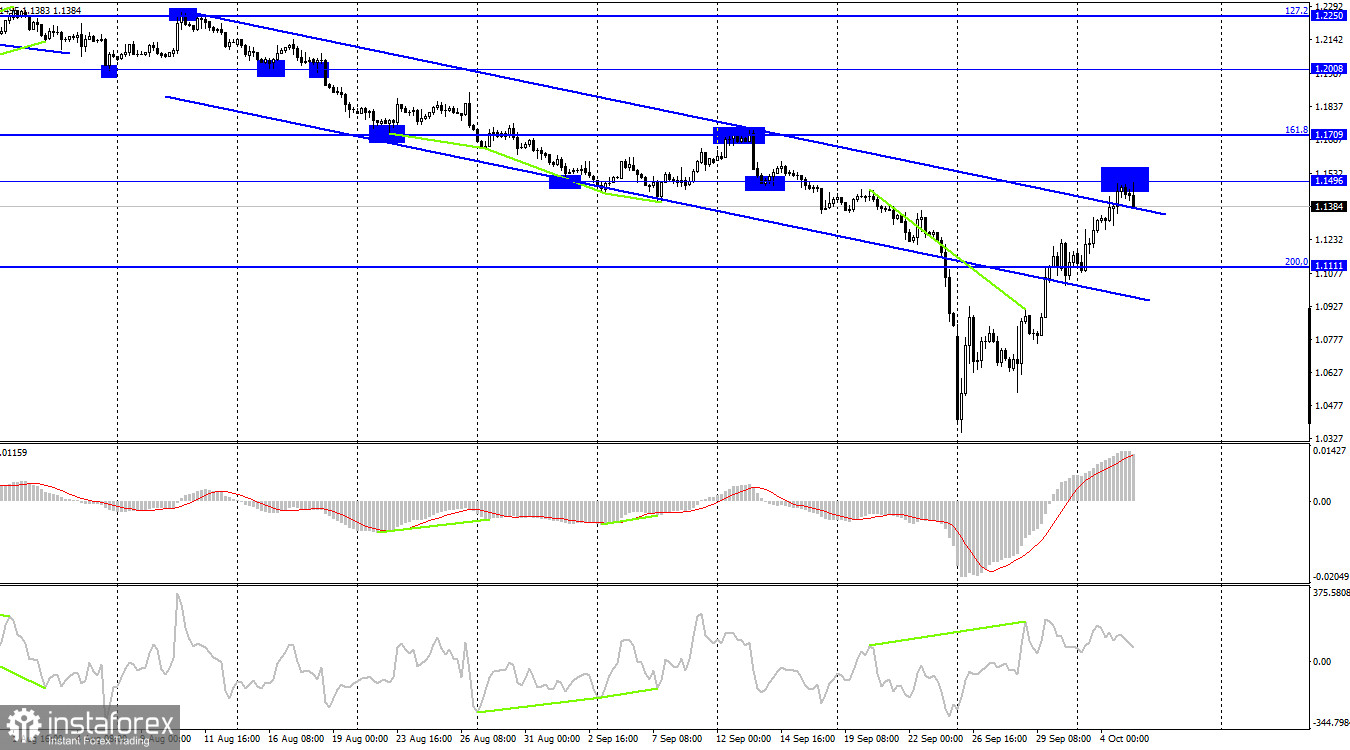

On the 4H chart, the pound/dollar pair climbed to 1.1496 and retreated from it. It may cause a downward reversal to the correction level of 1.1111, the Fibo level of 200.0%, despite the consolidation above the downward corridor. The pound sterling has risen too sharply. So, a slight drop is unlikely to undermine its rally.

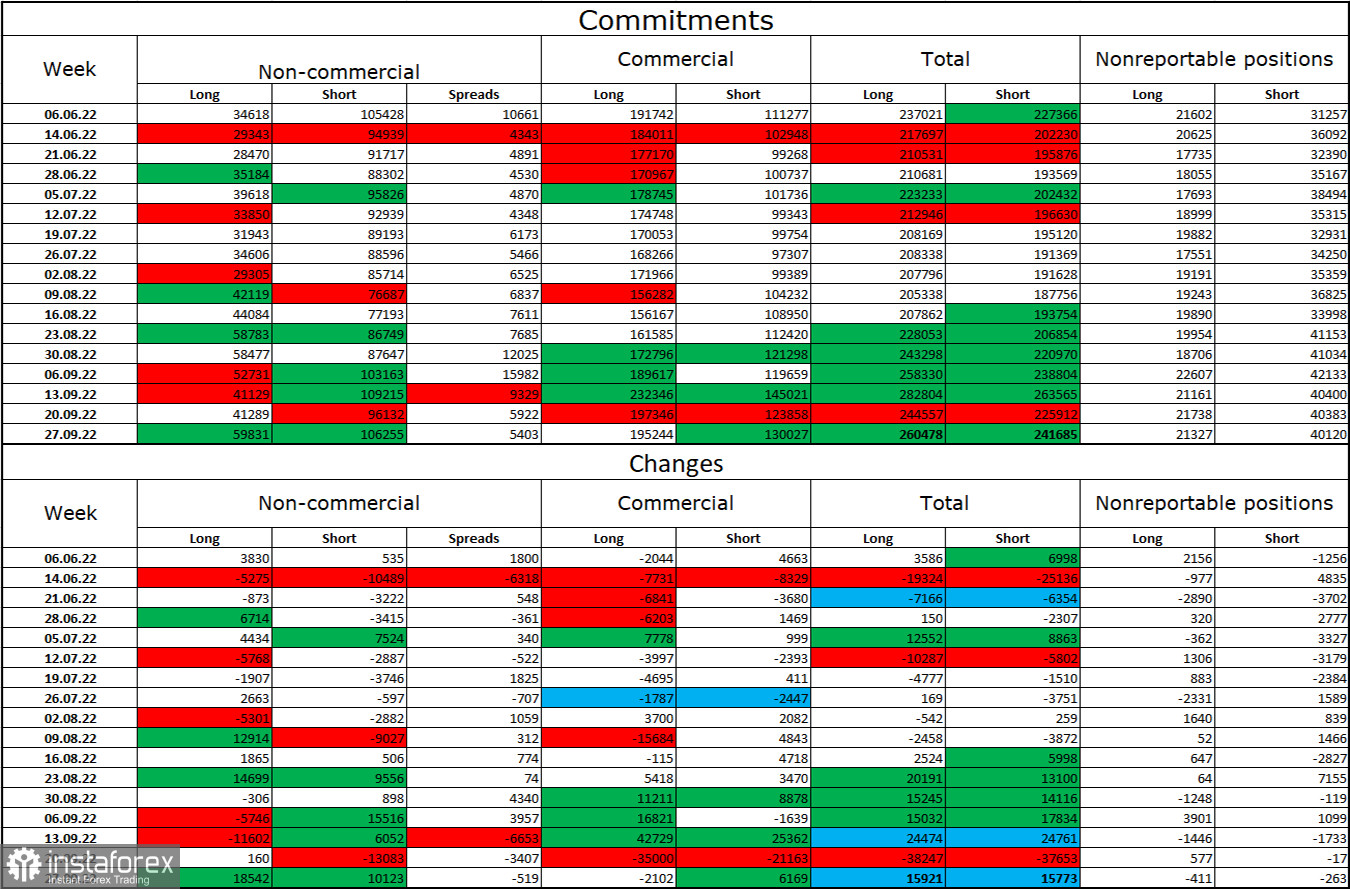

Commitments of Traders (COT):

The mood of the Non-commercial traders has become less bearish over the past week than a week earlier. The number of Long positions increased by 18,542, while the number of Short ones advanced by 10,123. The sentiment of large traders remains the same – bearish. The number of Short positions still significantly exceeds the number of Long ones. It means that large traders prefer short positions and their mood is slowly but surely turning bullish in recent months. The pound sterling may grow only if there are upbeat economic reports. Yet, there have been fewer positive reports recently. The total number of Long positions surpasses the number of Short ones. The overall sentiment is bullish. However, the pound sterling may lose ground rather quickly amid fresh negative reports.

Economic calendar for US and EU:

EU– PMI Services Index (08:00 UTC).

US – ADP Employment Change (12:15 UTC).

US – PMI Services Index (13:45 UTC).

US - ISM Services Index (14:00 UTC).

On Wednesday, the UK released only one report, which has already caused a slight drop in the British currency. The US is going to unveil its macro stats later. The impact of fundamental factors on market sentiment is likely to be moderate today.

Outlook for GBP/USD and trading recommendations:

It is recommended to open short positions at the target level of 1.1111 if it declines from 1.1496 on the 4H chart. It is better to open long positions if it consolidates above 1.1496 with the target level of 1.1709.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română