In recent weeks, the cryptocurrency market and Bitcoin have been in a protracted and boring sideways movement. Asset prices move within narrow ranges, limited by pessimistic sentiment in the markets. However, over the past few weeks, enough factors have appeared that indicate a cardinal change in the current macro trend.

Macroeconomic factors

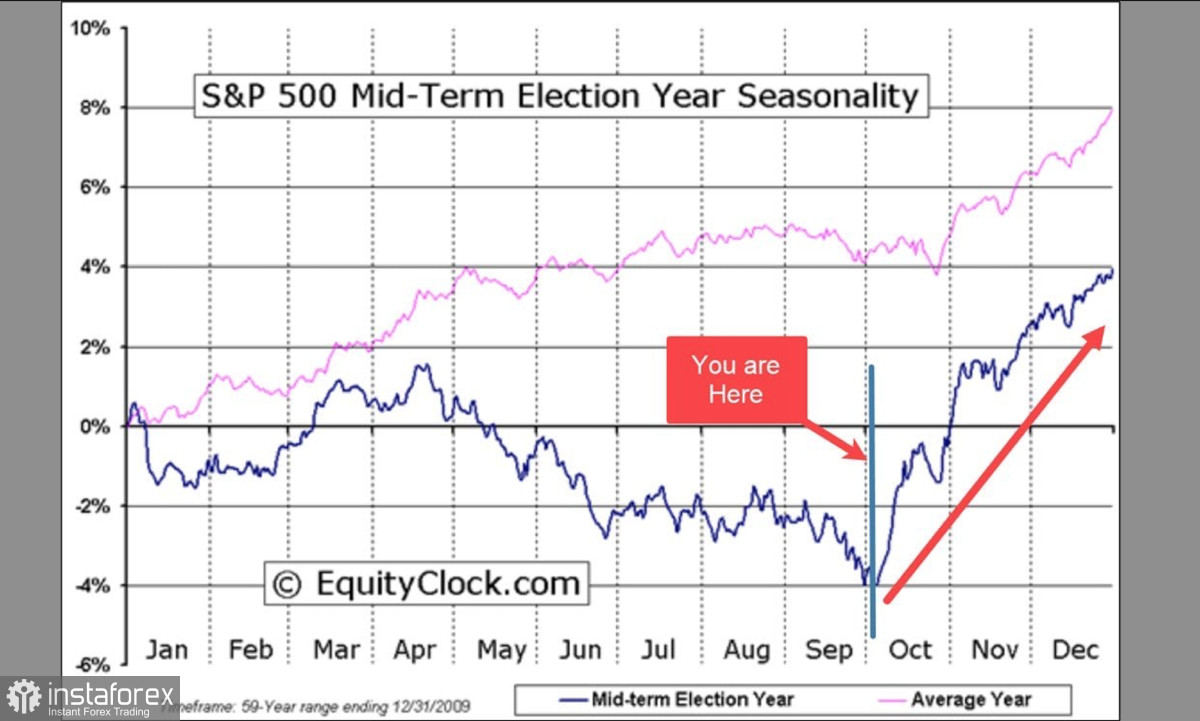

Despite the general lull, interesting and promising signals begin to emerge around the cryptocurrency market. October is historically a bullish month, with most assets making certain highs. The S&P 500 ended a bearish trend six times out of seventeen in October.

Macroeconomic news also points to preparations for a rally in the price of high-risk assets. The main asset of the last 8 months, the US dollar index, reached a 20-year high at 114 and is starting a correction.

At the same time, the UN turned to the Fed and other central banks with a request to stop the current monetary policy due to the deterioration of the overall economic situation. With the US holding congressional elections in November, a suspension or curtailment of aggressive policies looks likely.

Crypto Market Signals

The cryptocurrency market is actively responding to changes in the macroeconomic architecture. According to The Block, the total volume of trading on crypto exchanges increased by 16% in September after a month-long stagnation. In addition, CoinShares recorded a small influx of funds into crypto funds for the second week in a row.

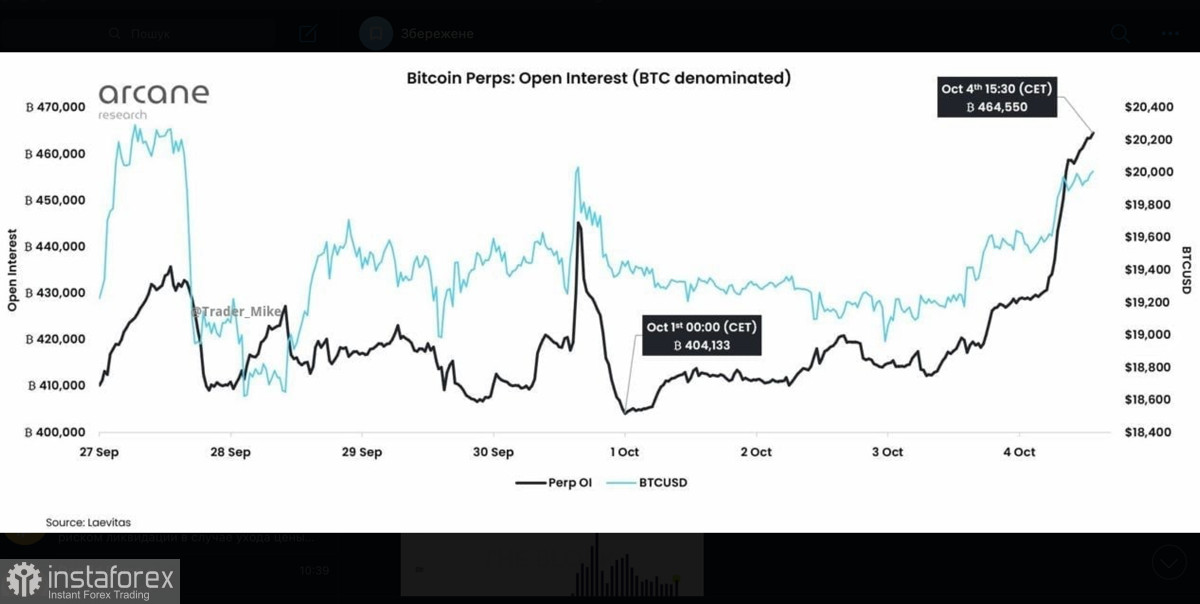

Arcane Research has published a study showing a significant increase in open interest in Bitcoin. Over the past four days, the indicator has risen by 60,000 BTC and reached its highest level since mid-summer. Large investors also continue to replenish their holdings: on September 30, an unknown address purchased more than 34,000 BTC.

BTC/USD Technical analysis

The technical picture of Bitcoin also shows positive signals. On the weekly chart, we are witnessing the formation of a bullish divergence. The price continues to remain in a narrow range with a downward direction. At the same time, the relative strength index shows clear bullish signals.

Bitcoin completed its consolidation below $19.5k and solidly settled above $20.2k. The cryptocurrency has come close to the downward trend line, which is the main resistance zone for the coin. If this area is broken, the asset opens the way to $23k.

Technical metrics on D1 show the weakness of the buyers, who lack volume for further upward movement. This may indicate an unsuccessful attempt to retest the $20.4k level, consolidation near this level, and a second retest of the resistance area.

Two outcomes

Given the growing positive on the market, we can assume that the $20.4k target will be conquered. However, as of October 5, we still haven't seen rising trading volumes in action. At the same time, social activity on BTC remains low, investors are not interested in the likelihood of a price rebound.

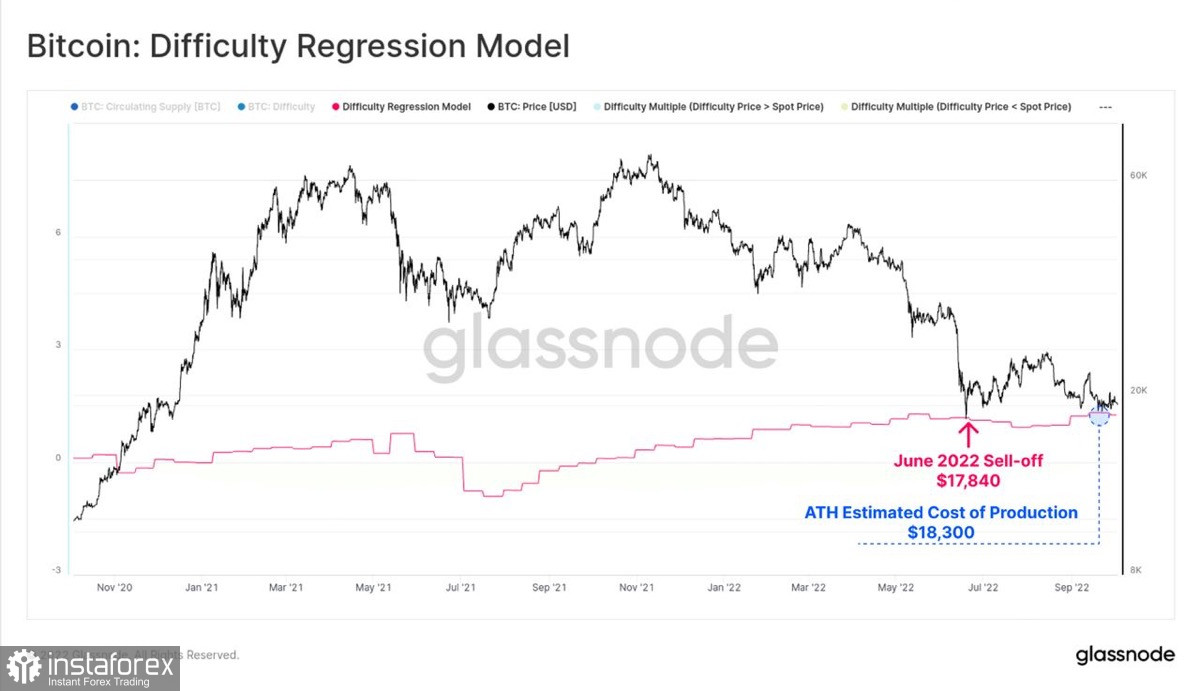

And in case of an unsuccessful assault on $20.4k, there is every reason to see the price fall below the $18.5k–$19.5k zone. According to Glassnode, if the price breaks this milestone, then there is a high probability of a cascading liquidation of more than 78,000 BTC. Given the difficult liquidity situation, there is no doubt that the big players will want to reap a significant Bitcoin harvest below $18.5k.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română