The actual data on manufacturing PMI in the US and the EU differed slightly from the estimates. Thus in the eurozone, the indicator was expected to drop to 48.5 from 49.6 but the actual decline was to 48.4. Meanwhile, in the US, the indicator advanced to 52.0 from 51.5 which exceeded the forecast of 51.8. Still, the European currency posted small gains thanks to the rapid rise in the British pound. The latter came after Liz Truss abandoned her plan to cut taxes for the wealthy and confirmed her intention to review the previously presented stimulus plan. The manufacturing PMI in the UK went up to 48.4 from 47.3, a bit below the estimated level of 48.5. So, just like in the eurozone, the actual reading came in a bit worse than expected.

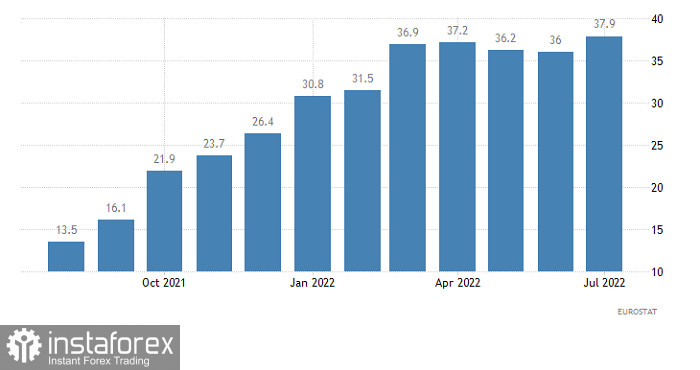

On Tuesday, the euro has a good chance to regain ground on a positive PPI report in the eurozone where the indicator is predicted to rise to 43.6% from 37.9%. At the same time, the recent inflation report indicated acceleration in consumer prices. Apparently, the PPI data will only support the intention of the ECB to increase rates. It seems that the European regulator has no other choice but to tighten monetary policy at a fast pace. So, interest rates in the EU are set to rise at least until next spring. On the other hand, the US Federal Reserve may slow down the pace of rate hikes until the end of this year. It is also possible that next spring, the US regulator may announce the first rate cut. If so, interest rates in Europe may turn out to be higher than in the US. This prospect will give the euro strength to grow further and may encourage the British pound to rise as well. So, today, the pound may show a more moderate advance compared to yesterday's session.

PPI (Europe):

The euro slowed down its upward cycle against the US dollar near the level of 0.9850. This resulted in a fluctuation range of 100 pips which still indicates that the market stays bullish. A firm hold above 0.9850 on the 4-hour chart will extend the current correction and may push the price towards the parity level. Otherwise, the existing trend will continue.

GBP/USD continued to develop a correction from the local low in the course of a strong upside movement. This brought the quotes to the level of 1.1410. Despite a rapid change in the price, buyers still have strong upside potential. In case the price settles firmly above the 1.1410 level on the 4-hour time frame, the correction may go on. Until then, traders will count on a rebound from 1.1410.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română