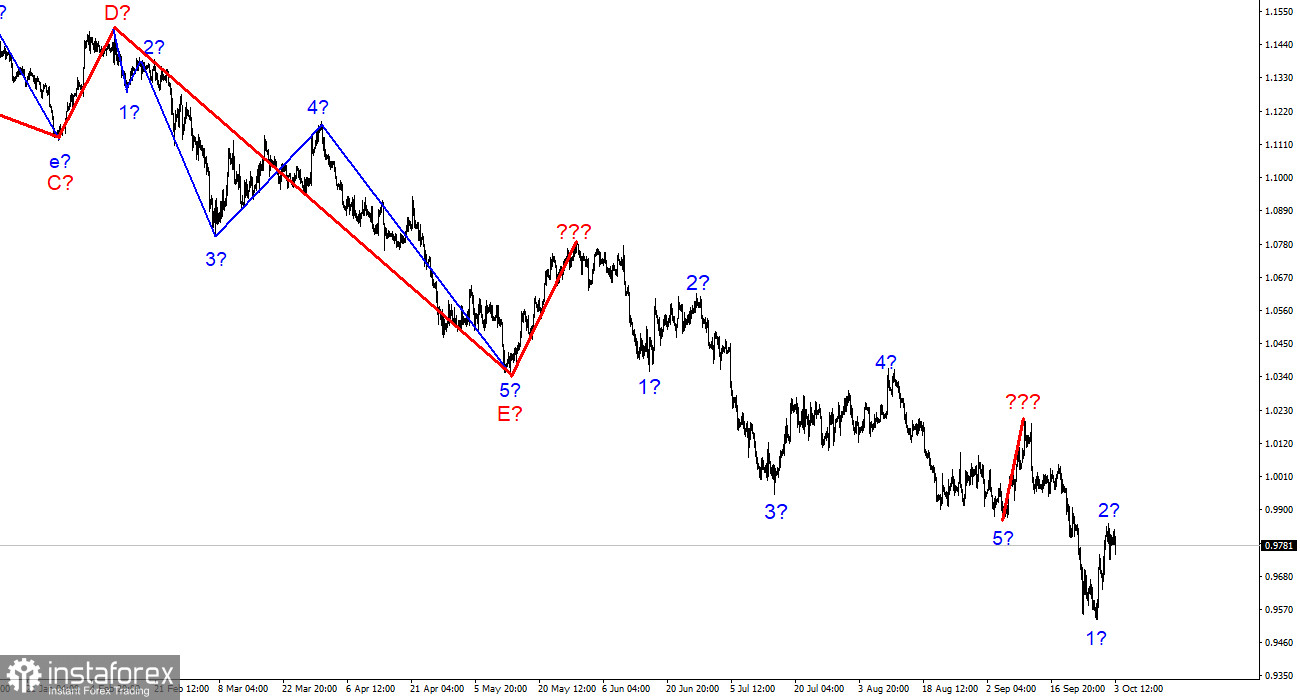

On the 4-hour chart, the wave structure of EUR/USD is getting more complex but does not require any adjustments. A new five-wave impulsive bearish pattern formed. It was followed by a corrective wave, and the price then tested the low of wave 5. Notably, a similar situation took place five months ago when a bullish wave and five bearish waves emerged after the completion of the 5-wave descending structure. Right now, it is definitely not the case of a traditional wave structure consisting of five trend waves and three corrective waves. Due to the current fundamental background, the market is reluctant to build even simple waves. Therefore, we can barely forecast how the downtrend section will end. In fact, a situation where a strong bearish wave is followed by a weak corrective bullish wave could last for quite a while. The targets of the descending section that has become more complex and prolonged could stand all the way to the round level of 0.90 and even lower. In fact, the corrective wave 2 of the new downtrend section may well be in the process of building up (or has already been completed).

The European Union could face natural gas shortages this winter.

On Monday, EUR/USD trades mostly sideways. At the moment of writing, the current price of the asset is in line with its open price. In other words, demand for the euro stopped growing, which could result in the completion of the supposed wave 2. We have repeatedly underlined that waves may now alternate quite chaotically because market sentiment is now weighing on the fundamental background. Overall, there have been no important fundamentals lately, which could drive the euro, apart from the aggressive ECB.

Last week, the European Union faced yet another problem, namely explosions that damaged the Nord Stream pipeline. They are now investigating who may be behind this act of sabotage. In the meantime, the EU stopped receiving natural gas via the pipeline, which is harmful to the ras-reliant industry. The euro is still in demand and gas prices are so far stable. However, it remains to be seen how it will affect gas supplies to the EU this winter. Many experts say gas storage facilities in the region are 80% full. However, for some reason, nobody says anything about how long gas would last if the reserves were even 100% full. Of course, they can buy gas elsewhere but it is obvious that the pace of deliveries would drop significantly, and transportation costs would increase. In this light, many more bearish waves could form on the chart.

Final thoughts

The formation of the downtrend segment goes on but may be completed at any time. A corrective wave could be in the process of building up. So, selling could be considered with targets near the 423.6% Fibonacci retracement of 0.9397, as the MACD has reversed to the downside. Still, it is important to trade cautiously, as it is not clear for how long the downtrend in the euro will last.

In the higher time frame, the downtrend wave section is getting more complex and prolonged. Therefore, it would be wiser to work with three and five-wave standard structures for now. One of such five-waves patterns may be already completed, and the construction of a new one may have just begun.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română