The implementation of the UK emergency plan aimed at the country's economic support got stuck due to numerous disagreements and criticism within the Conservative Party. That is why the market switched to other events at least for some time.

As a result, the pound/dollar pair increased on Thursday. Investors learnt the eurozone inflation forecasts and became worried about the disparity between the key interest rates of the ECB and the Fed. The fact is that next year, it may not only narrow but disappear at all since the ECB's benchmark rate may exceed the one in the US. Thus, the pound sterling was gaining in value thanks to the euro. Meanwhile, the eurozone inflations surged more than expected to a new all-time high of 10.0%. Notably, the greenback did not drop. Firstly, it considerably depreciated a day before that. Secondly, on Friday, all eyes were turned to Vladimir Putin's speech and the ceremony for signing the treaties on the accession of four more regions to the Russian Federation. Just before that, everyone was focused on the speech provided by NATO Secretary General Jens Stoltenberg. Most people were concerned that Jens Stoltenberg would make loud and extremely bellicose statements. However, the situation turned out to be better than expected.

The secretary general of NATO said that NATO's entry into the conflict in Ukraine was out of the question at least at that moment. However, that was enough to cap the rise in both the euro and the pound sterling. Nevertheless, the market remained at the levels recorded on Thursday. In other words, the growth in the eurozone inflation prevented the euro and the pound sterling from a decline regardless of rising tension in Europe.

It is quite possible that the market will continue hovering at the current levels. The final data on the manufacturing PMI will hardly make it move. The data should just confirm the preliminary estimate, which is already priced in. Thus, only news about Liz Truss' economic plan may affect the market. If the prime minister continues to insist on the implementation of the current plan without adjustments, the situation may balloon into a real political crisis. Notably, the UK elected a new prime minister not so long ago as its predecessor was removed from office because of a political scandal. In this light, the pound sterling has limited opportunities to rise.

The pound/dollar pair closed the previous trading week with a sideways movement within the range of more than 200 pips.

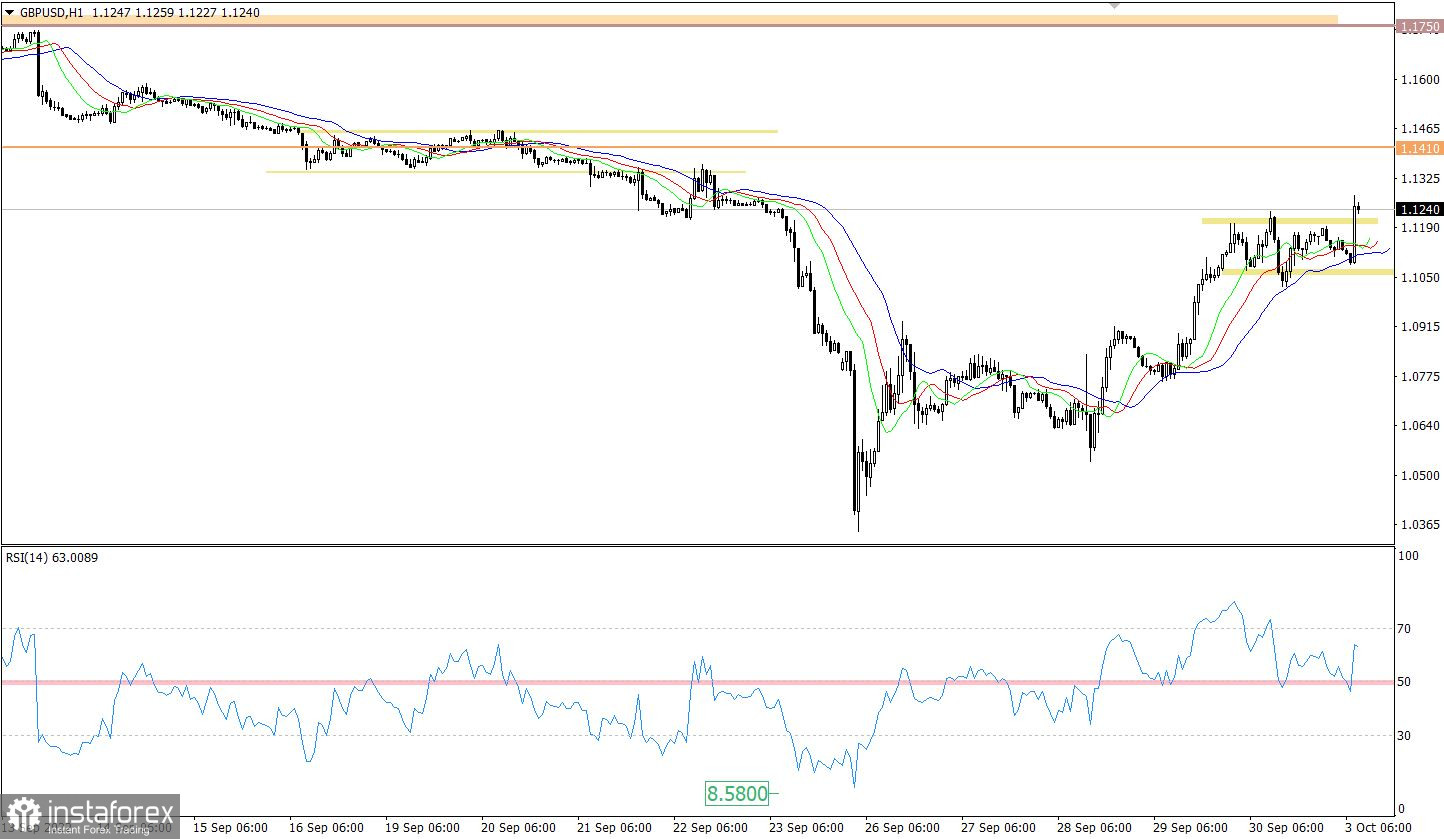

On the one-hour chart, the RSI technical indicator is moving along the middle line 50, which corresponds to the sideways movement. On the four-hour chart, the indicator is moving in the upper area of 50/70, thus pointing to the mainly bullish sentiment among traders. On the daily chart, the RSI is still hovering in the lower area of 30/50. However, judging by the magnitude of the correctional movement, the alternative signal may appear soon.

On the four-hour chart, the RSI MAs are headed upward, which corresponds to the correctional movement. On the daily chart, the indicator is pointing to a global downtrend. There are no intersections between the MAs.

Outlook

At the beginning of the new trading week, the pair upwardly broke the sideways channel. The jump occurred amid high speculative activity, which led to an inertial movement of more than 180 pips.

If the price consolidates above last week's high, the pound sterling may advance towards such levels as 1.1410 and 1.1750. Otherwise, the price will return to the earlier broken range of 1.1050/1.1200.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, the indicator is providing buy signals amid a rapid upward movement. In the mid-term period, the indicator is still pointing to a downtrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română