Analysis of Wednesday's deals:

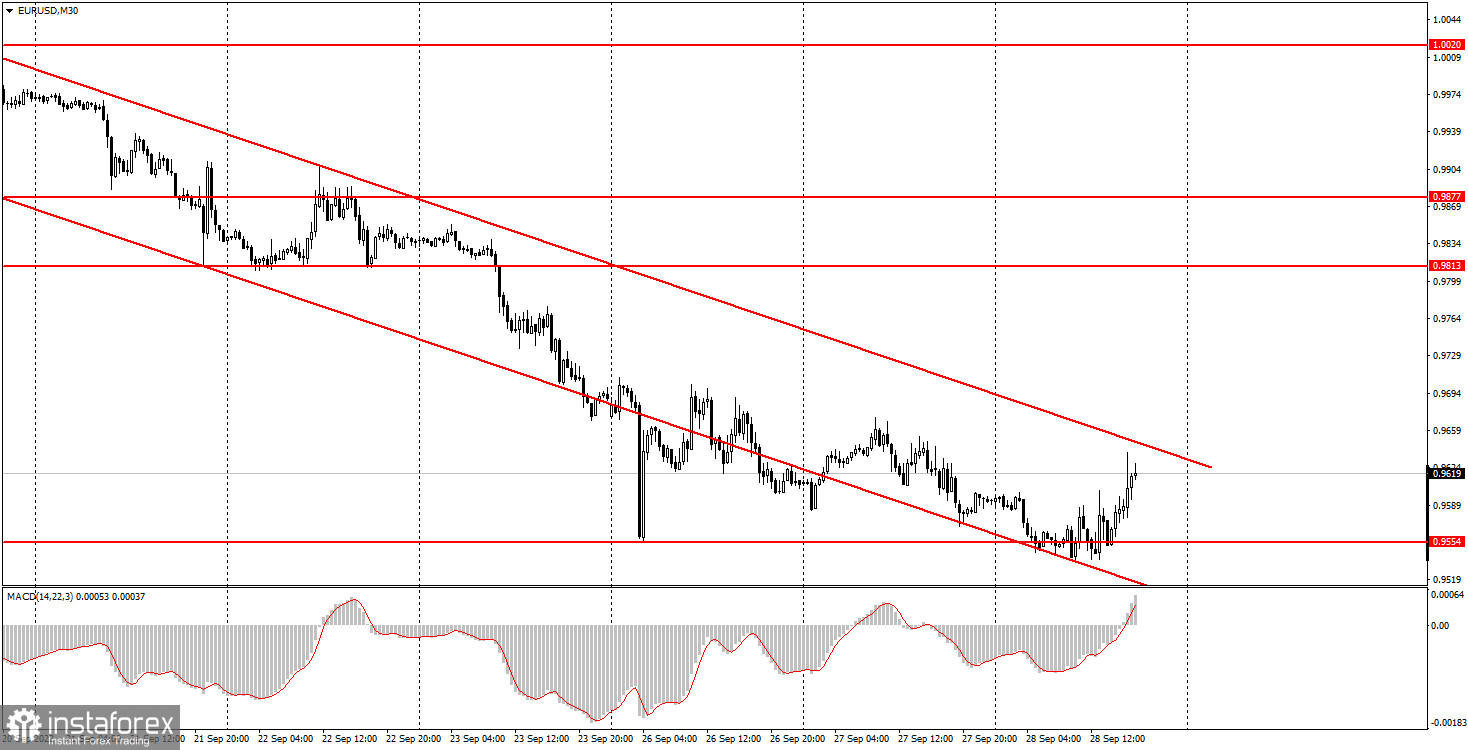

30M chart of the EUR/USD pair

The EUR/USD currency pair managed to do everything on Wednesday. First, it has once again updated its 20-year lows. Secondly, it corrected slightly during the day. Of course, this correction is quite formal, since the price has only moved away from its lows by 90 points. What is 90 points? It's one day. It is hardly possible to judge from one day that a correction has begun and now the price will not move down for at least some time. There was absolutely nothing to take note of from Wednesday's macroeconomic events. There was not a single important report or publication. But European Central Bank President Christine Lagarde delivered her speech for the third consecutive day. The rhetoric, however, did not differ from the first two speeches. And in general, if you look now, without knowing the name of the speaker, at the statements made by Lagarde and Federal Reserve Chairman Jerome Powell, then they can easily be confused, because they say the same thing: rates will continue to rise, inflation is still high, the economy will be "cool". However, both the ECB and the Fed are already raising rates, and not just the Fed, as it was before. And only the US dollar is growing anyway. At the moment, the pair is near the upper border of the descending channel, from which a rebound may follow. Such a rebound could provoke a new round of downward movement, which is not surprising at all.

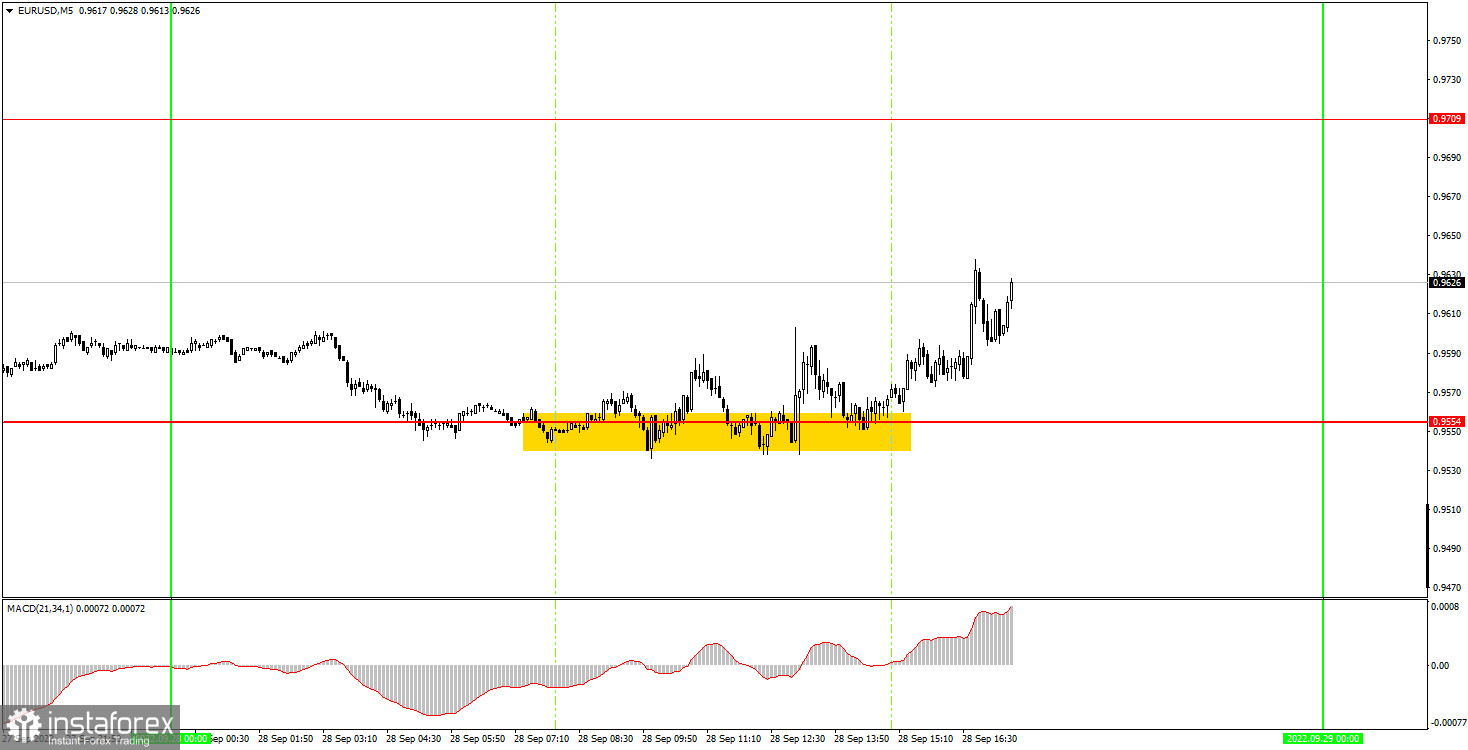

5M chart of the EUR/USD pair

Several trading signals were formed on the 5-minute timeframe on Wednesday, but it would be better if they were not. Let's start with the fact that the bears faced a rather strong barrier in the face of the level of 0.9554 and failed to overcome it. There were several attempts and each time the price went 10-15 points below the designated level. You could interpret these "false breakouts" as sell signals. However, already after the first two signals (one of which is for short positions, and the second for longs), beginners had to stop trading near this level, since all the signals, except for the last one, turned out to be false. Therefore, novice traders could get a small loss on Wednesday, but the nature of the pair's movement during the day did not suggest otherwise. The movements were ragged and "flat".

How to trade on Thursday:

The downward movement actually continues on the 30-minute timeframe. The minimum upward pullback that we had the honor to observe today can, of course, develop into something more, but this requires at least a consolidation above the descending channel. Therefore, small and cautious longs can be considered after that. In general, we believe that the euro may continue to fall for a long time. At least a couple of weeks. On the 5-minute TF on Thursday it is recommended to trade at the levels of 0.9554, 0.9709, 0.9813, 0.9877, 0.9910. When passing 15 points in the right direction, you should set Stop Loss to breakeven. The European Union will host several speeches by members of the ECB, and there will also be several speeches by members of the Fed in the US. We do not consider it possible to keep track of each speech, especially since they overlap in time. From the reports, we can highlight the report on GDP in the US for the second quarter, but this is the final value, which is unlikely to differ from the previous ones.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română