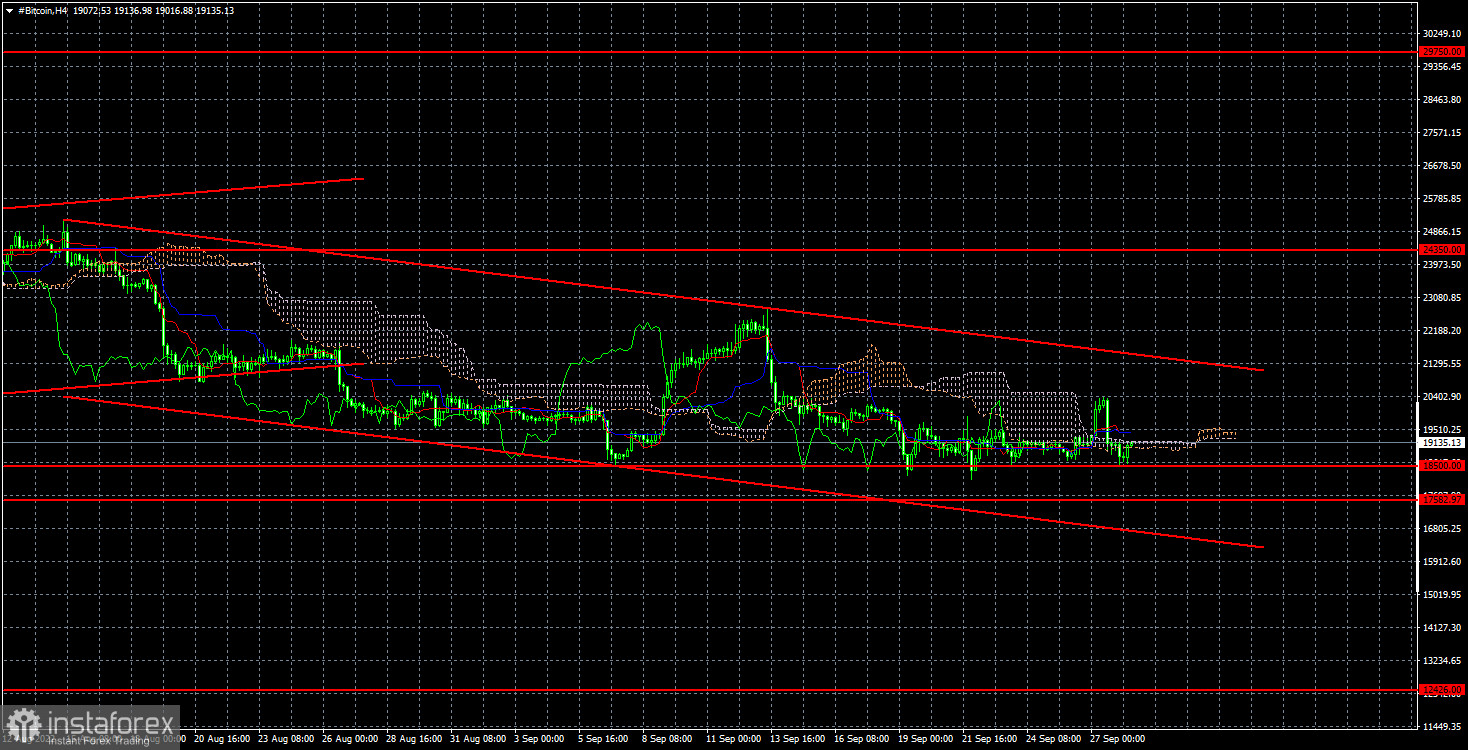

On the 4-hour TF, it is even better to see that recently, bitcoin has been moving exclusively sideways, with minimal volatility and exactly along the $18,500 level. At the same time, there is also a fairly solid descending channel on the 4-hour timeframe, which will put pressure on the cryptocurrency. We have already said that the side and trend channels/lines contradict each other. It cannot be that both a trend and a flat are observed at the same time. However, for a certain amount of time, they can coexist with each other without conflict. This is the picture we see now on the 24-hour TF, the same picture on the 4-hour. Sooner or later, the upper line of the channel will fall to the level of $ 18,500 and then either the quotes will consolidate above the channel or below the level of $ 18,500. Therefore, the "X hour" may come soon. Bitcoin can't trade sideways forever now.

In the last article, we discussed that the fundamental background remains negative for the cryptocurrency market. This can include the "hawkish" rhetoric of the heads of the Bank of England, the ECB, and the Fed. It can also be attributed to the continuing deterioration of geopolitics or panic in the foreign exchange market. Rates on government bonds in many countries worldwide are rising or remain at a high level. And the increase in yield rates means the demand for this type of security is low.

Consequently, investors still do not want securities with a yield of 3–5% if inflation is 10% simultaneously. Of course, these securities are long-term, but who says that inflation will quickly return to 2%? Moreover, it hardly makes sense to think even a month ahead in such difficult times. The world may face war, another economic crisis may come, and the coronavirus pandemic has not gone away. It's just that news feeds are now busy covering other news. Thus, the demand for treasury bonds is not growing, the demand for stocks and indices is falling, and the cryptocurrency market is at a local "bottom."

One can, of course, ask the question, where does the money go in this case if bank deposits do not also cover inflation? We believe that various real estate objects, luxury items, and other valuables provoke even more significant inflation. And as for bitcoin, it can continue its decline since the factors that brought it to its current point remain relevant.

In the 4-hour timeframe, the "bitcoin" quotes completed an upward correction. We believe the decline will continue in the medium term, but we must wait for the price to consolidate below the $17,582-$18,500 area. If this happens, the first target for the fall will be the level of $ 12,426. The rebound from the level of $18,500 (or $17,582) can be used for small purchases, but be careful – we still have a strong downtrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română