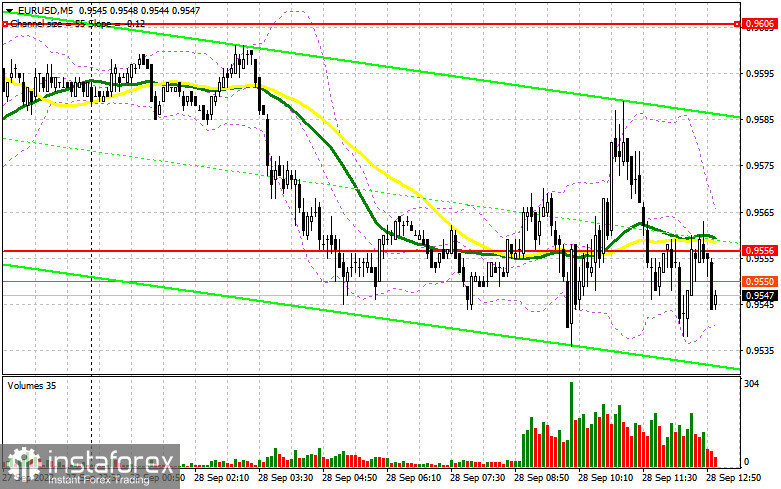

In the morning article, I turned your attention to the level of 0.9556 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and try to figure out what actually happened. Traders ignored the German macro stats as was the speech of ECB President Christine Lagarde. A rebound above 0.9556 at the beginning of European trading occurred without a downward test. So, the pair declined. In the afternoon, the technical outlook changed slightly.

Conditions for opening long positions on EUR/USD:

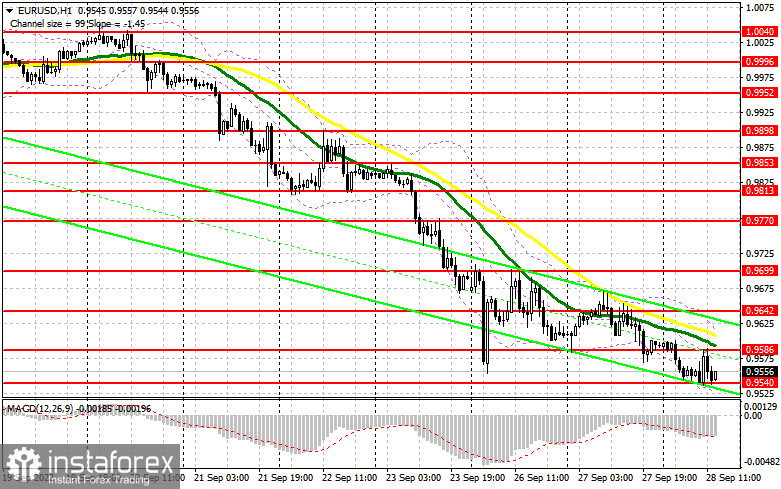

Traders are now more willing to buy the euro. However, it is rather risky given that geopolitical tensions may escalate at any moment. If so, relations between Russia and other countries will deteriorate sharply. During the American session, the US is going to unveil Trade Surplus and Pending Home Sales reports. Rafael Bostic and Jerome Powell are scheduled to deliver speeches. Judging by the hawkish remarks made on Monday, they are sure to voice strong commitment to further aggressive tightening. It is bullish for the US dollar. If the pair drops, it is better to open long positions against the trend after a false breakout of the support level of 0.9540, formed in the morning. It will give a good buy signal with the prospect of a rise to 0.9586. If demand for risk assets returns, the pair could climb above this level and perform a downward test. If so, bears will be unable to take control over the pair. It will provide a buy signal. The price is sure to advance to 0.9642. A more target will be the 0.9699 level where I recommend locking in profits. If EUR/USD dips after Fed policymakers' hawkish statements, the breakout of new yearly lows and bulls show no activity at 0.9540, the pair will quickly slide down to the next support level of 0.9490. At this level, it would be appropriate to open long positions only on a false breakout occurs. You can open long positions on EUR/USD immediately at a bounce from a yearly low of 0.9439 or 0.9392, keeping in mind an upward intraday correction of 30-35 pips.

Conditions for opening short positions on EUR/USD:

Sellers have failed to regain the upper hand. They were unable to push the pair below a yearly low. Given that large traders are now testing the waters, the pair could grow sharply in the near future. For this reason, the main task of sellers today is to protect the resistance level of 0.9586. If the US publishes strong data, they are likely to succeed. A false breakout of 0.9586 will give a sell signal with the prospect of a decrease to 0.9540, the level formed in the first half of the day. The moving averages are also moving around 0.9586. It significantly impacts the trajectory of the pair. Bears and bulls are unlikely to tussle for 0.9540 after a repeat test. Everything will depend on the US fresh reports. Strong data will help bears regain ground. A drop below 0.9540 will increase pressure on the euro. An upward test will generate an additional sell signal. Bulls will be forced to close Stop Loss orders. The pair could fall to a low of 0.9490. A more distant target will be the support level of 0.9434 where I recommend locking in profits. If EUR/USD advances during the US session and bears show no energy at 0.9586, the pair is likely to start an upward correction to 0.9642. I advise you to open short positions only a false breakout takes place. It will give a new sell signal. You can sell EUR/USD immediately at a bounce from a high of 0.9699 or 0.9770, keeping in mind a downward intraday correction of 30-35 pips.

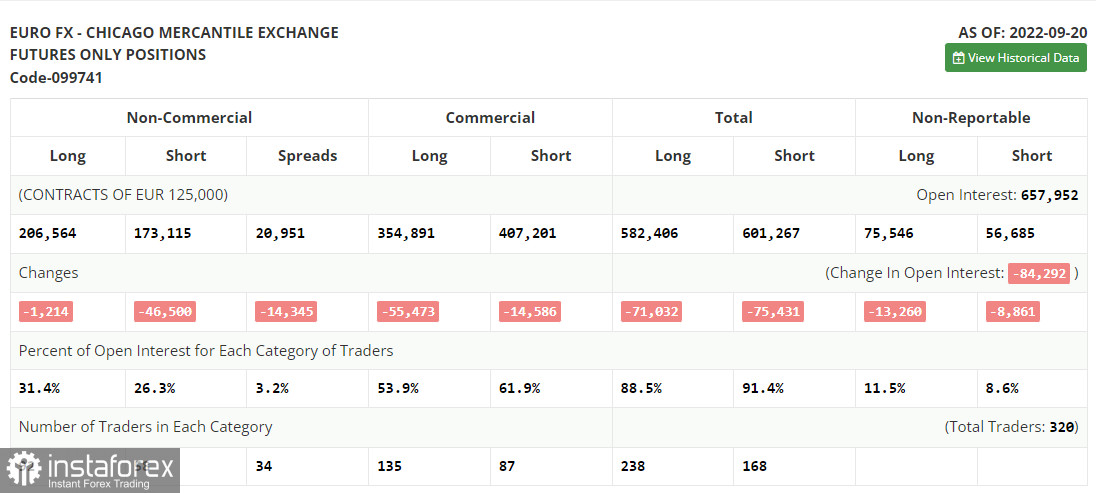

COT report

The COT report for September 20 logged a drop in both long and short positions. The data reflects the ECB's meeting in September and a sharp rise in the key interest rate of 0.75%. However, the Fed's meeting took place a bit later and failed to affect the report. Notably, the Federal Reserve also raised the benchmark rate by 75 basis points and maintained the gap between the interest rates of the central banks. As a result, pressure on the euro increased. In general, the current economic situation in the eurozone is affecting the euro, which has already dropped to 0.95 and has no reason to recover. A worsening geopolitical situation in the world has a significant influence on the eurozone. It may greatly slacken the European economy in autumn and winter. Against the backdrop, the economy may slip into recession as early as spring of 2023. That is why in the mid-term, the euro will hardly gain in value. Even though the US publishes weak fundamental data, investors will still prefer safe-haven assets, including the greenback. The COT report unveiled that the number of long non-commercial positions dropped by 1,214 to 206,564, whereas the number of short non-commercial positions slumped by 46,500 to 173,115. At the end of the week, the total non-commercial net position became positive and increased from -11,832 to 33,449. This indicates that investors have benefited from the situation and continued to buy the cheap euro, thus accumulating long positions. They hope that the crisis will end soon. The weekly closing price rose to 1.0035 from 0.9980.

Signals of technical indicators

Moving averages

EUR/USD is trading below 30- and 50-period moving averages, indicating a further drop in the pair. Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

If EUR/USD grows, the indictor's upper border at 0.9620 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română