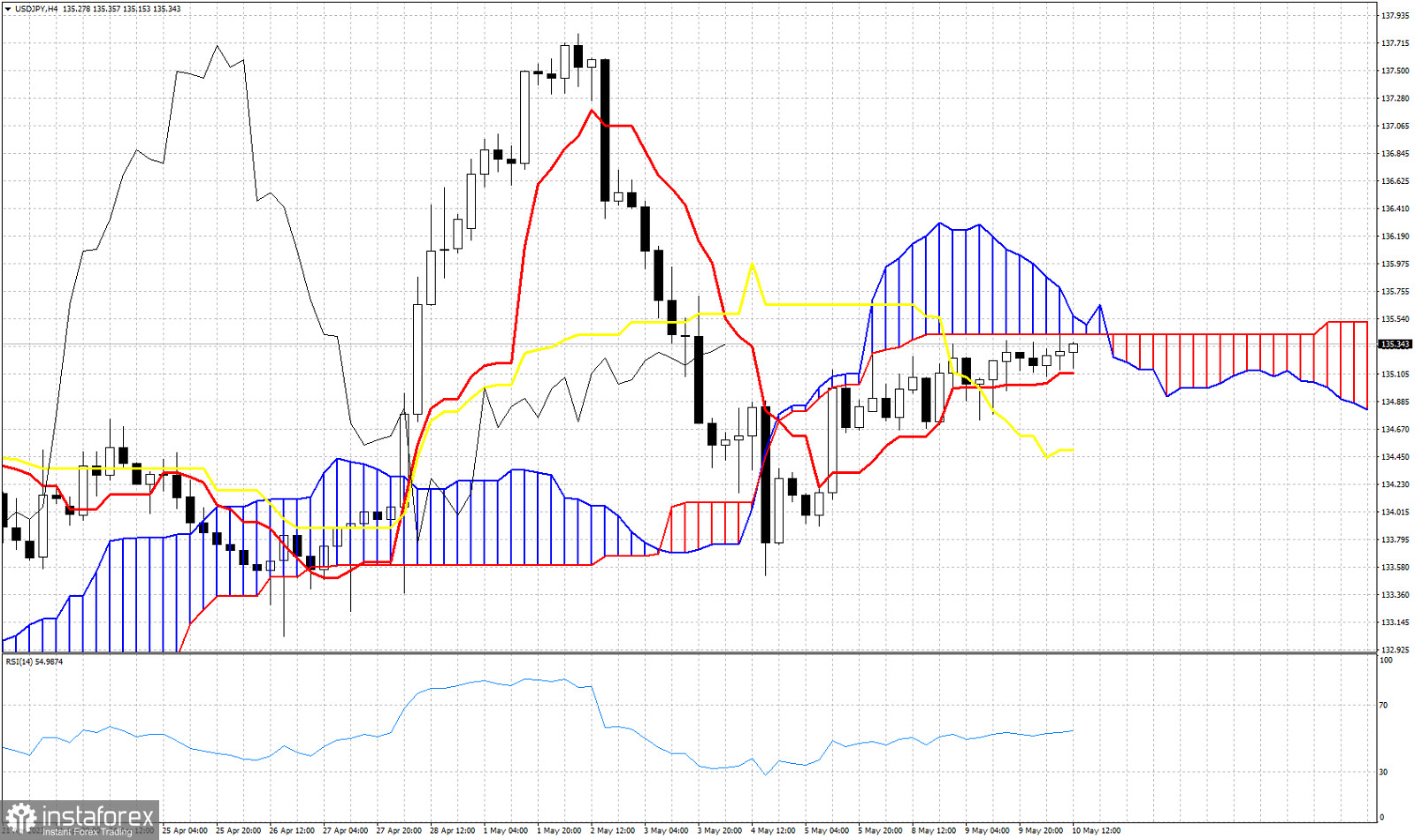

USDJPY is in a bearish trend according to the Ichimoku cloud indicator in the 4 hour chart. Price remains below the Kumo (cloud) and is vulnerable to a move lower. With price currently trading at 135.35, a rejection at the cloud resistance would be a bearish sign. A rejection at the cloud resistance will bring a pull back at least towards the kijun-sen (yellow line indicator) at 134.48. This is the short-term support according to the Ichimoku cloud indicator. The Chikou span (black line indicator) is trading above the candlestick pattern (bullish), but this is not a strong indication as long as price is below the cloud. If price breaks above the cloud and the chikou span remains above the candlestick pattern, then it will have a stronger significance.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română