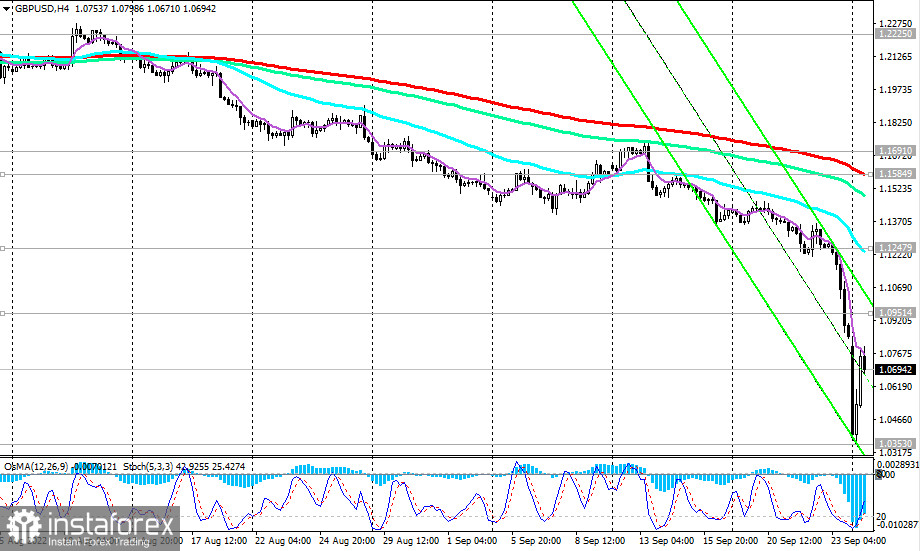

Strong bearish momentum continues to weigh on the GBP/USD pair. During today's Asian trading session, it reached a new local and record low for the last more than 37 years, dropping to 1.0353.

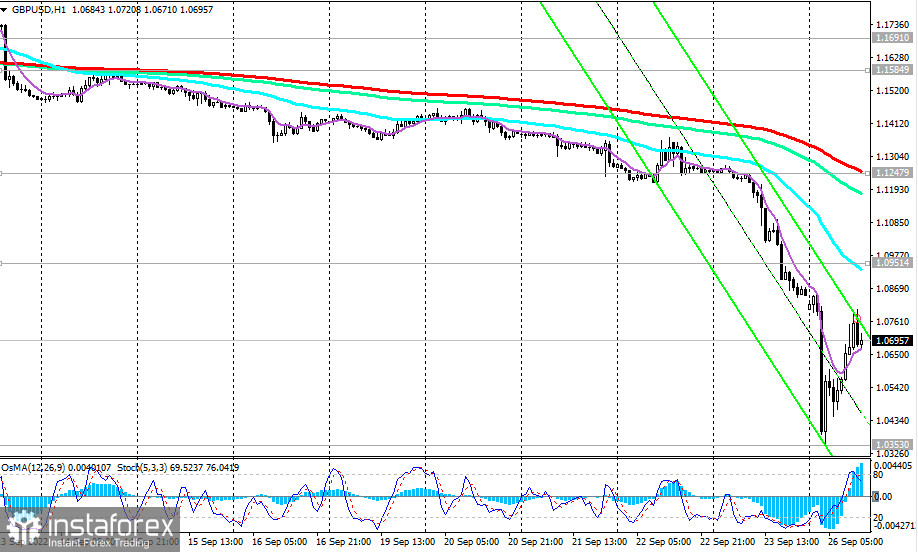

It's too early to talk about purchases yet. Such a relatively safe opportunity may appear only after the price manages to gain a foothold in the zone above the important short-term resistance level of 1.1247 (200 EMA on the 1-hour chart).

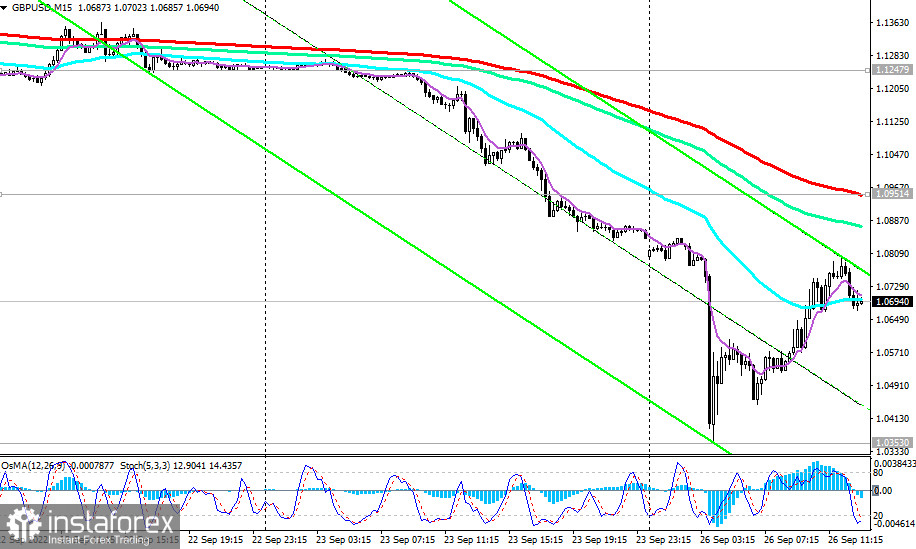

However, an earlier and more aggressive buy signal may appear after the breakout of the short-term resistance level 1.0951 (200 EMA on the 15-minute chart). Below these levels, it is better to stay on the sellers' side.

The price has already rolled back and reached the first resistance level 1.0735 (200 EMA on the 5-minute chart), from which short positions can be resumed. The first target is today's low at 1.0353. The next will depend on the situation.

In an alternative scenario, the breakdown of the resistance level 1.1247 may provoke further growth of GBP/USD, up to the resistance levels 1.1585 (200 EMA on the 4-hour chart), 1.1691 (50 EMA on the daily chart). Further growth looks unlikely so far, while the US dollar is at the highs of the last 20 years. In general, the downward dynamics of the GBP/USD remains, despite the current upward (and so far short-term) correction.

Thus, for now, short positions remain preferable. Below the key resistance levels 1.2225 (144 EMA on the daily chart), 1.2435 (200 EMA on the daily chart), GBP/USD remains in the long-term bearish market zone.

Support levels: 1.0700, 1.0600, 1.0500, 1.0400, 1.0353

Resistance levels: 1.0735, 1.0951, 1.1247, 1.1585, 1.1691, 1.2225, 1.2435

Trading Tips

Sell by market, Sell Limit 1.0950. Stop Loss 1.1010. Take-Profit 1.0700, 1.0600, 1.0500, 1.0400, 1.0353

Buy Stop 1.1250. Stop-Loss 1.1180. Take-Profit 1.1300, 1.1400, 1.1500, 1.1585, 1.1690

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română