European stock indices hit new yearly lows and the main index of the UK broke through its summer low amid a sell-off triggered by rising recession risks.

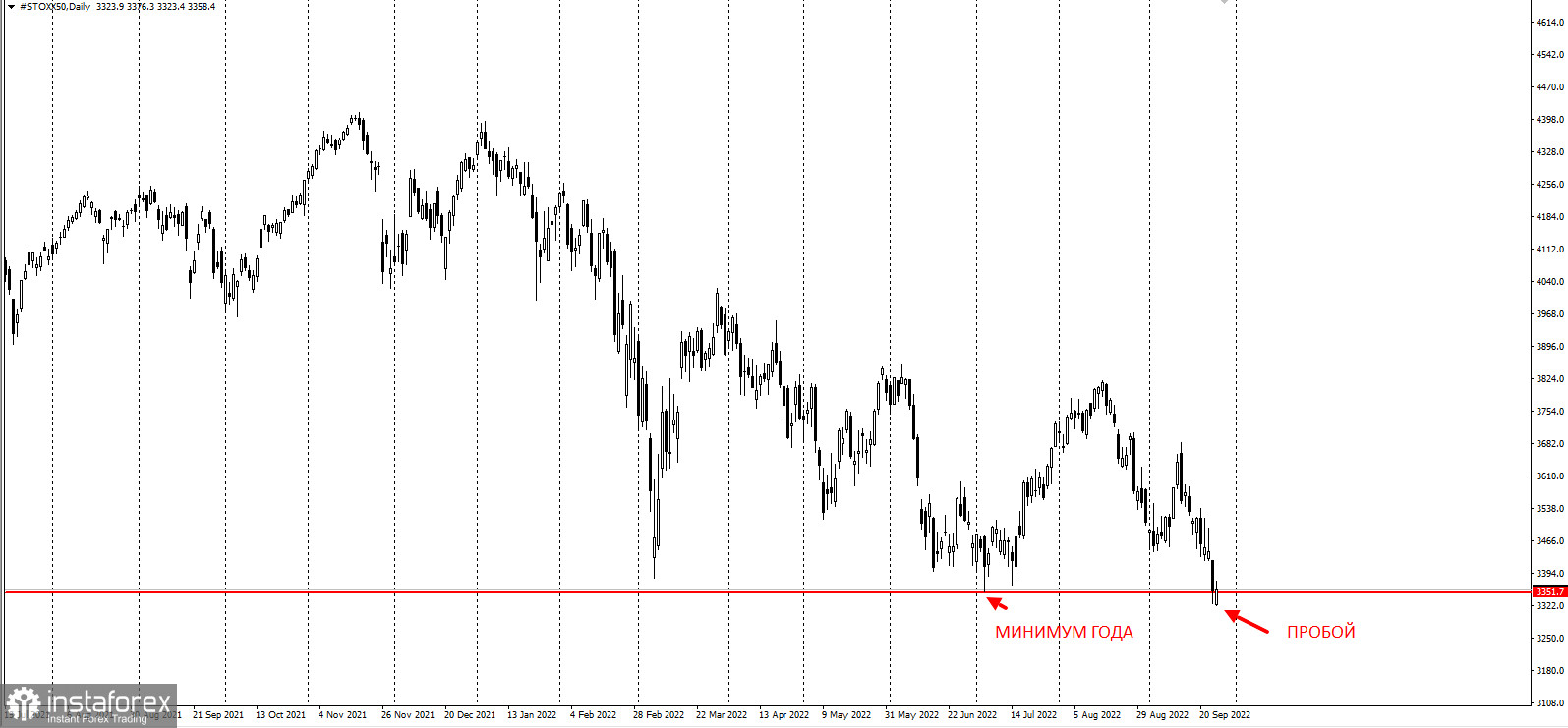

The Stoxx50 index lost 0.6% in early European trade. Miners and retail investors posted the biggest losses, while tech stocks scored gains. The Stoxx50 index broke through its yearly low.

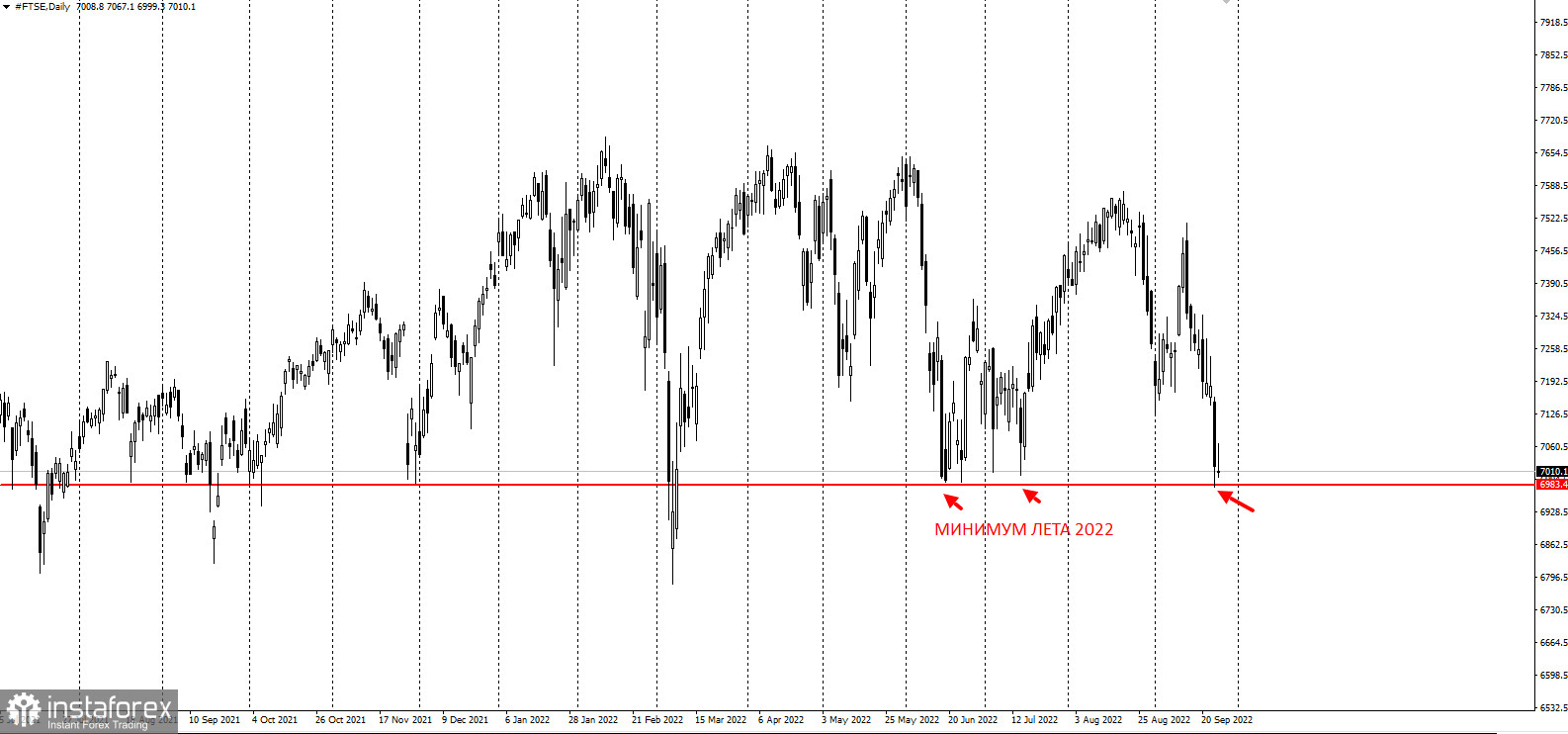

The FTSE 100 index updated its summer low. Today, it bounced slightly off the psychological level of 7,000:

Italy's FTSE MIB dropped by 0.1%, following Giorgia Meloni's win of a clear majority in Sunday's Italian election.

The European benchmark index plummeted by 21% from its January high amid a collapse in the market triggered by rising recession risks, the energy crisis, and the hawkish stance of the large central banks.

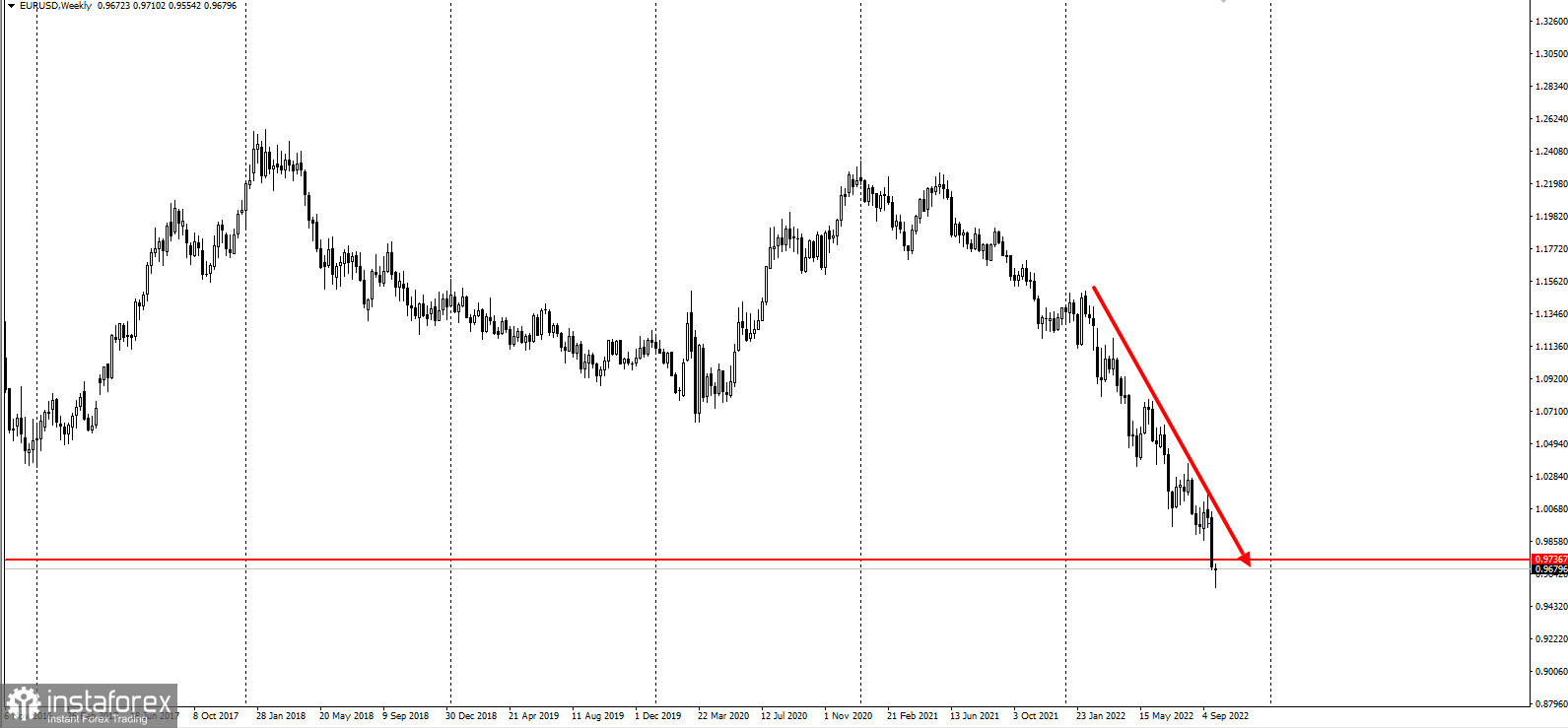

Investors are closely monitoring the inflation situation. The European Central Bank is forecast to raise the interest rate by 75 basis points at the next meeting.

"In terms of our central bank expectations at this juncture, risks of them over-tightening have significantly increased and that leading to a recession has increased too," Wei Li, global chief investment strategist at BlackRock Inc. said.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română