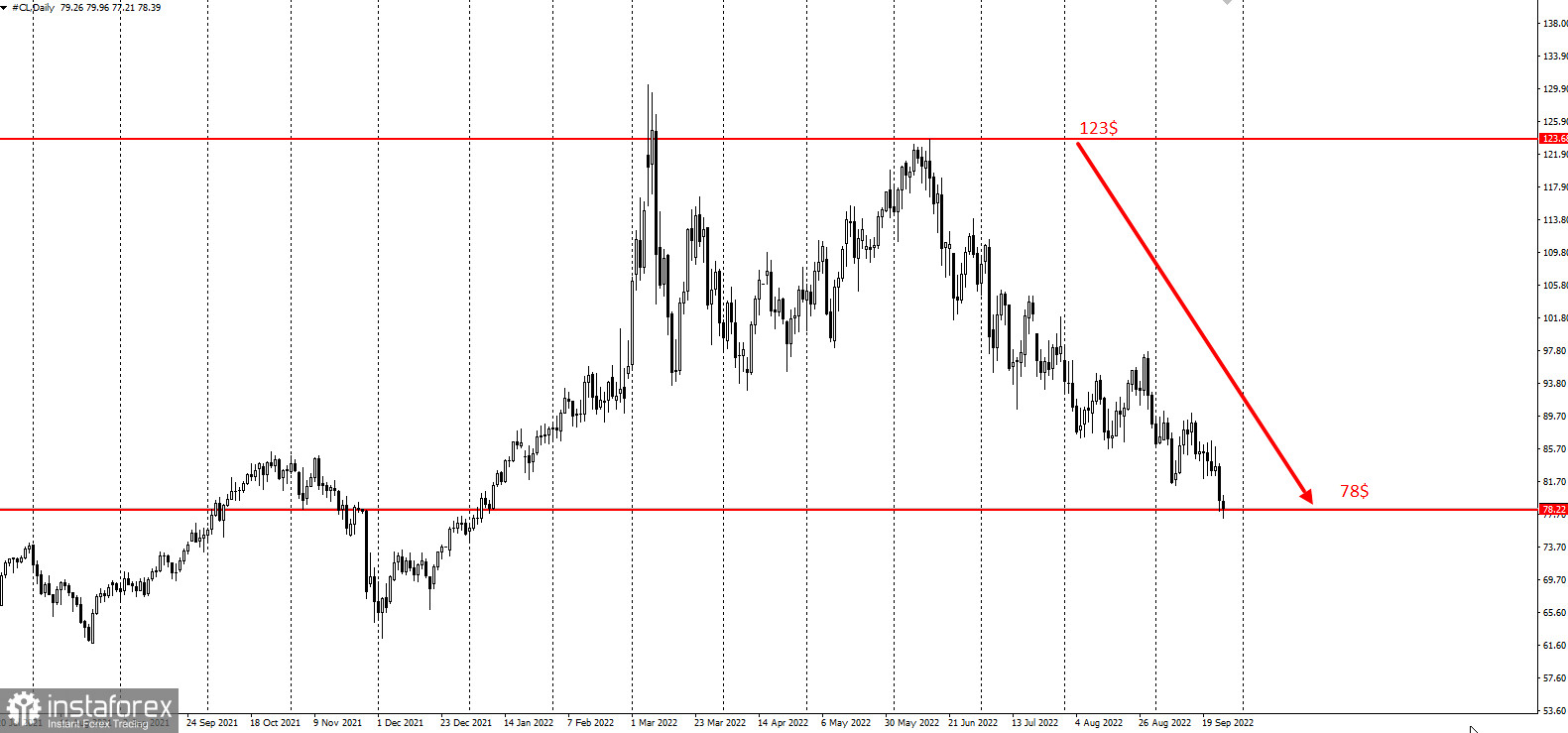

Crude is again trading below $75 per barrel amid the stronger greenback as rising recession risks threaten global demand.

Crude oil hit its lowest intraday level, unseen since January, following a record surge in the US dollar index. Last week, crude lost about 6%, marking its fourth week of decline.

Crude is likely to see a steep quarterly fall as the world's largest central banks, including the US Federal Reserve, are rising interest rates to curb stubborn inflation, thus harming energy demand and risk appetite. Aggressive moves of the US central bank helped boost the greenback to a record level, making commodity prices in the currency more expensive for foreign buyers.

A fall in crude prices could urge OPEC+ to consider intervention to stop the decline by cutting output. Earlier this month, OPEC+ announced a symbolic supply reduction and said it would monitor developments in the market.

Meanwhile, crude traders were also keeping track of Tropical Storm Ian, which is expected to strengthen and turn into a hurricane this week as it nears the Florida mainland. Forecasters are now trying to determine where it will make landfall, possibly anywhere from the Panhandle to Tampa Bay.

Widely watched time spreads have narrowed, indicating an easing in short-term tightness. Brent's prompt spread — the gap between its two nearest contracts — was at $1.06 a barrel, down from almost $2 a month ago.

"At current levels, it appears the market is pricing-in the typical deep impact of a deep recession," Australia & New Zealand Banking Group Ltd. said in a note. "The sell-off could see OPEC intervene again."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română